Euro-Dollar Breathes Sigh of Relief after U.S. Inflation Stalls but 1.17 Still in Jeopardy

- Written by: James Skinner

- EUR/USD enjoys tepid relief rally after U.S. inflation stalls

- Main CPI measure holds 5.4% as core price pressures ebb

- EUR/USD lifts off 1.17 as simmering hot USD comes off boil

- But Fed’s taper timeline leaves question mark over outlook

Image © Adobe Stock

- EUR/USD reference rates at publication:

- Spot: 1.1735

- Bank transfers (indicative guide): 1.1324-1.1406

- Money transfer specialist rates (indicative): 1.1630-1.1653

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Euro enjoyed a tepid relief rally in tandem with other currencies in the mid-week session as the Dollar came off the boil after Bureau of Labor Statistics data provided further tentative evidence that U.S. inflation may be cresting, although some analysts say Euro-Dollar remains at risk of slipping below 1.17.

American inflation rates have more-than doubled this year and prompted both market participants and Federal Reserve (Fed) officials alike to begin entertaining the idea that interest rates in the world’s largest economy might need to rise sooner than was previously envisaged by all.

But July’s consumer price index inflation measures from the Bureau of Labor Statistics provided a further suggestion that U.S. central bankers might have been right after all, and in the first place when they said that recently explosive gains in prices paid by all were a mere “transitory” phenomenon.

“Inflation remains elevated but the print did not exceed already lofty expectations,” says Neil Wilson, chief market analyst at Markets.com.

“Inflation is here to stay but we’re not sensing the Fed is getting more angsty just yet, so is allowing gold to climb. Indeed if anything, deceleration in price growth allows the Fed to take a slower route to the taper, so risk is finding some bids,” Wilson says.

Europe’s single currency had been ebbing steadily back toward its year-to-date lows only a few points above the 1.17 handle but bounced heartily, albeit less so than other currencies after the main measure of U.S. consumer prices stalled in July and the more important core measures slipped.

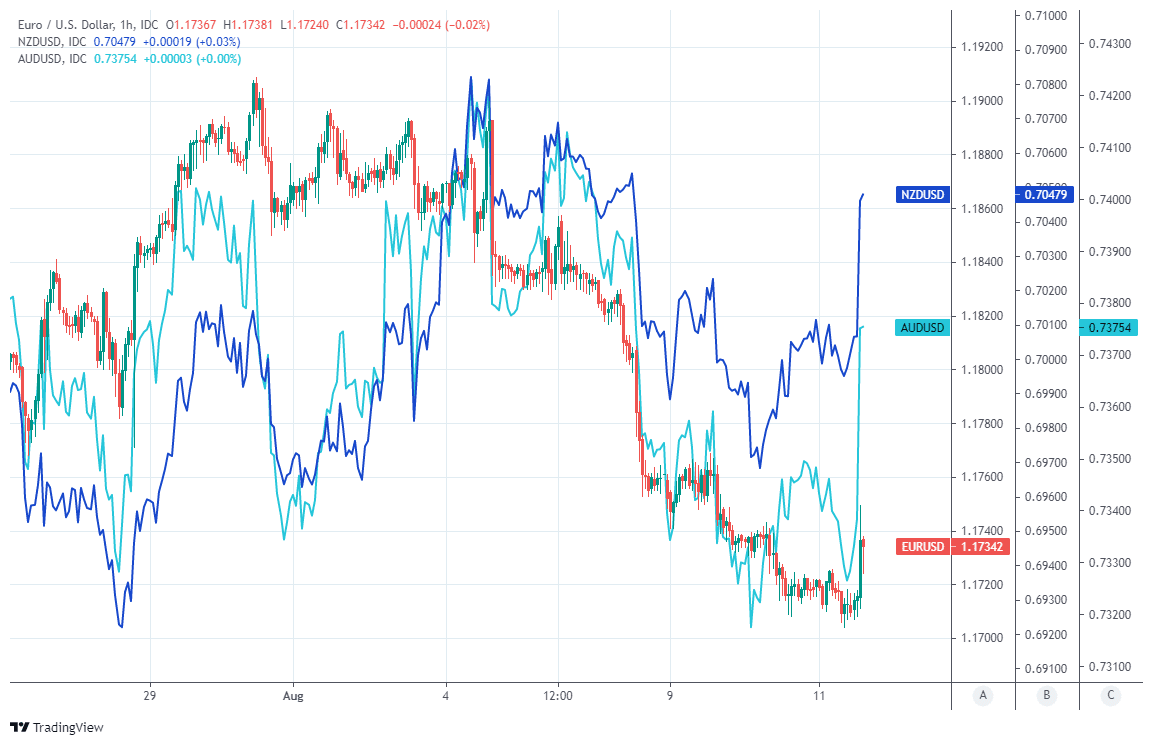

Above: Euro-Dollar rate shown at hourly intervals alongside NZD/USD and AUD/USD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The main measure of inflation rose at a steady 5.4% last months, the data showed, which is more than twice the 2%-average target of the Federal Reserve and a problematic pace of growth for central bankers and many borrowers if it’s sustained over a meaningful period of time.

But crucially the benchmark did not rise any further, despite that many other numbers this year have surprised on the upside of market expectations, while the all-important core measure of prices slipped from annualised rate of 4.5% to 4.3% in line with market expectations.

These are not dissimilar outcomes to those reported by the Bureau of Economic Analysis for Fed’s favourite inflation gauges, the personal consumption expenditures price indices, for June when the data was released at the end of last month.

“In the USA, the corona-induced surge in inflation has probably passed its peak,” says Dr Christoph Balz, a senior economist at Commerzbank.

“The core rate fell to just 0.2% [month-on-month], the third consecutive month of decline. Today's data therefore tend to support the Fed's view, which we share, that this is largely a temporary inflation spurt. Next year, many of the bottlenecks should be removed and inflation should fall significantly,” Dr Balz explains.

Balz and Commerzbank colleagues said in a note following the release that although inflation rates are likely over their peak and could fall back significantly next year - owing mainly to statistical ‘base effects’ and an easing of other temporary factors - the data is unlikely to knock the Fed off a recently charted course to taper its $120BN per month quantitative easing programme.

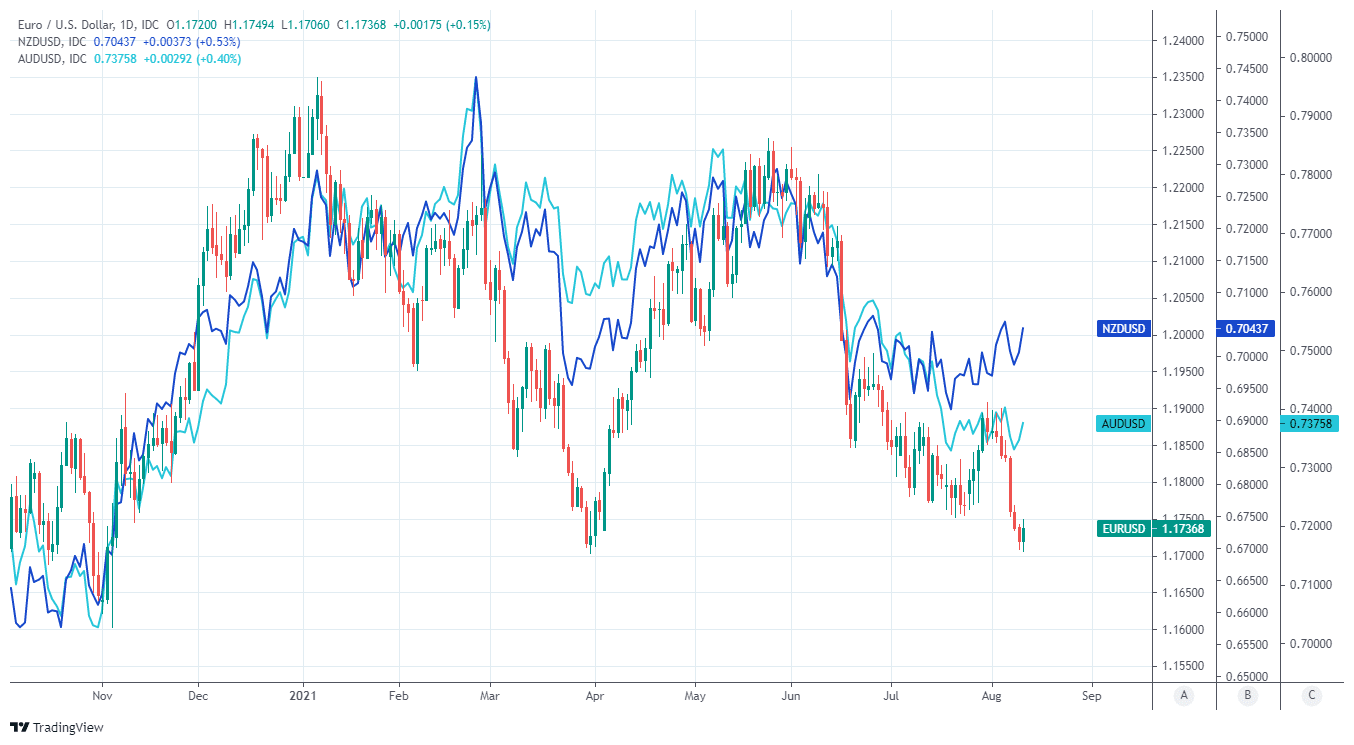

Above: Euro-Dollar rate shown at daily intervals alongside NZD/USD and AUD/USD.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

Expectations of a tapering have built in recent months and throughout a period when the European Central Bank (ECB) has made clear that it’ll likely continue its own bond buying programme until at least the end of the first quarter 2022, which is a big part of why the Euro-to-Dollar exchange rate has come under pressure throughout the second quarter and thus far in the third.

The announcement containing plans for the process of winding down the Fed’s emergency monetary support could come as soon as September and so, although the Euro-Dollar rate found relief in Wednesday’s U.S. inflation figures, the single currency might not get far off the 1.17 level.

“EURUSD rallies are likely to be faded and 1.17 support looks vulnerable to breakage,” says Mazen Issa, a senior FX strategist at TD Securities.

“We reckon that dips in the USD will get faded as payrolls matter more for the taper discussion than what is a well-known story of 'transitory' inflation pressures peaking,” Issa says.

Wednesday’s inflation figures come less than a week after other Bureau of Labor Statistics data showed the U.S. economy creating or recovering from the coronavirus close to 1 million jobs for a second consecutive month, which has brought the labour market a step closer to the “substantial further progress” in the direction of full employment the Fed has been seeking as a precondition for a tapering of its quantitative easing programme.

These numbers followed July’s Institute for Supply Management Services PMI, which rose to a fresh record high and potentially indicates that the U.S. economy shifted anew into another higher gear early during the third-quarter.

Meanwhile, earlier this week the influential ZEW survey published by the Leibniz Centre for Economic Research suggested that companies in Germany became more pessimistic about the outlook for their businesses and Europe’s largest economy, citing concerns about the possibility of a fourth wave of coronavirus infections this winter and an ongoing slowdown in the key Eurozone export market that is China.