Euro Bears Hike EUR/USD Forecasts post-ECB

- Written by: Gary Howes

Image © Adobe Images

Euro bears ABN AMRO acknowledge that recent developments at the European Central Bank leave their euro forecasts looking too pessimistic and they have accordingly raised them.

We describe strategists at the lender and financial services provider as 'Euro bears' because their forecasts for the Eurozone's single currency are far below those of consensus.

Indeed, ahead of their latest upgrades they were expecting Euro-Dollar towards parity by the end of 2023.

The divergence in policy between the U.S. Federal Reserve and European Central Bank is the central driver of the Euro-Dollar outlook, and of late this has shifted in favour of the Euro.

"Currently, rate hike expectations dominate FX markets, and we expect this to continue for some time," says Georgette Boele, Senior FX Strategist at ABNA AMRO.

- EUR/USD reference rates at publication:

Spot: 1.1400 - High street bank rates (indicative band): 1.1000-1.1085

- Payment specialist rates (indicative band): 1.1300-1.1350

- Find out more about market-beating rates and service, here

- Set up an exchange rate alert, here

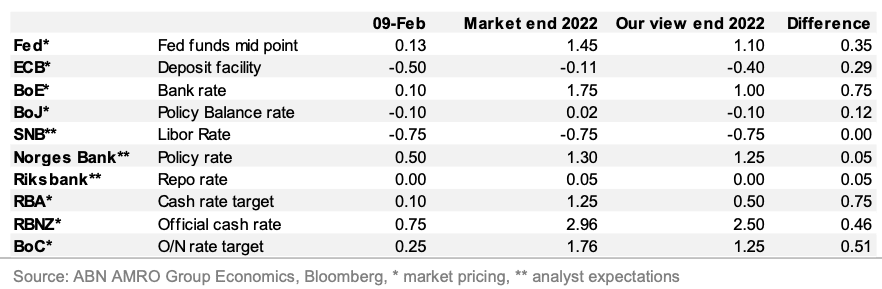

ABN AMRO says for 2022 financial markets expect four rate hikes by the ECB in steps of 10 basis points.

This follows the ECB's February policy update where policy makers signalled a rate hike in 2022 was now likely, marking a momentous step away from a long-running Negative Interest Rate Policy (NIRP), introduced in 2014.

The Fed is meanwhile expected by markets to deliver five rate hikes of 25 basis points.

In contrast to market expectations, ABN AMRO expects one rate hike of 10 basis points by the ECB, and four rate hikes of 25 basis points by the Fed.

"We think that if our view proves to be correct then that the euro still weakens versus the US dollar this year and next year," says Boele.

But they say it is likely the overall size of the move lower by EUR/USD is smaller than they had originally anticipated.

Their new EUR/USD forecast for end 2022 is 1.07 (up from 1.05) and for the end of 2023 they forecast 1.05, up from 1.0 perviously.

Above: ABN AMRO's central bank forecasts vs. what the market is expecting.