Into the Bull Trap: EUR/USD Week Ahead Forecast

- Written by: Gary Howes

Image © Adobe Images

The Euro can recover in a week that will be dominated by U.S. politics, Eurozone PMIs and the U.S. PCE inflation index. However, one analyst warns a recent decline could mean the Euro to Dollar exchange rate has fallen into a classic 'bull trap' and warns of further weakness.

Before we delve into the technical aspects of Euro-Dollar, there are some significant fundamental developments to consider now that U.S. President Joe Biden has exited November's election.

The 'Trump trade' - considered to be broadly supportive of the USD - could unwind following Sunday's announcement by Biden. His replacement on the ticket is highly likely to be Vice President Kamala Harris, whom pollsters suggest has a better shot of beating Trump.

"The impact on the USD from Harris’ likely ascension depends on whether the odds of a President Trump victory increase or decrease. If President Trump’s chances of victory are perceived to increase, we expect the USD to lift," says Joseph Capurso, a foreign exchange strategist at Commonwealth Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Any positive USD-related flows linked to expectations for a Trump presidency can reverse if his odds of winning retreat from here. (See where over 30 investment banks forecast Euro-Dollar to be by September and year-end).

Sentiment has a grip on foreign exchange markets right now, with last week's global IT outage worrying markets and prompting investors to buy 'safe haven' dollars at the expense of euros. With the glitch fixed, we could see some improving investor sentiment that can support Euro-Dollar once more.

But the Biden administration's decision to further squeeze technological exports to China raised concerns of a looming trade war, which would only be more intense under an expected Donald Trump Presidency. In short, no matter who wins in November, increasingly tense China-U.S. relations are a concern.

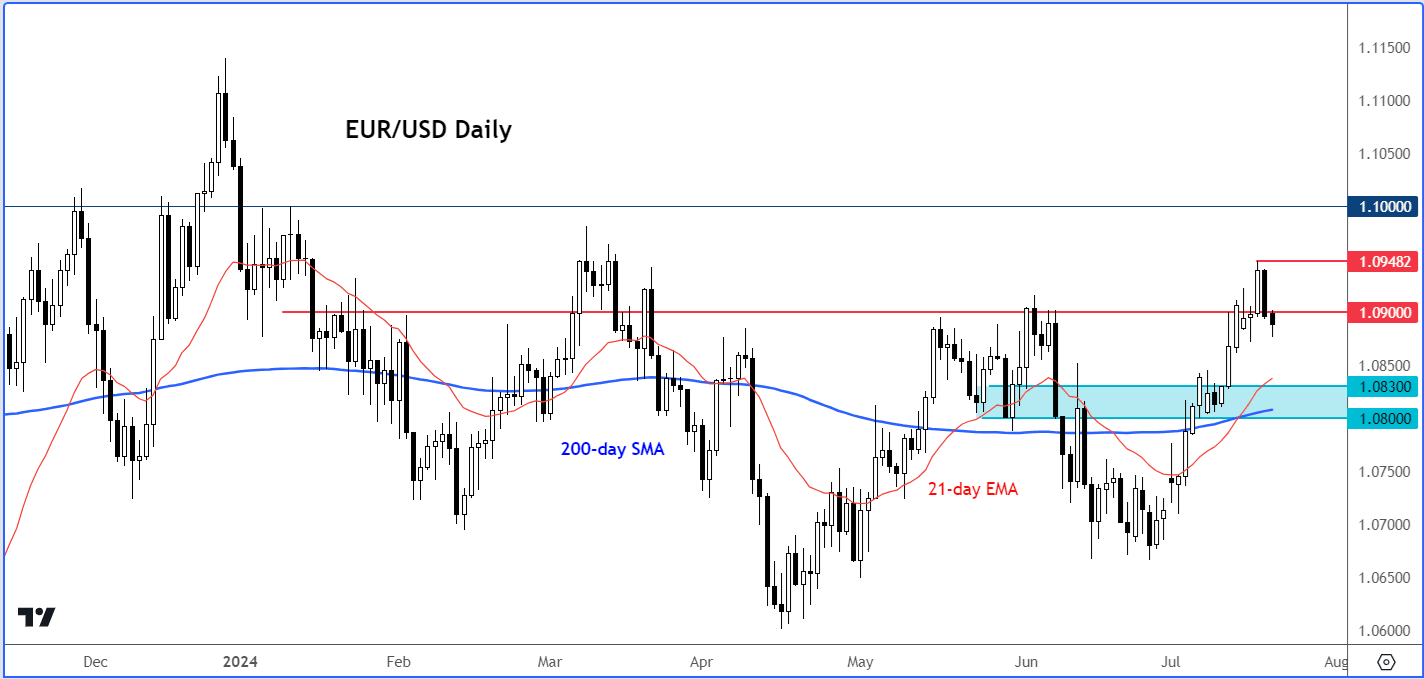

Euro-Dollar peaked at 1.0948 last week and has since retreated to 1.0884 amidst these rising concerns, where it is looking to stabilise immediate-term. One analyst thinks the Euro can rise from here.

"The EUR/USD holding above the 21- and 200-day moving averages indicates a bullish trend. Despite recent price action suggesting otherwise, the small pullback in the last couple of days follows a strong rally, which should not be ignored," says Fawad Razaqzada, Market Analyst at City Index.

"This pullback is likely a retracement against the underlying bullish trend. Look for bullish setups near support for trade ideas," he adds.

City Index analysis shows a key area to watch is between 1.0800-1.0830, where prior support and resistance meet the moving averages.

"On the upside, short-term resistance is around 1.0900, followed by 1.0945, and potentially 1.1000 if the pair climbs above this week’s high,” says Razaqzada.

Image courtesy of City Index's Fawad Razaqzada. Track EUR/USD with your custom alerts; find out more here

However, Martin Miller, a Reuters market analyst, warns that the Euro could have just entered a 'bull trap'.

"EUR/USD failed to sustain this week's break above the 1.0934 Fibonacci, a 61.8% retrace of the 1.1139 to 1.0602 (2023 to 2024) EBBS drop, setting up a likely bull trap," he says.

A bull trap is set when a market breaks above a technical level but subsequently reverses and is usually a bearish sign.

"There is a good chance of a relapse back to the daily cloud that currently spans the 1.0759-92 region," says Miller.

Turning to the calendar, in the U.S., preliminary GDP figures for the second quarter are on view Thursday, where an annualised figure of 2.0% is expected.

The highlight of the week is Friday's release of the PCE inflation measures, which the Federal Reserve places a great degree of weight on when considering interest rate policy.

The PCE index is expected to have risen 0.2% m/m in June, and any undershoot of this figure can weigh on the Dollar as it bolsters the odds of a September interest rate cut.

Eurozone PMIs are the only significant calendar risk for the Euro in the coming week. They are released on Wednesday and you can see the updated consensus forecasts on our calendar. Should Eurozone data beat expectations, the Euro can recover further against the Dollar.