Debt Ceiling & Recession: A Cocktail for Further U.S. Dollar Gains

- Written by: Sam Coventry

Image © Adobe Images

Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole, has conducted research shedding light on the potential impact of a debt ceiling resolution on the U.S. Dollar (USD).

Marinov's findings indicate that such a resolution, expected in the coming weeks, could play a crucial role in the USD's recovery and reshape market expectations.

According to Marinov, a debt ceiling resolution would enable the US Treasury to increase debt issuance, prompting the US rates markets to scale back their expectations of Federal Reserve rate cuts.

This, in turn, would help drain USD liquidity, boost the appeal of USD rates, and potentially lay the groundwork for a more sustainable recovery for the currency.

Marinov states, "we expect that a debt ceiling resolution in the coming weeks would allow the US Treasury to increase debt issuance and encourage the US rates markets to pare back their Fed rate cut bets. This could help drain USD-liquidity, boost the USD rate appeal and thus pave the way to a more sustainable recovery for the currency."

Drawing on historical data, Marinov's research reveals that the USD has shown significant gains across the board following most debt ceiling resolutions since 1993.

Notably, during these episodes, only gold managed to hold its ground, while the Norwegian krone (NOK), Swedish krona (SEK), and British pound (GBP) were among the biggest underperformers on average.

Marinov emphasises the potential implications of a debt ceiling resolution, stating, "the USD gained strongly across the board following most debt ceiling resolutions since 1993. In that, only gold was able to hold its ground while the NOK, SEK, and GBP were the biggest underperformers on average."

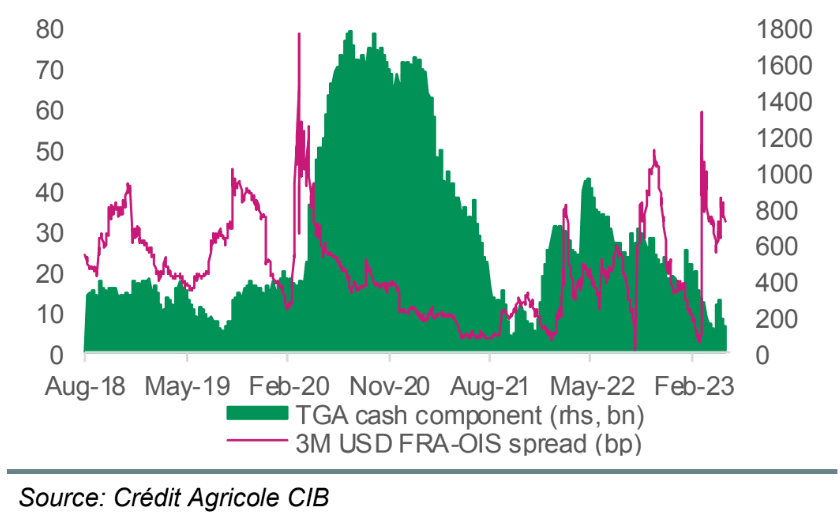

Above: "A rebuilding of the US Treasury’s cash position may fuel USD scarcity." - Crédit Agricole.

In addition, Crédit Agricole's U.S. economist predicts a potential recession for the U.S. in the second half of 2023.

Marinov notes that during debt ceiling episodes coinciding with a U.S. recession, such as those experienced in 2008 and 2009, the USD emerged as the best-performing G10 currency.

Marinov suggests that this historical episode could serve as a relevant template for foreign exchange (FX) markets if the GOP and Democrats agree only to a temporary extension or suspension of the debt ceiling until September.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

He says, "our US economist expects the US to slip into a recession in H223. We thus note that the USD has emerged as the best performing G10 currency when debt ceiling episodes coincided with a US recession, as was the case in 2008 and 2009. This episode could become a relevant template for FX markets if the GOP and Democrats only agree to temporarily extend/suspend the debt ceiling until September."

Marinov's research also includes an analysis of the performance of G10 USD-crosses and gold in the months surrounding debt-ceiling episodes since 1993.

The results indicate that the USD experienced the most pronounced losses against gold, the Japanese yen (JPY), and the Swiss franc (CHF). However, the USD remained relatively stable and even slightly stronger on average against currencies such as the GBP, New Zealand dollar (NZD), Australian dollar (AUD), Swedish krona (SEK), and Norwegian krone (NOK).

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks