Euro-Dollar Week Ahead Forecast: Cooling Heels as ECB's Concerns, Vaccine Trouble Curbs Appetite

- Written by: James Skinner

- EUR/USD showing resilience but faces growing headwinds.

- Could be sidelined as ECB, vaccine crisis encourage caution.

- Ahead of January's CPI data & amid global market weakness.

- But FX moves elsewhere to keep EUR/USD supported ahead.

Image © European Central Bank

- EUR/USD spot rate at time of writing: 1.2138

- Bank transfer rate (indicative guide): 1.1713-1.1798

- FX specialist providers (indicative guide): 1.1956-1.2053

- More information on FX specialist rates here

The Euro-to-Dollar exchange rate gave a robust account of itself on Friday but was still carrying a 2021 loss that could remain a burden over the coming days as European Central Bank (ECB) rhetoric and a vaccine crisis in Brussels risk prompting investors to eschew the single currency in the short-term.

Europe's unified unit was unchanged against the Dollar on Friday but had declined -0.32% over the course of the week, taking its 2021 loss to -0.61% while whittling its one-year gain down to 10.05% after stock markets suffered some of their steepest declines since October.

Stock and commodity market losses were a downward influence on the positively-correlated Euro-Dollar rate, although the currency was also seen hampered by rhetoric from the European Central Bank (ECB), which is fretting about EUR/USD gains that have lifted the trade-weighted Euro.

ECB complaints came alongside the threat of EU restrictions on the export of coronavirus vaccines, which came into effect on Sunday and will require all exports to be authorised by national governments who can hold up shipments if manufacturers have not met what the EU says are contractual commitments.

"The risk is that vaccination in Europe could lag by 1-2 quarters from that in the US and the UK. Threats for a vaccine export ban could backfire and we hope will not be followed through," says Athanasios Vamvakidis, head of FX strategy at BofA Global Research. "The EU economy is weak and is weakening further. The lockdown continues and vaccination has been disappointingly slow. The ECB is pushing against EUR strength. We got both a rates sell-off, earlier in the year, and an equities sell-off this week. Still, EURUSD is just above our 1.20 forecast for Q1. We suspect that the main reason is that real money, who is long EURUSD, has not capitulated, at least not yet. Hedge fund positioning has been much lighter. Both have now stopped selling the USD."

Above: Euro-to-Dollar rate shown at daily intervals with S&P 500 index futures (yellow).

Export restrictions are a potential source of tension with other countries beyond Britain this week, and one that serves as a direct reminder of Europe's lacklustre progress on vaccinations, which is in contrast to the performance of the U.S. where Washington is closing the gap with the UK in its vaccination campaign.

Meanwhile, the ECB's concerns are a burden for EUR/USD without moves elsewhere that offset the impact gains have on the trade-weighted Euro. Combined together, this and the vaccine crisis could limit investor appetite for the Euro, leaving it sidelined or even vulnerable to a grind lower this week.

However, the most significant short-term determinant of EUR/USD direction would be whether or not global stock and commodity markets are able to stabilise ahead of January's inflation data.

Stabilisation would send the Dollar into retreat if recent trends continue.

"EUR/USD has held above the 1.2100 level for most of the week, showing further signs of resilience to dollar-buying pressures and unencouraging contagion data in Europe," says Petr Krpata, chief EMEA strategist for currencies and bonds at ING. "Inflation numbers are set to rise thanks to a German VAT increase and higher energy prices. While the dollar may fail to show signs of weakness, we see no reasons for the euro to lose its resilience."

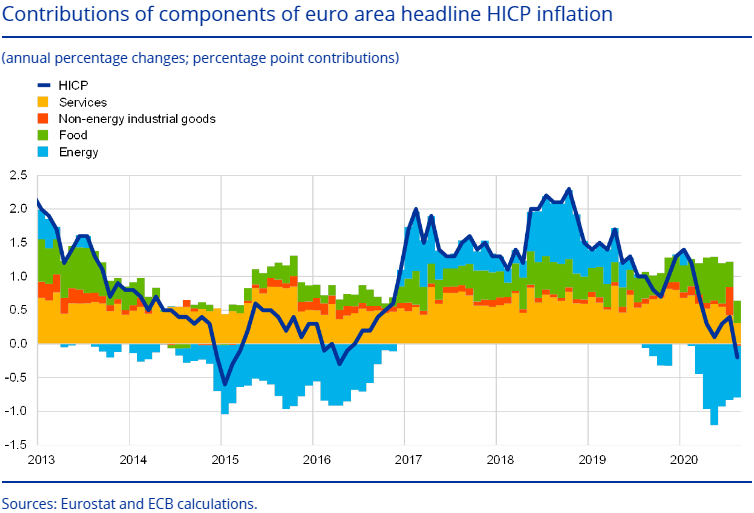

Above: Eurozone inflation and its constituent parts. Source: European Central Bank Economic Bulletin. Shows that energy price fluctuations explain almost all of the deviation above and below the 0%-to-1% range. Also highlights that inflation components over which policymakers have most sway - services and prices of non-energy industrial goods - have not risen since the launch of the ECB's quantitative easing program in January 2015.

The highlight of the Euro calendar this week is January's inflation data, which could be perceived as having implications for ECB policy and may support the Euro when it's published by Eurostat at 10:00 on Wednesday.

Europe's consumer price inflation rate has stuck below zero since September 2020 but consensus implies that a rise from -0.3% to 0.4% is likely for January, with this seen lifting the core inflation rate sharply from 0.2% to 0.7%.

Both numbers would still leave inflation far below the ECB's target, while the increases would be mostly the result of one-off factors that will not be repeated, although the data could still be welcomed by the single currency.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

"EU officials recently expressed their desire to raise the global status of the EUR, but the evidence in practice suggests they'd also like market forces to play a smaller role in determining its value. The aforementioned makes the case for the EU side weaker, but in the current economic climate that does not mean further action to thwart EUR appreciation is less likely. We sense that there has been a clear shift in the ECB's thinking on the exchange rate," says Stephen Gallo, European head of FX strategy at BMO Capital Markets. "Our approach is still to look for pullbacks in EURUSD in order to get long, but we'd prefer it if those pullbacks were fairly large."

Fearing for the medium-to-long term prospects of attaining the ever-elusive "close to, but below 2%" threshold, ECB policymakers have appeared to be increasingly attempting to discourage EUR/USD from further disinflationary increases this month. Bank staff told Bloomberg News last week that they see investors underestimating the odds of an interest rate cut up ahead, days after it was reported that they're also investigating the impact Federal Reserve monetary policy has had on EUR/USD.

"We remain in a deep crisis with huge uncertainties, not least as the roll-out of the vaccine looks disappointingly slow. All present indicators point to a struggling economy with massive output gaps, and all respectable economics institutions predicting that Europe will be the last major economy to restore GDP back to pre-pandemic levels," says Erik Nielsen, chief economist at UniCredit Bank.

Above: Euro-to-Dollar rate shown at weekly intervals with U.S. Dollar index (yellow).

The Fed has sunk the Dollar with its unprecedented response to the coronavirus, driving much of the increase in EUR/USD in the process, although the greenback was widely seen as substantially overvalued beforehand and still remains above long-term averages against many currencies.

"While new rate cuts even further down into negative territory would surely help undermine the EUR, they likely remain controversial. According to the ECB’s research from October, balance sheet (QE) policies DO matter," says Martin Enlund, chief FX strategist at Nordea Markets. "In relative terms, the size of the Fed’s balance sheet peaked in June, and since then the ECB has printed new EUR’s at an even more dizzying pace...The US is going to outperform the Euro area in a 2018 kind of way during the next six months and remember that this was exactly what caused EUR/USD to turn south during the early parts of 2018."

The idea the ECB might cut rates further is not new, as the bank itself reiterates the commitment that if required it "stands ready to adjust all instruments" following each meeting, but the fact the ECB is attempting to repackage rate cut risk as news speaks volumes about the extent of Frankfurt's currency concerns.

Those were given only lip service after January's meeting, but short-term threats to the economy and a consensus outlook for a weaker Dollar as well as stronger EUR/USD may explain why that coolness has evapourated.

"The row about vaccine distribution, a plethora of covid-related restrictions in the region and the approach of the end of the Merkel era are all factors which may make investors reluctant to extend long EUR positions – even without the addition of ECB jawboning," says Jane Foley, a senior FX strategist at Rabobank. "While we see scope for EUR/USD to pullback towards the 1.20 area this quarter as investors reassess the change in fundamentals, we expect to see 1.22/1.23 again later on in the year."

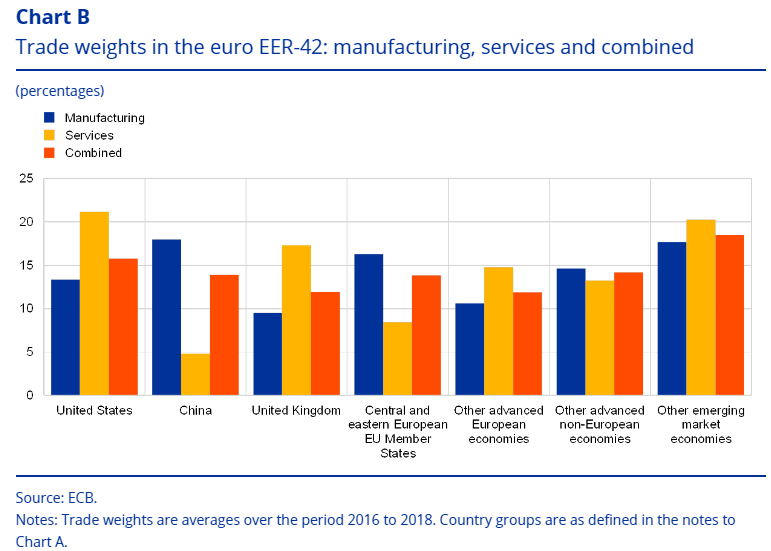

Above: U.S. Chinese & UK shares of trade-weighted Euro alongside regional groupings. Source: ECB Economic Bulletin.

EUR/USD accounts for a double-digit percentage of the trade-weighted Euro, which has risen to decade highs and is now threatening to reduce inflation by cutting the cost of goods imported into Europe.

But the ECB's concerns need not be the end of the 2021 Euro-Dollar rally if Sterling or the Yuan continues to climb during the months ahead.

"Removing the USD aspect from the equation is also a viable way forward; the recent developments make us more confident that key EUR cross rates are likely to drift lower over the course of H1 (EURCAD, EURGBP, EURNOK, EURAUD, EURCNH, and EURINR)," BMO's Gallo says.

Just like the Chinese and U.S. currencies, the British one also has a sizeable share of the trade-weighted Euro and with a sufficient increase from long-term lows in the near-term, could enable EUR/USD to rise in manner that has a neutral impact on the trade-weighted Euro later this year.

This would mean EUR/USD need not be a concern at the ECB. China's underway, if-not complete economic recovery has already enabled the Yuan to push EUR/CNH -1.5% for 2021, while the Pound had pushed EUR/GBP -1.02% lower, with Sterling the biggest gainer of major currencies and the major economy outperformer on vaccinations.

"The Israeli vaccine lab is now slowly but surely producing convincing real-time evidence of the vaccine working. The average age of hospitalized patients in Israel is falling (a good signal in this case), the amount of new cases among those vaccinated is dropping fast and the mRNA style vaccine seems able to combat virus mutations as well. If the UK is able to mirror these results with a time-lag of 2-3 months, which seems rather likely, then GBP could be the next gainer from the vaccine competition," Nordea's Enlund says.

Above: EUR/USD at monthly intervals with other bilateral rates selected for trade-weighted significance. EUR/GBP in pink. Click for closer inspection.