Euro to Dollar Rate The Big Loser of This Trump Landslide

- Written by: Gary Howes

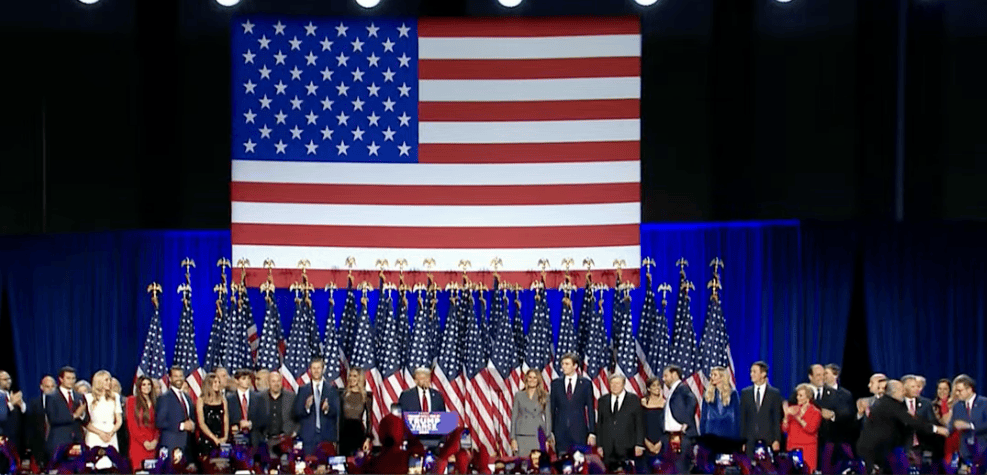

Above: Trump declared victory as he addressed supporters.

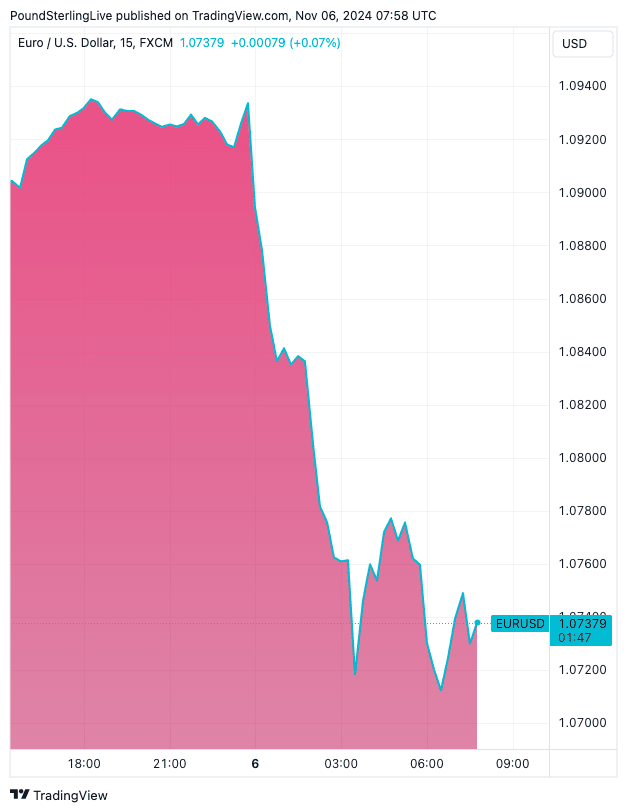

The Euro to Dollar exchange rate (EUR/USD) is one of the biggest losers in the financial markets as it becomes clear Donald Trump and his Republican Party have swept the board.

Donald Trump has won the key swing states of North Carolina, Georgia and Pennsylvania and appears on course to sweep Wisconsin and Michigan in what would amount to a landslide win.

The Republican Party has taken the U.S. Senate from the Democrats and will soon take the House of Representatives, meaning Trump can pursue his agenda for the U.S. and the world unencumbered.

"Results of U.S. Presidential election are set to keep the USD well on bid across the board. The US Dollar index (DXY) has already climbed above 105. We thus expect EUR-USD to remain under pressure below 1.07," says Roberto Mialich, FX strategist at UniCredit.

The Euro to Dollar exchange rate has fallen to 1.0737 by the time of writing.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Trump will raise tariffs on imports, introduce mass deportations and cut taxes, which creates an inflationary policy mix.

This will ensure the Federal Reserve must act cautiously when considering cutting interest rates going forward, which can bolster the Dollar.

Trump will also deliver supply-side reforms, most notable to the oil and gas industry, that can further enhance the 'U.S. exceptionalism' trade that is by nature supportive of the Dollar.

Above: EUR/USD at 15-minute intervals.

For Euro-Dollar, it's not just USD positives that are driving weakness: the Euro is particularly exposed to Trump 2.0.

"The eurozone is likely to face a more challenging external environment with Mr. Trump as president of the U.S.," says Chiara Silvestre, an economist at UniCredit Bank.

"The euro area is likely to suffer disproportionately from a restrictive US trade policy," says Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Leuchtmann explains that the U.S. is "the ultimate sink of global trade flows" as it hoovers up everything everyone has to sell.

Should this demand fade, global trade as a whole may suffer.

"This will affect the export nations. And quite a few of them are in the euro area. Germany, for example," he says.

In addition, Leuchtmann says that if one believes that exports are an important growth driver for a number of eurozone economies, one must also assume that a restrictive U.S. trade policy will cement Europe's growth disadvantage vis-à-vis the US.

"This, too, would be negative for EUR-USD in the long term. Because all these consequences are becoming apparent this morning, EUR-USD is suffering not only in the distant future, but also this morning – beyond the extent of general greenback strength," says the Commerzbank analyst.