U.S. Dollar's Recovery Against Euro Still Has Legs

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate has declined to 1.0811 as the Eurozone grapples with slow growth and policy uncertainty and the U.S. continues to enjoy economic resilience.

FX strategists and market analysts say rate differentials, market sentiment, and political risks are likely to keep the Euro-Dollar exchange rate under pressure in the short to medium term. They point to a variety of factors contributing to the current trend, with some emphasising the role of rate differentials and market sentiment.

Kit Juckes, FX Strategist at Société Générale, notes that the absence of significant U.S. economic data this week has left bond investors, and by extension, the foreign exchange market, in a state of unease.

"This week is bereft of meaningful U.S. data, and bond investors are left to worry. The FX market is looking at the bond market and worrying too,” said Juckes.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The U.S. dollar continues to enjoy strong demand, outperforming its main counterparts. In particular, euro/dollar is trading at the lowest level since early August," says Achilleas Georgolopoulos, Market Analyst at Trading Point.

Georgolopoulos noted that political uncertainty surrounding the upcoming U.S. presidential election could be adding to the dollar’s strength as investors seek safety.

"There is a common theme that could explain these movements. The U.S. presidential election is acting as the rising tide that lifts all boats, with investors seeking protection from a potentially negative market outcome," he explains.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

With the election on the horizon, Georgolopoulos suggested that market participants are preparing for various scenarios, including the possibility of a contested election result, which could evoke memories of the 2000 election.

"It is up to the market to decide if a Trump or a Harris win will produce a risk-off reaction, but market participants could also be preparing for a repeat of the 2000 presidential election, when the result was declared in courts almost one month after the election date," he said.

Dollar Rally Has Legs

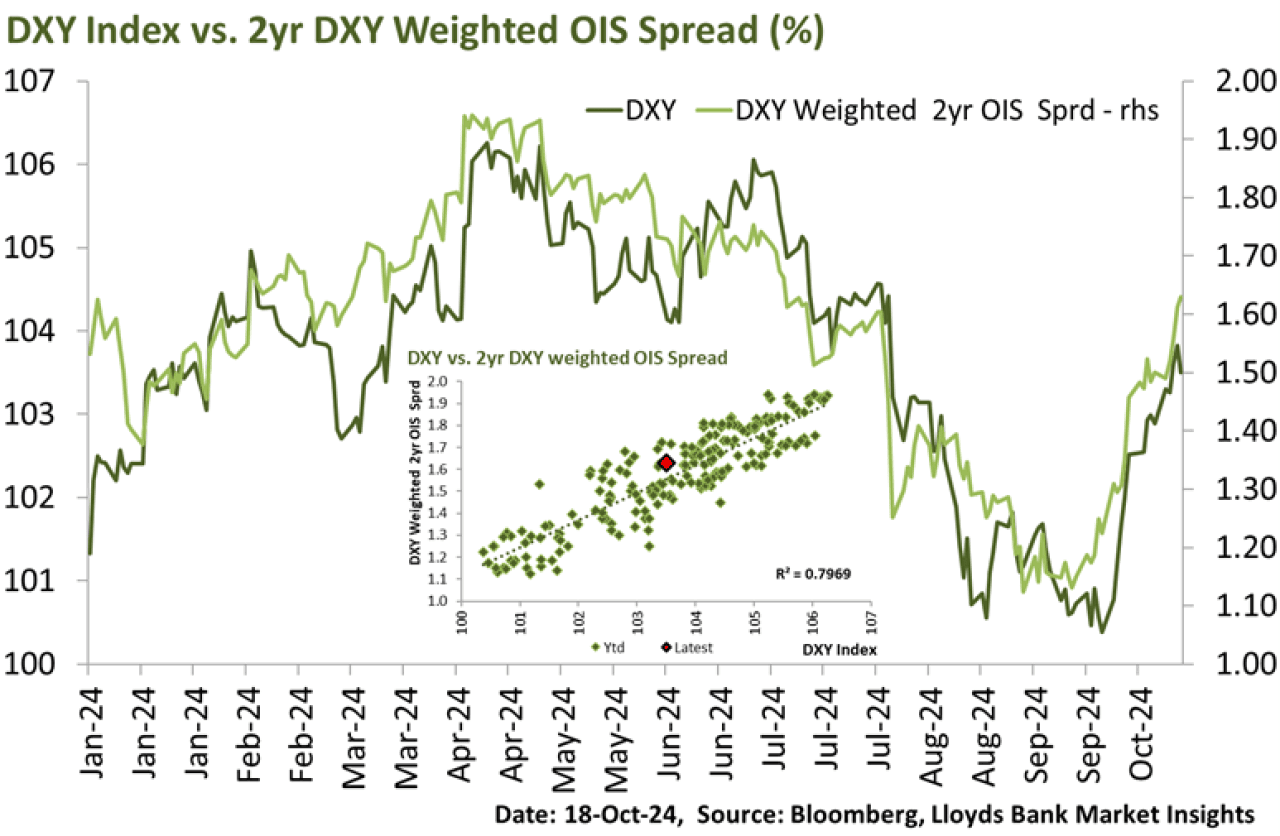

The disparity in central bank policies also remains a key driver of the Euro-Dollar exchange rate, according to Nick Kennedy, FX Strategist at Lloyds Bank.

He highlights the influence of rate differentials over recent weeks:

"Rate differentials continue to be the main driver of exchange rate swings with the paring back of Fed cut hopes and the increase in expectations for ECB easing the main catalyst over the past few weeks."

He points out that market pricing for rate cuts has adjusted across major central banks, narrowing the gap between the U.S. Federal Reserve, the European Central Bank (ECB), and the Bank of England (BoE).

"That has realigned market pricing for rate cuts through to next summer, with barely a paper’s width between the Fed, ECB, and BoE,” Kennedy added, underscoring the increasing alignment of market expectations around rate cuts.

Kennedy says the Dollar's rally has further to run, noting a "disconnect" in the market’s fundamental outlook, especially regarding the robustness of U.S. growth,

He suggests that the current U.S. rate cut expectations might be overly pessimistic regarding downside growth risks, while in the Eurozone, there could be insufficient recognition of the risks posed by the region’s economic stagnation.

"While the Eurozone probably does not have enough downside priced in, particularly with the risk of the current economic malaise leading to inflation undershooting again,” he remarks.

"The U.S. looks resilient with a trend growth rate more than double the single currency area, far higher productivity, and fewer structural risks. The rates backdrop still looks supportive for the U.S. dollar," he concludes.