Euro / Dollar Rate Risks Pointed Lower on ECB Outcome: ING

- Written by: Gary Howes

Image © European Central Bank

- EUR/USD reference rates at publication:

- Spot: 1.1593

- High street bank rates (indicative band): 1.1187-1.1268

- Payment specialist rates (indicative band): 1.1489-1.1535

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

Expectations for higher interest rates out of the European Central Bank will meet a "reality check" on Thursday, according to a noted foreign exchange strategist, and this could weigh on the Euro.

Francesco Pesole, FX Strategist at ING Bank, says the market's current expectation for a rate hike to be delivered by the ECB as early as 2022 will be resisted by ECB President Christine Lagarde, although she will have to carefully negotiate various factions on the ECB board.

"We think ECB President Lagarde will use all her diplomatic skills to moderate the diverging views of hawks and doves within the Governing Council on Thursday, and a neutral message may ultimately defy some of the market's hawkish expectations," says Pesole in a preview of the Thursday rate decision.

ING finds the balance of risks for EUR/USD appears slightly tilted to the downside.

The Euro to Dollar exchange rate has been contained in a tight range lying between 1.1530 and 1.1670 since September and investors are questioning whether this Thursday's policy decision will be enough to inject some volatility into the pair.

Above: Moves in the Euro following recent ECB meetings.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Euro's decline against the Dollar during September period was partly arrested by a notable shift in market expectations regarding the future of Eurozone interest rates.

A long held assumption has been that rates at the ECB would only rise in 2024, at the earliest, given the bloc's notoriously sluggish inflation rates.

But now inflation is pushing sharply higher, driven largely by ongoing supply chain issues and surging energy prices.

This has prompted the market to reevaluate the outlook for Eurozone policy by bringing forward expectations for the first rate hike into 2022.

This expectation has been massaged by the rapid repricing of rate hike expectations at other central banks, including the Bank of England and U.S. Fed: 'if everyone else is moving then the risks of us moving are diminished'.

Rising rate expectations make for tighter monetary conditions i.e. the cost of finance rises and poses headwinds to Eurozone economic growth.

This is why there might be strong disagreement amongst ECB policy makers: some on the ECB board agree that some of this is warranted given high inflation (the hawks), but others are of the view that costs must be kept low at all costs (the doves).

"The market reaction to higher energy prices has been channelled through a widespread hawkish re-repricing in rate expectations, which has also involved the ECB," says Pesole.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

For foreign exchange markets, the question now is whether the ECB board will agree that the recent move in rate hike expectations and associated monetary tightening is warranted.

"These hawkish expectations may face a first reality check at the October ECB meeting on Thursday," says Pesole.

He says the board will likely discuss whether the recent upside pressure to inflation will still prove more or less transitory and crucially whether it will soon be necessary to further scale back the bank’s emergency policy tools.

"Our view is that the policy statement and the following press conference by President Christine Lagarde will be quite neutral, possibly with a further more explicit acknowledgement that higher inflation could be more persistent in 2022," says Pesole.

ING expects Lagarde to avoid giving any hint that the current debate between the hawks and doves in the Governing Council is leaning in any clear direction, ultimately leaving many options open when it comes to the timing and pace of the unwinding of monetary stimulus.

From an FX perspective, buyers of the Euro on more hawkish rate expectations could be disappointed.

ING warn of potential Euro weakness on Thursday as some of those hawkish bets are partly scaled back.

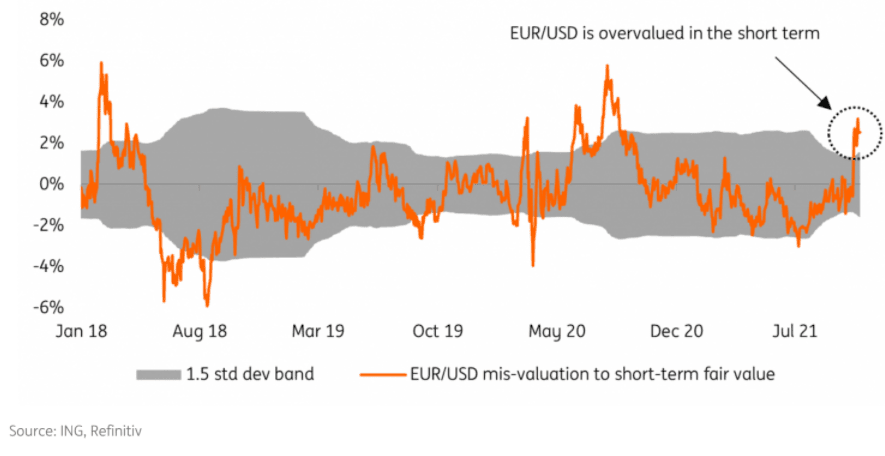

Their short-term fair value model shows (chart above) meanwhile shows EUR/USD is currently trading in expensive territory (around 2.5% overvalued), with the short-term rate differential showing the highest beta of all factors considered in the model.

ING analysis meanwhile shows the Euro's reaction to recent ECB meetings suggests it has not been very reactive to rate announcements of late.

"Accordingly, we expect to see only a contained downward correction in EUR/USD on Thursday," says Pesole.