Dollar Still Forecast Higher against the Euro by Danske Bank

- Written by: Gary Howes

Image © Adobe Images

The Dollar is ultimately set to appreciate against the Euro over the coming weeks and months say analysts at Danske Bank.

The Scandinavian lender says the Dollar looks set to benefit from "tightening" global financial conditions and strong investor demand for U.S. stocks and bonds.

"A key assumption behind our FX forecasts is that of a stronger USD and tightening of global financial conditions," says Jens Nærvig Pedersen, Director, FX & Rates Strategy at Danske Bank.

The call comes amidst turmoil in the global banking sector that has prompted investors to bet central banks will ease the pace at which they raise interest rates.

The Dollar has proven volatile in this environment, having fallen amidst news of the failure if Silicon Valley Bank and fears for other smaller regional lenders.

The developments have prompted investors to cut back their expectations for further Federal Reserve rate hikes, which drags on U.S. yields and the Dollar.

Market price action over the past week suggests investors are relatively sanguine about the prospects for Eurozone banks.

The Euro to Dollar exchange rate (EUR/USD) was as low as 1.0516 on March 15 as fears about Swiss lender Credit Suisse reached fever-pitch, but the pair has since staged a recovery to current levels near 1.0770.

"We are cautiously optimistic on systemic risk fears subsiding although we acknowledge that the outcome space is very wide," says Pedersen.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The Euro has been tracking European bank stocks which fell as fears for Credit Suisse mounted, before recovering on the subsequent takeover by UBS and assurances from authorities in Switzerland, the Eurozone and UK that the likelihood of contagion was limited.

"By taking the risk off the table of a more disorderly outcome for Credit Suisse that could have proven more disruptive for financial stability in Europe, the deal has helped to ease downside risks for the euro in the near-term. The price action for EUR/USD is consistent with this view," says Lee Hardman, Senior Currency Analyst at MUFG Bank Ltd.

Easing concerns would allow investor focus to shift back to the strong U.S. economy and the prospect of further Federal Reserve rate hikes.

This, and rising interest rates around the world will tighten global financial conditions.

"Financial conditions have indeed tightened recently which help explain the drop in EUR/USD, but we think more could come and keep our forecast profile intact," says Pedersen.

Danske Bank maintains its strategic stance for a lower EUR/USD, keeping a downward sloping profile forecasting EUR/USD at 1.02 in 6-12M.

If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

But the Euro is unlikely to break below parity against the Dollar again; "new energy/real rate shocks are required for a return all the way to the September lows," says Pedersen.

Risks to the forecast lies with the Federal Reserve delivering an actual policy pivot, whereby they cut interest rates.

Danske Bank believes such an outcome would emerge due to systemic risk fears or a weaker U.S. economy than currently anticipated.

But Danske Bank's forecast for a weaker Euro and stronger Dollar is challenged by analysts at Société Générale.

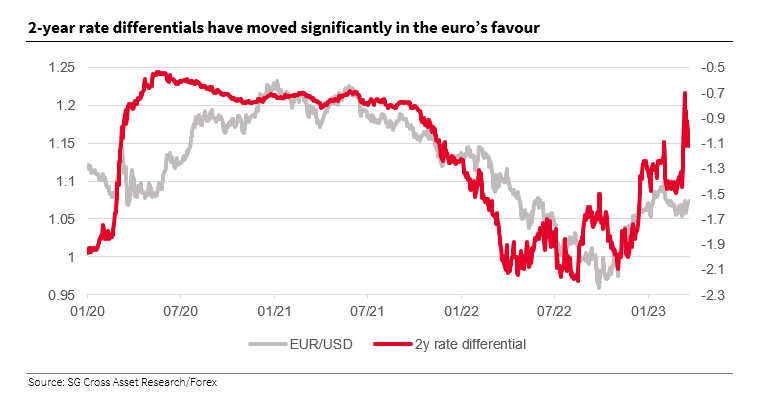

In a regular daily note to clients, Soc Gen's head of FX research, Kit Juckes, says the rise in Eurozone bond yields relative to those of the U.S. will act as an irresistible upside force on Euro-Dollar.

"There’s a strong chance that there will be little lasting impact on this side of the Atlantic, but less chance of the US escaping unscathed. That should avoid the narrowing in US/European rate/yield differentials that we have seen in recent days being reversed," says Juckes.

"And that n turn, suggests that the euro has significant upside as the situation calms down and risk aversion fades away," he adds.

Image courtesy of Société Générale.