Euro-Dollar Rescued by China

- Written by: Gary Howes

Image © European Commission Audiovisual Services

The Euro is recovering from recent losses, and analysts say China is to thank.

The Euro to Dollar exchange rate (EUR/USD) is back at 1.12 in midweek trade, having been as low as 1.1083 on Monday, amidst expectations that a Chinese economic revival can help rescue the Eurozone's economy.

"The EUR gained across the board following the China stimulus news," says Thanim Islam, an analyst at Equals Money.

China on Tuesday lowered the reserve ratio requirements for banks by 0.5 percentage points, bringing it down to 9.5%. It also cut rates, reducing the 7-day reverse repo rate by 0.2 percentage points to 1.5%.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Authorities announced billions of dollars worth of liquidity facilities would be made available to help reboot the stock market. In addition, significant cuts to mortgage ratio requirements were also announced.

"We see this as the first of a number of stimulus measures required to rescue the Chinese economy from its current malaise," says John Meyer, an analyst at SP Angel.

The Euro rose 0.60% against the Dollar on the day, overturning a 0.40% decline registered on Tuesday after the September PMI survey showed the Eurozone economy had fallen into contractionary territory, dragged lower by Germany's worsening industrial slowdown.

These data raised the odds of the European Central Bank (ECB) following up September's interest rate cut with another in October, whereas the market thought we would wait until December before the next move.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

But Tuesday's news of a surprisingly large Chinese economic stimulus announcement suggests a turnaround for the Eurozone economy beckons if the new measures succeed in boosting Chinese demand.

This is because China is a crucial market for German industrial and manufacturing exports. The ongoing malaise in Chinese growth is a key reason why Germany is struggling (in addition to gas price rises following Russia's invasion of Ukraine).

"Increased global growth optimism will help and the stimulus measures announced by China will certainly add to US dollar selling momentum," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG Bank Ltd.

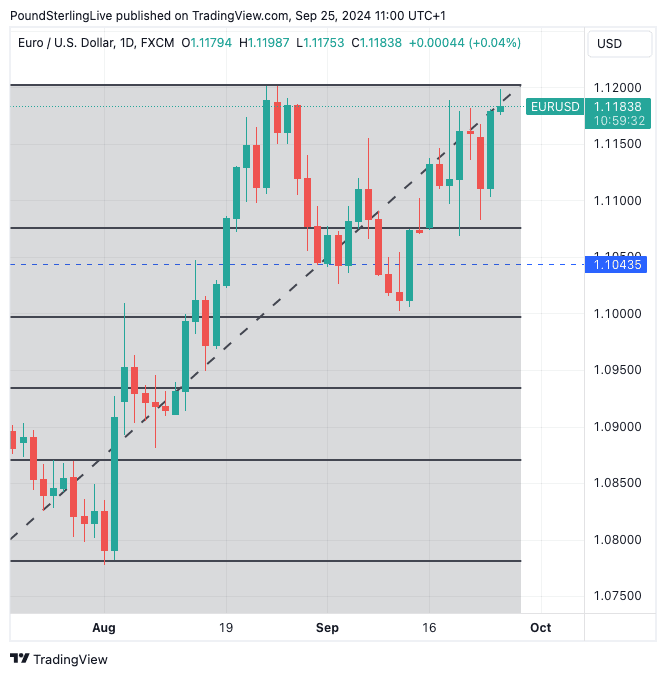

Above: EUR/USD at daily intervals. Weakness remains shallow and a test of 2024 highs beckons again.

Carsten Brzeski, Global Head of Macro at ING Bank, says not to rule out potential positive surprises for the German economy towards the end of the year.

"It is industrial production that could still come to the rescue," he said in a note issued in response to Tuesday's disappointing German Ifo sentiment survey. "It'd only take a small improvement in industrial order books to turn the inventory cycle and get industrial production growing again. Admittedly, this would be a cyclical improvement coming from very low levels, hardly changing the narrative of a country stuck in stagnation."

MUFG's analysts are meanwhile not yet convinced of the potential for a pick-up in rate cuts from the ECB. "Until underlying inflation is back closer to target the risk is that the ECB continues for now with a more cautious approach to monetary easing even in circumstances of weaker than expected growth."

The Euro could also be set for a boost against the Dollar if it can break above a key technical resistance line.

"The euro could be about to break a key level that would likely prompt some further buying. The 1.1200-level has now been hit three times in August and September and a break could see a move

extend to test the high from last year at 1.1276," says Halpenny.