EUR/USD Week Ahead Forecast: Asymmetric Reaction Function

- Written by: Gary Howes

Image © Adobe Images

The Euro is tipped to stay above 1.08 against the Dollar over the duration of the coming week, which will see two major tests in the form of Wednesday's U.S. inflation report and Thursday's European Central Bank decision.

The Euro to Dollar exchange rate recovered the sharp losses that initially followed last Friday's strong U.S. job report, which is significant because it tells us the bar to further USD strength is now set incredibly high.

The ECB will keep interest rates unchanged but will likely introduce guidance that readies the market for a June interest rate cut, which market participants fully expect.

For the Euro to weaken, the ECB might need to say things that encourage the market to bet on further rate cuts in the months following a June kick-off.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

This could be a tall ask for those hoping for a weaker Euro. The scenario we anticipate sees ECB President Lagarde gently verifying market consensus for a June rate cut while warning that further cuts are entirely data-dependent.

This should generate enough uncertainty to keep the Euro sellers at bay and potentially push Pound-Euro lower.

"Ms. Lagarde indicating a rate cut in June on Thursday will likely prevent more EUR-USD strength, but a lack of indication on the pace of easing after June will likely offer EUR-USD a floor around 1.08," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan.

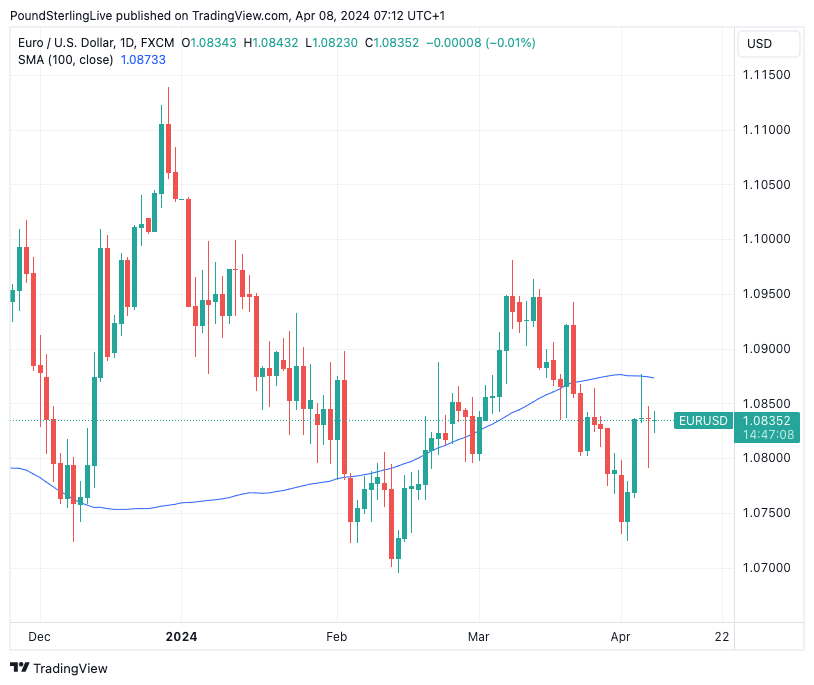

Above: EURUSD at daily intervals showing a well-supported, albeit capped, Euro. Track EUR/USD with your own custom rate alerts. Set Up Here

Carol Kong, FX analyst at Commonwealth Bank, says there is a risk that the ECB is perceived as dovish this week as they may begin to discuss rate cuts.

"However, we do not expect more than a modest impact on EUR/USD because the market is already pricing a very high chance of a June rate cut as well as at least two more rate cuts by the end of the year. As a result, a miss on the U.S. CPI can be the main driver of EUR/USD in the week ahead. EUR/USD faces support at 1.0764," she adds.

Turning to the U.S. inflation report, the market looks for the headline CPI inflation rate to have risen to 3.4% year-on-year in March from 3.2% in February as it continues to drift further away from the Federal Reserve's 2.0% target.

The Dollar can rally should the figure exceed this, but given the reaction to the NFP data, we suspect an exceptionally strong reading would be required to deliver a significant appreciation in the Dollar.

Instead, the biggest market movement would likely follow and undershoot in the data, confirming an asymmetric FX reaction function heading into the print.

"A higher-than-expected print may add modest support to the USD but a downside surprise may see USD react more to the downside. Asymmetric DXY price action to US data is likely in the interim," says Christopher Wong, FX Strategist at OCBC.