Euro / Dollar Week Ahead Forecast: Looking for a Footing Near 1.13

- Written by: James Skinner

- EUR/USD may attempt to stabilise near 1.13

- After ECB, Fed & geopolitics prompt setback

- But cocktail of risks limits scope for recovery

- ECB, Fed speak ahead as Ukraine risk lingers

Image © Adobe Stock

The Euro to Dollar exchange rate was dealt a significant setback last week and although it may attempt to stabilise above the nearby 1.13 handle over the coming days, there’s a triple-barrelled cocktail of risks that could be likely to limit its scope for recovery in the short-term.

Europe’s single currency sustained some of the heaviest losses of all in the G10 contingent ahead of the weekend when the Euro-Dollar rate’s earlier declines appeared to be exacerbated late in the day on Friday by reports in U.S. and international media alleging that an an extension of Russia’s 2014 military incursion into Ukraine could be likely to begin from mid-week.

“In short, markets are belatedly waking up to the geopolitical risks posed by Russian military action against Ukraine. We now even have an alleged potential start date, with all the usual caveats – Wednesday, February 16,” says Michael Every, a global macro strategist at Rabobank.

“Of course, Russia continues to vociferously deny it has any such intentions, and correctly points to the US not being a good actor when it comes to casus belli. Then again, Moscow just refused to comply with an official Organization for Security and Co-operation in Europe (OSCE) request to transparently explain what its military is doing all around Ukraine’s borders,” Every wrote in a Monday briefing to clients.

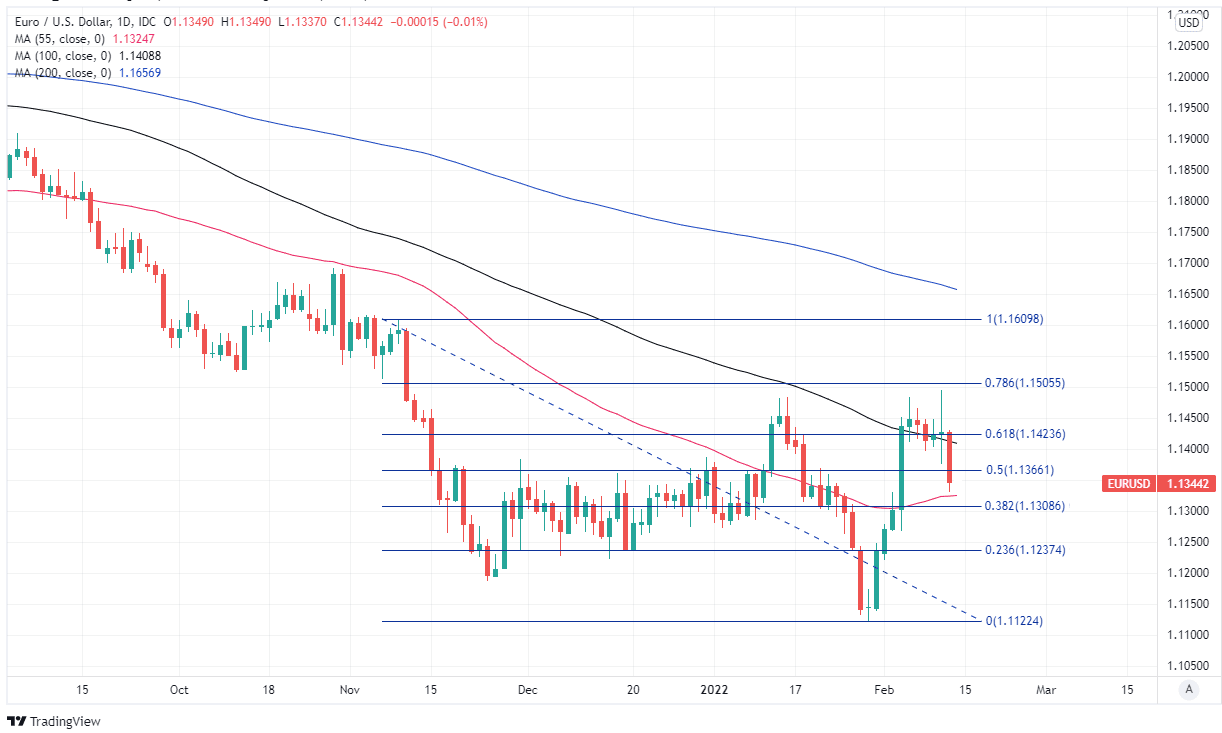

Above: Euro-Dollar rate shown at daily intervals with Fibonacci retracements of November decline indicating likely areas of technical resistance to any recovery by the Euro. Selected moving-averages denote possible support and resistances.

- EUR/USD reference rates at publication:

Spot: 1.1400 - High street bank rates (indicative band): 1.1000-1.1085

- Payment specialist rates (indicative band): 1.1300-1.1350

- Find out more about market-beating rates and service, here

- Set up an exchange rate alert, here

White House officials have since acknowledged that an attack on Ukraine is not actually certain but the alleged threat of one has helped to lift the Dollar and appeared to weigh especially heavily on the Euro during the final hours of trading Friday.

This could be due to some Euro area countries sharing borders with either Ukraine or Russia-aligned Belarus, although it’s not only geopolitics that have weighed on the Euro in recent days as Federal Reserve (Fed) and European Central Bank (ECB) policy developments have also been burdensome too.

“The ECB hawkish pivot following the January inflation surprise was a game-changer last week, but the very strong NFP in the US and, even more so, the strong inflation numbers for the US in January stopped the EUR rally,” says Athanasios Vamvakidis, head of FX strategy at BofA Global Research.

“We have been very concerned that the Fed is well behind the curve and the latest inflation numbers offer more evidence on this. The market is gradually adjusting to this reality, now pricing 6 hikes for this year and slightly more than 1 for next year. However, we expect 7 hikes for this year and 4 more for next year,” say Vamvakidis and colleagues, whose forecasts suggest the Euro-Dollar rate could end the year down around 1.10.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Euro-Dollar’s early February recovery reversed from late on Thursday and throughout Friday trading after the Federal Reserve Bank of St. Louis President James Bullard suggested the Federal Open Market Committee should consider lifting U.S. interest rates by a larger-than-usual increment of 50 basis points in March following the release of official data that showed U.S. inflation climbing to a four-decade high in January.

However, last Friday’s declines may also have been a result of commentary from ECB Chief Economist Philip Lane who reiterated in a Friday blog post that Eurozone inflation is likely to recede back toward the bank’s symmetric two percent target this year even without any increase in the ECB’s interest rates, which may have left some parts of the market disappointed given the excitement generated by the ECB’s February policy decision.

“While there are clear near-term headwinds from Fed tightening, some more cautious language from ECB officials, and the risk of fiscal fissures in the periphery, our new forecast reflects our view that exiting the long-standing negative interest rate policy (NIRP) would be an important development for the second most important reserve currency,” says Zach Pandl, co-head of global foreign exchange strategy at Goldman Sachs.

“Assuming the Fed moves gradually—and tensions ease between Russia and Ukraine—we think the broad Dollar should trade moderately weaker over the coming months,” Pandl and colleagues said on Friday after upgrading Goldman Sachs’ 12-month EUR/USD forecast from 1.15 to 1.20.

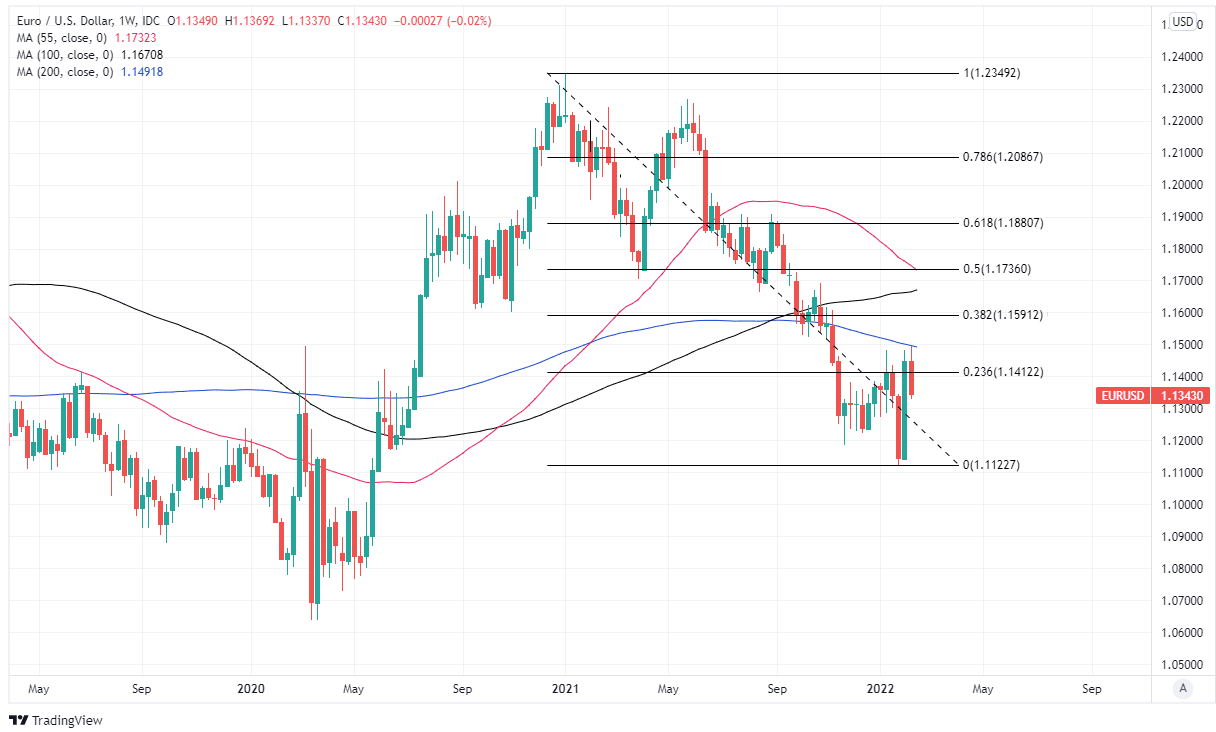

Above: Euro-Dollar rate shown at weekly intervals with Fibonacci retracements of 2021 decline and selected moving-averages indicating likely areas of technical resistance to any recovery by the Euro.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Both ECB and Federal Reserve policy will be back in focus for the Euro-Dollar rate this week, alongside the geopolitics, as ECB President Christine Lagarde and the Federal Reserve’s James Bullard are both set to speak publicly on Monday.

“The stronger than expected January CPI report increases the odds of a firmer monetary policy response by the Fed. We continue to expect the FOMC to raise rates by 25bp at its March meeting, but another solid print in February will likely encourage the Fed to accelerate the pace of hikes in 2022 and hasten both the timing and pace of balance sheet runoff,” says Mazen Issa, a senior FX strategist at TD Securities.

“A stronger print should keep market pricing for a 50bp hike next month elevated. That should leave the USD on its front-foot for now and has us looking at a 1.13 re-test in EURUSD near-term,” Issa and colleagues said in a Friday note to clients.

The Fed’s James Bullard is scheduled to be interviewed by CNBC News at 16:00 London time on Monday while President Lagarde is set to deliver the ECB’s annual report to the European parliament around 16:15, and the danger is their remarks leave the Euro-Dollar rate with little reason for cheer.

Minutes of the Federal Reserve’s January meeting are also due out on Wednesday and are another potential headwind for the Euro ahead of this Thursday’s busy schedule of speakers from the ECB’s board and Governing Council, which includes an appearance from Isabel Schnabel along with those from chief economist Lane and a further outing for President Christine Lagarde.