Confidence in the Euro Rebound Story is Growing Shows Key Fund Manager Survey

- Written by: Gary Howes

Image © Adobe Stock

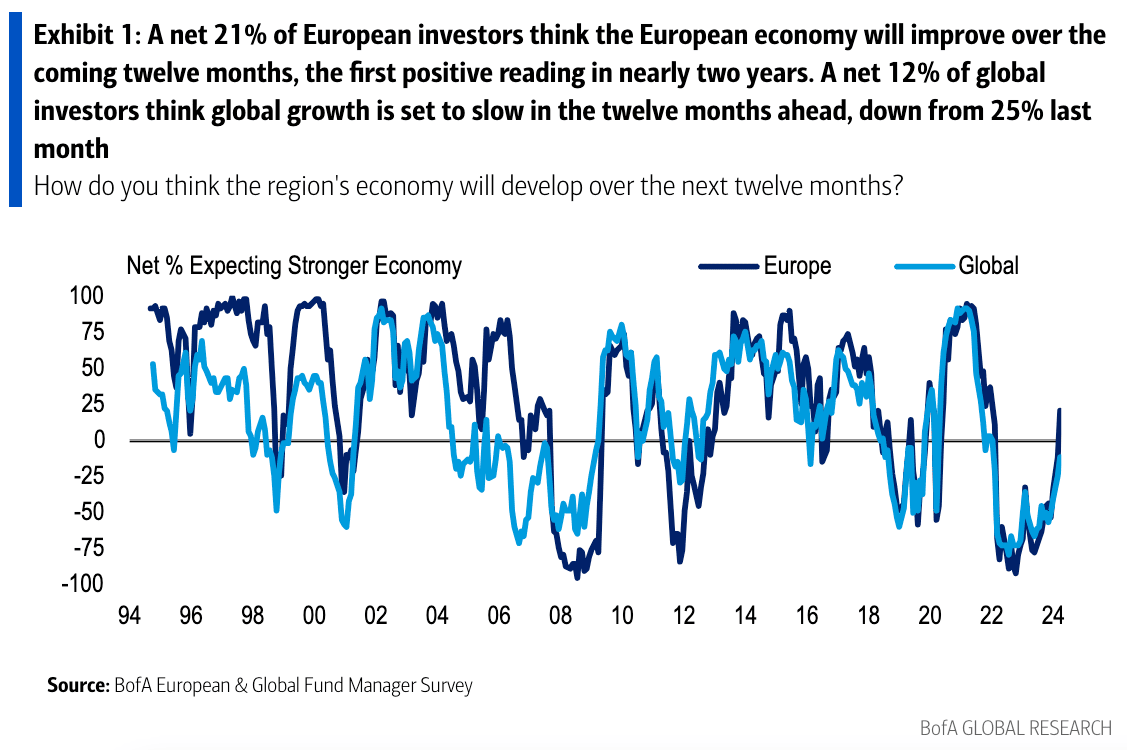

Confidence in the European rebound story is growing; on Tuesday Bank of America said its much-watched fund manager survey found "rising confidence in a European growth reacceleration".

According to the survey, a net 21% of respondents expect a stronger economy in Europe over the coming twelve months, up from a net 11% that expected a further weakening last month.

"For the first time in almost two years, participants do not see a recession in Europe on the horizon," says Andreas Bruckner, Investment Strategist at Bank of America.

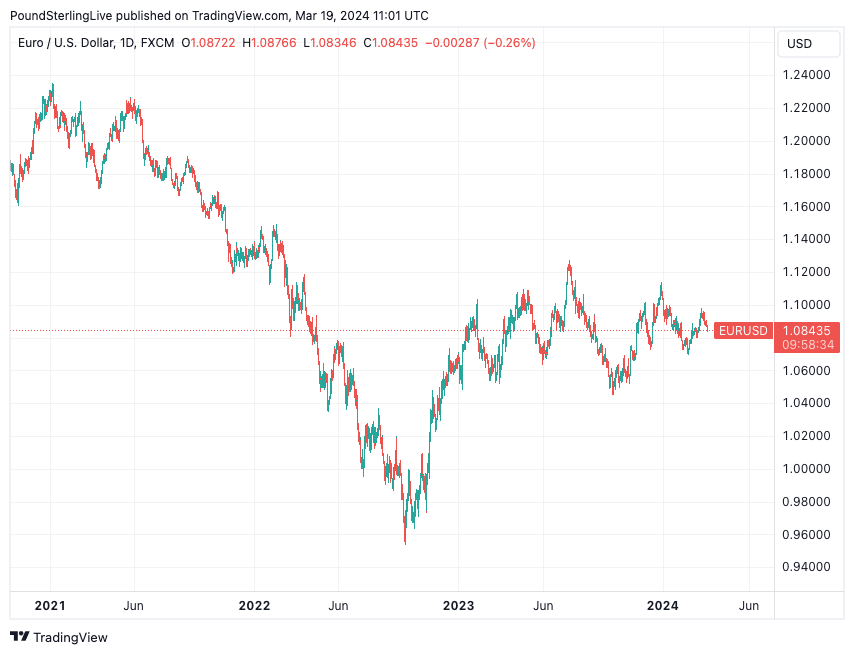

The findings could underpin a recovery in the Euro to Dollar exchange rate, which has been under pressure since 2021 as exceptional U.S. growth rates contrasted with those of the Eurozone, creating a compelling reason to sell the pair.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"Bottoming Eurozone activity and real income expansion signal the rebound is coming," says Davide Oneglia, an economist at TS Lombard. "Although the overall Eurozone economy remains stagnant, more concrete signs that activity has bottomed out and that it is starting to improve are finally emerging."

Contrasting to the rebound in Eurozone expectations, the share of fund managers who think U.S. growth will stay robust stands at 58%, little changed from last month but up from 28% in January.

62% think a soft landing is the most likely outcome for the global economy, with 23% in the no-landing camp, up from 19% last month and 6% in December.

39% expect falling inflation against the backdrop of robust growth to be the dominant macro theme over the coming months, up from 27% last month, with a net 57% expecting a decline in global inflation over the coming year.

"However, risks around the goldilocks scenario are seen as rising, with a plurality of 32% judging higher inflation as the biggest tail risk for markets, up from 21% in January," says Bruckner.

The survey shows investors think European equities can continue to rise, with 64% of participants expecting further near-term gains for the market (up sharply from 43% last month) and 88% projecting upside over the coming twelve months (up from 78% last month and the highest since January 2022).

Above: Growth divergence between the U.S. and Eurozone has been a particularly powerful downside force on Euro-Dollar. Track EUR/USD with your own custom rate alerts. Set Up Here

45% of respondents think equity upside will be driven by earnings upgrades in response to U.S. growth resilience and China easing, while 42% see a declining discount rate due to dovish central banks as the main catalyst.

A net 21% see European equities as undervalued, up from 14% last month.

45% of investors expect further upside for European cyclicals relative to defensives in response to easing credit conditions and rebounding PMIs (unchanged from last month), while 70% expect high quality to outperform low quality (up from 57%).

Tech is now the biggest sector overweight in Europe, overtaking insurance, while the cyclical sectors chemicals, retail and autos remain the least favourite sectors. 40% of survey participants think AI stocks are in a bubble, while 45% believe they are not.

Reducing equity exposure by too much and thus missing out on a continued rally is seen as the main portfolio risk for a plurality of 33%.