The Euro-Dollar Rate Treads Water as German Stimulus Seen Offering Only Limited Boost to Economy

- Written by: James Skinner

© Christian Müller, Adobe Stock

- EUR treads water on speculation of German fiscal stimulus.

- German gov seen open to stimulus as outlook dims further.

- But economist says budget laws mean stimulus to be limited.

- As others eye broader reform of Eurozone spending rules.

The Euro was treading water Wednesday amid speculation the German government could be about to loosen its purse strings in a bid to support its economy through an ongoing soft patch, although restrictive budget laws and other challenges will limit the impact of any stimulus.

Fiscal stimulus is the byword of the day for crisis-fighting now the European Central Bank (ECB) is widely seen as having run out of monetary bullets in can use to stoke growth and inflation, but restrictive budget rules in Germany and the Eurozone have left large increases in government spending looking like distant prospects. But Reuters reported late Tuesday that Chancellor Angela Merkel's party may be softening its stance on the idea after being compelled to cut its 2020 forecasts for the economy.

The government is said to now be expecting GDP growth of just 0.5% for 2019, down significantly from the 1.5% seen in 2018 and the 2.2% seen in 2017. And the government is said to have slashed its forecast for growth next year from 1.5% to 1% to reflect an outlook that has been darkened by the U.S. trade war with China, ongoing uncertainty over the UK's exit from the European Union and troubles in the automotive sector.

"It remains very unclear just how much the German economy has to slow before Merkel’s party is willing to loosen the purse strings. Moreover, any spending would still be subject to the German budget laws, which means that the size, and thus effectiveness, of any fiscal package will be limited from the onset," says Michael Every, a strategist at Rabobank.

The rub for Germany and the Euro is that the full year result could be even lower than the new government forecast implies and that restrictive laws around government borrowing could yet leaving any spending package looking like 'too little, too late'. Germany, which can set the mood for smaller European economies, is widely expected to have seen a second consecutive contraction of GDP growth in the third quarter that would leave the country in recession.

Above: Euro-to-Dollar rate shown at hourly intervals.

"EUR trades where it should. Still, it looks vulnerable to a top in GBPUSD, leaving us sellers into 1.11. A resolution to Brexit would help European FX, though a lasting impact, requires a positive growth story," says Mark McCormick, head of FX strategy at TD Securities.

German growth already fell by 0.1% in the second quarter, taking away from the 0.4% increase seen at the start of the year and leaving the economy up just 0.3% for 2019 ahead of the anticipated third quarter contraction. That could mean the economy has to rebound strongly in the final months of the year to avoid a further decline, which might be unlikely if either a 'no deal' Brexit happens in the weeks ahead or if the U.S. moves ahead and implements previously-announced tariffs on imports of European cars in mid-November.

However, and even if the German government does agree to spend more, it'll still be constrained by rules that prevent it borrowing any more than 0.35% of GDP. That's little more than €10 bn and likely inadequate for shocking the economy back into life even if the €45 bn budget surplus clocked up between January and June is spent as well. When combined, the two would amount to less than 2% of Germany's $3.6 trillion or €3.3 trillion GDP.

"The only way to keep the genie of yet another euro crisis in the bottle is to rethink the role of fiscal policy in the eurozone. Not in an irresponsible, unsustainable way but in the context of an economic debate on how to increase potential growth throughout Europe, and hence the level of the neutral interest rates. The current slowdown and a possible recession in Germany will only speed up the debate. The key to whether it is a recession made in heaven or hell lies in Berlin," says Carsen Brzeski, chief economist at ING Germany.

Above: Euro-to-Dollar rate shown at daily intervals.

China's economy is struggling beneath the weight of U.S. tariffs, which has reduced demand for products made in German factories although the slowdown is increasingly global in nature and moving beyond manufacturing industries, with the International Monetary Fund joining a long line of private sector economists in downgrading its forecasts for global growth on Tuesday.

Already, the downturn in Germany has seen quarterly GDP growth rates fall more than half for the Eurozone but broadening of the economic malaise now risks embroiling other countries, many of which are also constrained in their ability to borrow and spend by EU rules that make austerity a mandatory menu item. Those rules, created to keep the Euro together, leave the bloc unprepared for and potentially unable to handle a major economic downturn. ING is just the latest to call for reforms to them.

"My view remains that Germany will continue to deliver a slow-motion stimulus, possibly beefing it up modestly once the data confirm that the country has fallen into a mild recession. However, Germany will not deliver the one big fiscal push that could be a game-changer for the Eurozone. Beyond a hesitation to open the fiscal taps widely, serious bottlenecks prevent an even faster expansion of German public infrastructure spending," says Holger Schmieding, chief economist at Berenberg.

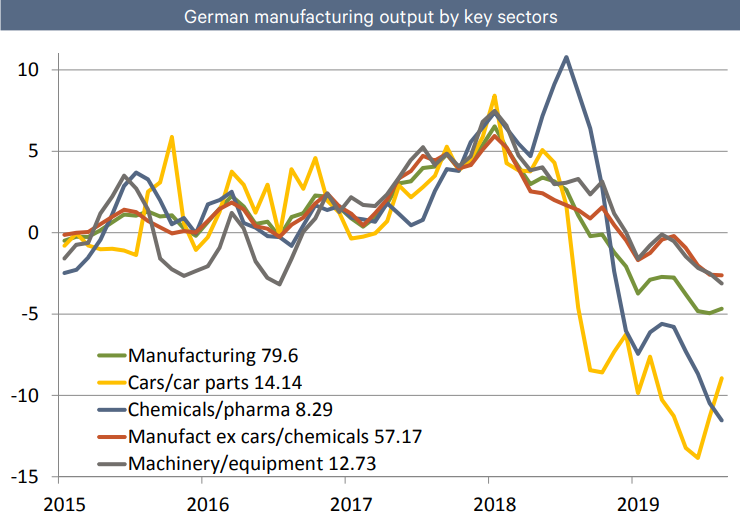

Above: Berenberg graph showing changes in output from various parts of German manufacturing sector.

The European Central Bank, which is widely regarded as having ran out of policy bullets with which it can fight any slowdown in growth, called in September for Eurozone governments to spend more whenever they are not constrained by EU rules. The bank cut one of its interest rates further below zero last month and restarted its quantitative easing program in an effort to lift growth and inflation but few see it being enough to reverse the slowdown in either the German or Eurozone economies.

Berenberg's Schmieding has factored additional government spending of no more than 0.5% of GDP into his forecasts for growth in 2020 and 2021. He says additional spending is likely to be directed toward "green projects" and subsidies of under-employment for those who already have jobs. However, and most notably, he says Germany could have trouble spending any new stimulus it in a manner that supports growth even if it does decide to do so.

"The German government should invest more. However, that is easier said than done. Germany is facing severe supply bottlenecks in construction. Public construction investment rose by an impressive 9.7% yoy in H1 2019. Unfortunately, a 5.9% surge in prices swallowed up most of the increase," Schmieding says. "If Germany were to step up public construction investment even faster than it does already, it would get little bang for the buck. Underemployed car workers cannot build or repair bridges."

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of a specialist foreign exchange specialist. A payments provider can deliver you an exchange rate closer to the real market rate than your bank would, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement