EUR/USD Week Ahead Forecast: Resistances Could Stymie Near 1.06

- Written by: James Skinner

- -EUR/USD rebound could fade near to 1.06

- -Multiple resistances loom while risks linger

- -ECB, Fed testimonies eyed ahead of PMIs

© Grecaud Paul, Adobe Stock

The Euro to Dollar rate climbed back from the brink of five year lows last week but with domestic headwinds mounting and technical resistances looming almost immediately above the market, the Euro could struggle upon any approach of the nearby 1.06 handle in the days ahead.

Europe’s single currency may benefit early in the new week from Monday’s rally by the closely correlated Renminbi, which followed an already anticipated Peoples’ Bank of China (PBoC) decision to leave some of its various interest rates unchanged.

The Renminbi was the best performing major currency on Monday in what was a favourable start for the Euro to Dollar rate, although the single currency will also have to navigate a number of headwinds that could limit its ability to recover further this week.

These include market fears for the global economy and risks stemming from last week’s curtailment of Russian gas flows to Germany and Italy, which prompted a sharp increase in the price of gas on international markets.

“The abundance of headwinds facing the euro area economy has convinced us that a technical recession at the turn of the year is very likely, absent a respite in geopolitical tensions and/or large fiscal interventions, both of which we deem unlikely,” says Ludovico Sapio, an economist at Barclays.

Above: Euro to Dollar rate shown at daily intervals with Fibonacci retracements of February and April downtrends indicating possible areas of short-term technical resistance. Click image for closer inspection.

Above: Euro to Dollar rate shown at daily intervals with Fibonacci retracements of February and April downtrends indicating possible areas of short-term technical resistance. Click image for closer inspection.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

“This week's decision by Russia to cut some of its gas exports to Germany, Italy and France may foreshadow a complete halt to gas flows. In that instance, we expect the euro area to experience an earlier and deeper recession,” Sapio and colleagues said on Friday.

Surging gas prices will add further to inflation in Europe and beyond but are coming at a point where financial markets were already growing concerned about the outlook for the global economy and due in part to the anticipated interest rate responses of central banks.

“It is time to take the recession risks more seriously. Global asset markets are in turmoil. The combined drawdown of equity and bonds markets are now exceeding the nominal drawdown during the financial crisis,” says Kjetil Martinsen, chief economist at Swedbank.

“The biggest risk to the current economic outlook and cycle, is that central banks will continue to hike too much and too long, that a recession is inevitable,” Martinsen said on Monday.

This is partly why Monday’s appearances by European Central Bank (ECB) President Christine Lagarde at the European parliament will be watched closely and are the highlight of the European calendar ahead of Thursday’s S&P Global PMI surveys of Europe’s services and manufacturing sectors.

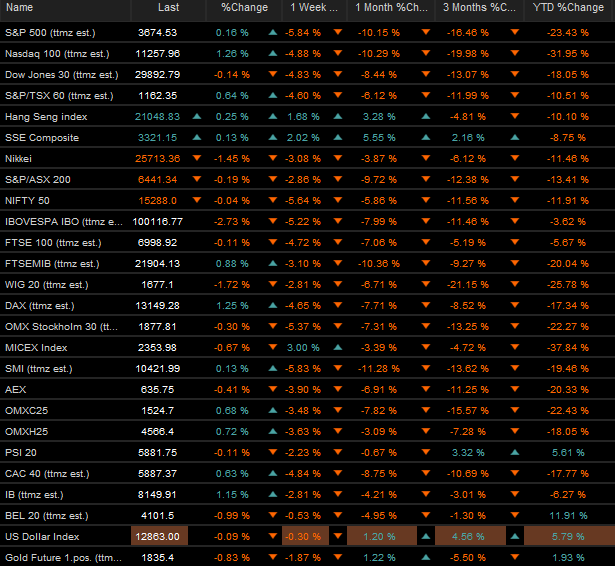

Above: Selected stock markets and performances over various horizons. Soure: Netdania Markets.

Above: Selected stock markets and performances over various horizons. Soure: Netdania Markets.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

These appearances come after the ECB called an unscheduled meeting last week and asked bank staff to "accelerate the completion of the design of a new anti-fragmentation instrument for consideration by the Governing Council" due to a rout in some Southern European bond markets.

Europe's bond sell-off followed the ECB's announcement earlier this month that it expects to begin lifting its interest rate in July, which will mark the beginning in earnest of a broader process to withraw the extraordinary monetary stimulus provided to the Euro area through sub zero interest rates and quantitative easing over a number of years.

“An ad hoc ECB Governing Council meeting has, via the reiteration of PEPP reinvestment as the first line of defence, stemmed fragmentation risks. However, the market will not be placated for long,” says Jeremy Stretch, head of FX strategy at CIBC Capital Markets.

“For now, we would be wary of the cross drifting back towards 1.0350 lows,” Stretch and colleagues said on Friday.

Financial markets will be especially interested in President Lagarde’s testimonies after the ECB asked bank staff last week to "accelerate the completion of the design of a new anti-fragmentation instrument for consideration by the Governing Council."

The week ahead is otherwise devoid of major economic appointments for the Euro and will likely see the market focus on appearances by Federal Reserve Chairman Jerome Powell who delivers the Semi-Annual Monetary Policy Report to congress on Wednesday and Thursday.

Above: Euro to Dollar exchange rate shown at daily intervals with spread or gap between 10-year Italian and German government bonds (yellow line), spread or gap between 02-year German and U.S. government bond yields (blue) and S&P 500 index futures (black). Click image for closer inspection.

Above: Euro to Dollar exchange rate shown at daily intervals with spread or gap between 10-year Italian and German government bonds (yellow line), spread or gap between 02-year German and U.S. government bond yields (blue) and S&P 500 index futures (black). Click image for closer inspection.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes