Euro-Dollar Touches 1.09: Convera

Image © Adobe Images

The Euro to Dollar exchange rate has shaken off its French-inspired jitters to touch a new five-week best at 1.09. Ruta Prieskienyte, Lead FX Strategist, at Convera writes that the pair is on track for its third consecutive weekly gain:

The euro surged to a five-week high, driven by a weakening US dollar on the back of a lower-than-expected US CPI report which reinforced hopes of a Fed rate cut in September.

European stocks and bonds trended higher as investors cheered the news.

Although largely ignored, German inflation eased to 2.5% in June, confirming earlier data and confirming the possibility of another rate cut by the ECB in September.

The Euro index, which tracks the performance of the common currency against a basket of leading global currencies, remained broadly unchanged on the day but is on track for its third consecutive weekly rise.

The index was mostly weighed down by the severe losses against the Japanese yen. Having touched its highest level since the euro’s launch sheer moments prior to the US CPI release, the EUR/JPY pair oddly plunged by over 1.4% post announcement, fuelling expectations of an intervention by the Japanese officials.

Similar sharp moves in JPY spot were also observed against the other majors. EUR/SEK also retreated upon the release of a survey indicating that Swedish long-term inflation expectations edged above the Riksbank’s target of 2%.

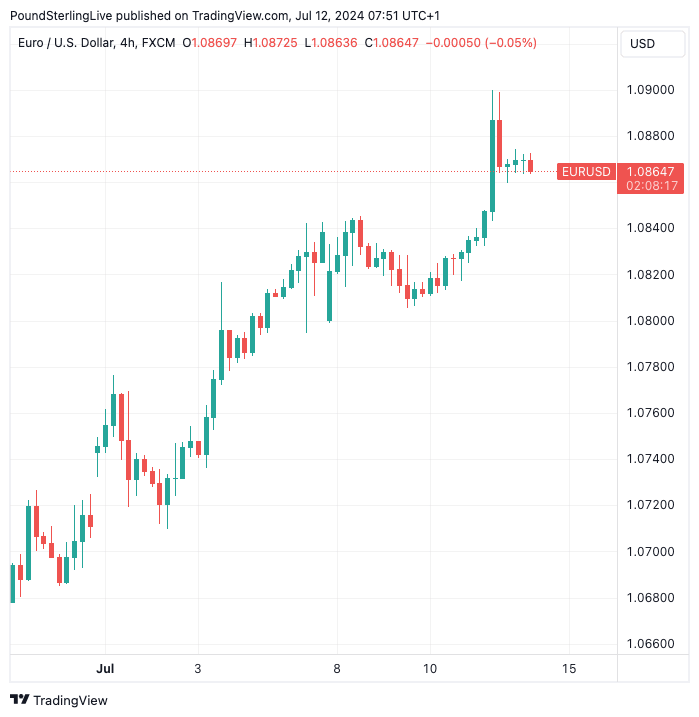

Above: EUR/USD at four-hour intervals. Track EUR/USD with your own alerts, find out more here.

GBP/EUR broke past the 200-month SMA barrier, a level it has been unable to trade above since 2015.

EUR/USD threatened to break the $1.09 resistance level but was met with fading interest.

The rate moves eroded the dollar’s yield advantage over the euro as DE-US 2-year spreads broke resistance near -170bps and hit their tightest since early March.

The pair is on track for its third consecutive weekly gain and the increased market confidence that the Fed may be growing more comfortable in moving toward rate cuts may soon put $1.10 on the agenda for the euro.

In the options market, 1-week EUR/USD risk reversal skew tightened to -0.128 in favour of euro puts, its least bearish in over a month.