Euro-Dollar: "Tactically, the Pullback is now as Good as Complete"

- Written by: Gary Howes

Image © European Union - European Parliament, Reproduced Under CC Licensing.

The Euro to Dollar exchange rate (EUR/USD) is certainly under pressure, but is it time for a breather?

EUR/USD reached its lowest level since early August on Thursday after the European Central Bank (ECB) cut interest rates and implied more were to come on account of a slowing economy.

The decline was also driven by above-consensus U.S. retail sales, which widened the fundamental wedge between the prospects facing the Eurozone and the U.S.

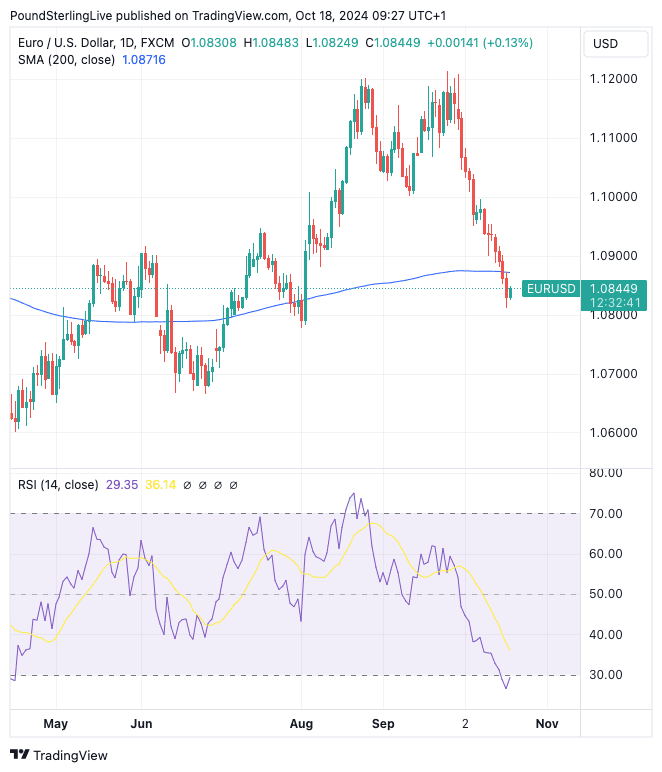

But, with the Relative Strength Index (RSI) now in oversold territory (indicated by a sub-30 reading) and the October pullback retracing the full extent of the August rally, it could be time for consolidation.

(If you know how to use TradingView you can monitor the RSI located in the lower panel in then above).

"Tactically, the pullback is now as good as complete," says Kenneth Broux, a strategist at Société Générale's corporate division.

He explains that exhaustion could set in following the 3.5% drop from the late September top around 1.12.

"What comes next?" he asks. "Near-term support rests at 1.0778, the early August low. A deeper fall cannot be ruled out in a repeat of 2016 if U.S. yields gain upward traction after the presidential election."

The EUR/USD has now broken below the 200-day moving average (DMA) - the blue line in the above chart - which represents a deterioration in the medium-term trend.

It suggests the exchange rate has entered a more protracted downtrend.

The 200 DMA now also acts as a resistance zone to any subsequent recovery that might follow the exhaustion of the frantic October selloff.

So, although the decline could be reaching its near-term limits, the prospect of a material relief rebound looks relatively limited at this juncture.

Euro Weighed Down by the ECB

The ECB cut its key policy rate by 25 basis points on Thursday, as widely expected following a run of softer economic data.

However, there was a subtle shift in emphasis that markets picked up on, whereby the ECB appeared to show greater concern about the prospect of a slowing economy.

The understanding is that if the ECB is comfortable enough to shift focus away from inflation to growth, then it could afford to maintain an aggressive stance to lower its policy interest rates.

"With disinflation 'well on track' in the euro area, and growth risks still pointing to the downside, we expect the ECB to deliver another cut in December," says Dean Turner, Chief Eurozone and UK Economist.

The market now understands the ECB is keen to get on with the job and the market could soon be close to fully 'pricing in' these developments.

When this happens, the Euro can find itself better supported.

With regards to the U.S., the rising odds of a Donald Trump win in November are proving bullish for the USD, which means we could see further USD strength in the coming three weeks based on U.S. political considerations.

"We hold our short EURUSD position given fragmentation risks in euro area, lack of engines of growth and rising risks of a Trump Presidency," says a note from TD Securities' FX strategy team.