Euro-Dollar Eyes Big Break On Unexpected Tariff Outperformance

- Written by: Gary Howes

Image © European Commission Audiovisual Services

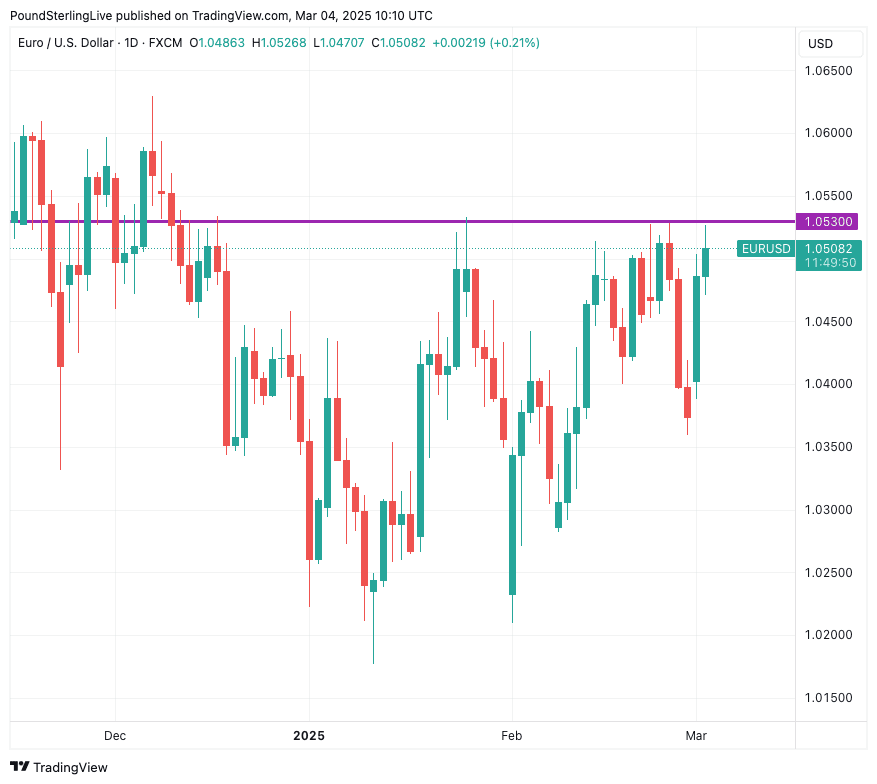

The euro-dollar has risen by more than a per cent following Trump's tariff confirmations; now, strategists say a break of key resistance at 1.0530 is in prospect.

The Euro-to-Dollar exchange rate trades at 1.0508, having jumped by more than one per cent following confirmation the U.S. would proceed with trade tariffs on China, Mexico and Canada.

The playbook until now has been that rising tariff tensions were good for the Dollar and bad for the Euro as the European Union will soon be targeted by Trump.

Tariffs will inevitably be bad for the EU and the Euro, but for now, there is a realistation that the Dollar must adjust to a new reality of higher domestic prices and weaker growth, owing to Trump's measures.

The Atlanta Federal Reserve's real-time measure of GDP growth is now forecasting U.S. GDP growth for the first quarter has dropped to -2.8% from -1.5%.

"It's ridiculous for anyone to claim that foreign nations have more to lose from a trade war than the U.S. Tariffs are taxes on imports. The U.S. is more dependent on imports than any other nation. Therefore, the U.S. has more to lose from a trade war than any other nation!" says Peter Schiff, Chief Economist and Global Strategist at Euro Pacific.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"The US dollar is not enjoying the latest round of tariff announcements, as it is underperforming against most major currencies. Euro/dollar has climbed above 1.0500 again, and dollar/yen is hovering below the key 150.15 level," says Achilleas Georgolopoulos, Senior Market Analyst at Trading Point.

Trump sparked a 0.80% selloff in the Dollar index after he said on Monday there's "no room left for Mexico or for Canada. No. The tariffs you know, they're all set. They go into effect tomorrow."

U.S. stock markets fell and investors raised expectations for further interest rate cuts from the Federal Reserve in response.

"Tariffs, through the lens of lower equities (wealth effect), are deflating UST yields and hurting the dollar vs Yen, Swissie and the euro," says Kenneth Broux, a strategist at Société Générale.

Until Trump's comments, market valuations suggested investors saw a decent chance that the threats were intended to force last-minute concessions in negotiations, as was typically the case during his first presidency.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Therefore, the decision to proceed was somewhat surprising, even given Trump's hawkish rhetoric on the matter.

"No clear route to de-escalation been signalled, whilst Donald Trump has previously suggested that ultimately the only way to avoid tariffs will be to shift manufacturing to the US – a lengthy, cumbersome and disruptive process for businesses," says Lindsay James, investment strategist at Quilter Investors.

"In effectively blackmailing companies to bring manufacturing onshore he is making is a dangerous and high stakes move, with retaliation and lower growth the clearest outcomes in a highly uncertain world," he adds.

Above: EUR/USD at daily intervals.

The Euro's rally against the Dollar also comes amidst a slowdown in U.S. economic data, eliminating the U.S. 'exceptionalism' narrative and driving a convergence in U.S. performance with elsewhere.

"Recent corporate surveys indicate the manufacturing sector is already seeing a weakening outlook as managers find ongoing uncertainty bad for business," says James.

Despite the Euro-Dollar's gains, it still faces a major test in the form of the 1.0530 resistance barrier, which has thwarted rallies since December.

According to analyst David S. Adams at Morgan Stanley, Dollar weakness has ample scope to run, although Euro-Dollar must break through resistance.

"While fundamental forces continue to shift, the DXY's selloff has been restrained by EUR/USD's failure to break out of its range. We think EUR/USD breaking above the 1.0530 level is a necessary condition to catalyse the next leg of the DXY selloff," he says.

Morgan Stanley strategists think this can happen, "and this week may prove critical in providing that catalyst."