EUR/USD Week Ahead Forecast: Gentle Downside

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate is forecast to remain under moderate pressure in the coming days, with eyes on Eurozone inflation numbers ahead of the Federal Reserve decision and U.S. pay numbers.

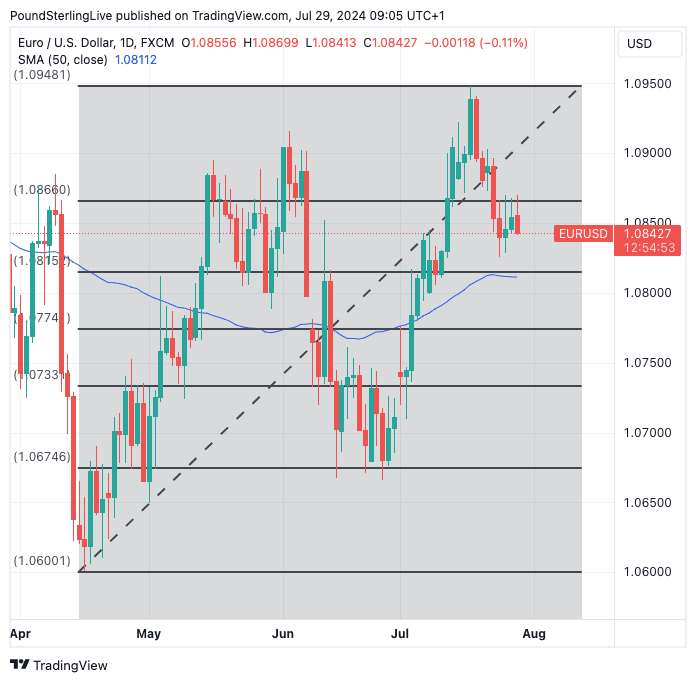

Euro-Dollar has eased back from July highs at 1.0948 and has now recorded three consecutive down weeks, consistent with a soft undertone. To be sure, weakness is likely to be limited, with selloffs interspersed with up days.

We look for a gentle retreat to the 50-day moving average at 1.0811 over the coming days. Note, this is also the approximate location of the 38.2% fibonacci retracement of 2024 high to low.

Above: Euro-Dollar can retreat to the 1.0811-15 area, where the 38.2% retracement and 50-day moving average is. Track EUR/USD with your custom alerts; find out more here

"The price movements are likely part of a sideways trading phase, and we expected EUR to trade between 1.0830 and 1.0870," says Peter Chia, Senior FX Strategist at UOB.

Expect potential Euro exchange rate volatility from Tuesday when the Eurozone's CPI inflation figures begin to be released, with the initial focus falling on Germany's figure.

Here, state-level figures are released from 7AM German time, which can give an early steer on the all-German figure due out later in the day. This, alongside the Spanish CPI release, can give a steer as to how the midweek Eurozone inflation figure will land.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Eurozone is expected to print a figure of 2.3% year-on-year, which is consistent with an ongoing process of disinflation. The ECB is expected to cut rates again in September, meaning it would take a big surprise in the data to leave a lasting impact on the Euro.

Instead, it is the USD side of the equation that will offer the volatility this week.

The Federal Reserve policy decision is due Wednesday. No change in interest rates will be made. Expect cautious guidance that is consistent with expectations for a first interest rate in September.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The market is now 'fully priced' for such an outcome, meaning the Dollar would rally if the Fed casts any doubt on firing the starting gun to a rate cutting cycle in September. We would anticipate the Fed to continue with its new strategy of highlighting concerns that keeping rates unchanged for too long could negatively impact the labour market.

This is consistent with the Fed saying it thinks it can afford to cut interest rates before inflation falls back to the 2.0% target.

The more important event for the Dollar comes on Friday when the U.S. jobs report is released. Should the data undershoot expectations the market will price in more policy easing from the Federal Reserve for the coming months, which will weigh on the Dollar.

July non-farm payrolls are expected to print at +178k, with the unemployment rate remaining at 4.1%. That follows a stronger-than-expected print of +206k in June.

"The bigger driver for USD would be on payrolls report and the next few inflation readings – to get a sense of the possible extent of rate cuts," says Christopher Wong, an analyst at OCBC.