EUR/USD Week Ahead Forecast: Outlook Brightening on Charts

- Written by: James Skinner

Image © European Central Bank

The Euro to Dollar exchange rate has overcome meaningful resistance on the charts and could erode another key level in the days ahead, which would signal scope for an eventual return to last December’s high at 1.1140 and potentially even a recovery above there in the medium or longer-term.

Europe’s single currency decisively overcame stubborn resistance coming from the 61.8% Fibonacci retracement of the downtrend from December 2023 last week as the US Dollar fell in the wake of US producer and consumer price figures suggesting that further disinflation is likely in the pipeline.

The data has led markets to become more confident in wagering that the Federal Reserve is likely to cut interest rates by as much as 100 basis points by year-end, which would erode the US Dollar’s interest rate advantage over other currencies, likely marking a meaningful evolution of the outlook for the greenback.

“Despite the drop back from the mid-week peak near 1.1050, the overall trend remains EUR-bullish. The intraday chart shows the EUR sustaining a trend rise from the early August low,” says Shaun Osbourne, chief FX strategist at Scotiabank, writing in a Friday market commentary.

“The daily chart shows the EUR sustaining a steady appreciation trend since June. Short-, medium– and long-term trend oscillators remain bullish,” he added.

Above: Euro to Dollar rate shown at daily intervals with Fibonacci retracements of December 2023 downtrend indicating possible areas of technical resistance, and selected moving averages indicating far away supports. Click image for closer or more detailed inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

EUR/USD now faces additional resistance around 1.1025 immediately overhead, which is the 78.6% Fibonacci retracement of the December downtrend and the last defence of the 200-week moving average at 1.1062

The risk is that the nearby Fibonacci retracement at 1.1025 acts to slow the Euro’s advance relative to other currencies in the short-term, and likewise with the 200-week average further up at 1.1062.

These technical headwinds could be all the more obstructive because of the lack of major European economic figures in the calendar ahead of this Thursday’s S&P Global PMI surveys of the bloc’s manufacturing and services sectors. Final European inflation figures for July on Tuesday are the only other calendar highlight.

“EUR/USD recently broke out from its symmetrical triangle, denoting potential upside towards 1.1140 and the July 2023 high of 1.1275,” Societe Generale strategists said in a Friday review of the Euro to Dollar charts.

“Last week’s low of 1.0880 is now key support,” they added.

Above: Euro to Dollar rate shown at weekly intervals with 200-week moving average (purple line) and Fibonacci retracements of the January 2021 and February 2022 downtrends indicating possible areas of technical resistance. Click image for closer or more detailed inspection.

Both the Euro and Dollar are likely to be highly sensitive to the S&P PMI surveys on Thursday. Any sign of economic momentum ebbing further could weigh on each currency respectively, though the undervaluation of EUR/USD might mean the Dollar is likely to respond more than the Euro to any negative surprise.

However, the main event of the week ahead is the Federal Reserve’s Jackson Hole Symposium where Chairman Jerome Powell is set to speak publicly on Friday. Market focus will be on whether he validates or pushes back against expectations for up to 100 basis points of interest rate cuts from the Fed this year.

But another factor that could become increasingly supportive of Euro and cumbersome for the Dollar in the weeks and months ahead is the recent evolution of US election opinion polls, which now suggest Democratic Party candidate Kamala Harris is leading former President Donald Trump in multiple key swing states.

“I still think a Harris presidency is bearish US growth and bearish US stocks and bearish the US dollar, but the market isn’t trading that way right now,” says Brent Donnelly, president at Spectra Markets and a veteran FX trader with a career spent between major banks like HSBC, Nomura and Lehman Brothers.

“The Biden administration has been lambasted for the 2020/2021 inflation shock and the Dems’ desire to push inflationary fiscal policy in 2025 is probably not nearly as boisterous as DJT’s. Many provisions of the TCJA also come up for renewal on December 31, 2025, and it’s unlikely that a Kamala Harris government would be keen to renew Trump’s signature legislation,” he said the am/FX daily macro newsletter.

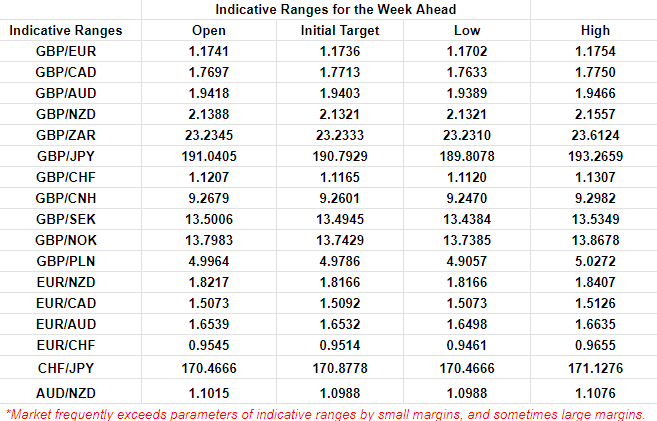

Above: Quantitative model estimates of possible ranges for the week. Source: Pound Sterling Live.