Euro-Dollar Rate Takes Airbus Tariffs on Chin but It's November Car Levies that Matter

- Written by: James Skinner

Image © White House

- EUR choppy in early trading, after tariff hit over Airbus subsidies.

- $7.5 bn of U.S. tariffs on agriculture, airplanes and Scotch whisky.

- Comes ahead of November U.S decision on whether to target cars.

- EU says it's open to a deal, retaliatory spiral will hurt both economies.

- EUR/USD takes tariffs, and the threat of more to come, on the china.

The Euro was choppy in early trading Thursday after the U.S. formally announced new tariffs that will target a range of European goods exports to the U.S. from October 18, lifting tensions between the already-uneasy trade partners and stoking further fears for the global economic outlook.

Europe's single currency was choppy but avoided notable losses Thursday for a number of reasons, although not least of all the U.S. decision to set its tariff rate much lower than it could have done. The U.S. was authorised by the World Trade Organization to impose a 100% tariff on EU goods exports to the U.S. totalling $7.5 bn annually, the largest ever award made by the global body, in a move that brought an end to more than 15 years of legal wrangling.

“For years, Europe has been providing massive subsidies to Airbus that have seriously injured the U.S. aerospace industry and our workers. Finally, after 15 years of litigation, the WTO has confirmed that the United States is entitled to impose countermeasures in response to the EU’s illegal subsidies,” says Robert Lighthizer, U.S. Trade Representative. “We expect to enter into negotiations with the European Union aimed at resolving this issue in a way that will benefit American workers.”

The White House has chosen to target aircraft, Scotch Whiskey and a range of agricultural items, with the aviation tariff set at just 10% and the agricultural tariffs going on at 25%. The decision is a further blow for the already-ailing Eurozone and global economies, although not as severe a blow as it could have been. Brussels responded with a statement late Tuesday in which it appealed for talks to begin so that differences over subsidies for airplane manufacturers can be addressed.

"The mutual imposition of countermeasures, however, would only inflict damage on businesses and citizens on both sides of the Atlantic, and harm global trade and the broader aviation industry at a sensitive time," says Cecilia Malmstrom, European Union Commissioner for trade, in a statement. "The European Commission has consistently communicated to the United States that the European Union is ready to work with them on a fair and balanced solution for our respective aircraft industries."

Above: Euro-to-Dollar rate shown at daily intervals.

Malmstrom says the EU will, in some months time, be given an opportunity to impose its own duties on U.S. goods over a separate complaint relating to tax breaks that have been given to Boeing over the years and that a "preliminary list" of U.S. products that can be targeted is being drawn up.

"EUR/USD is starting to recover from just above some strong supports offered by the base of the weekly channel at 1.0899 currently. We have 13 counts on the daily and weekly charts, together with TD support at 1.0850. Extreme caution is warranted and we would allow for this to hold the downside and provoke recovery.," says Karen Jones, head of technical analysis at Commerzbank.

The U.S. tariffs come just six weeks out from the expiry of a 180 day delay to the imposition of a 25% tariff on EU exports of cars to the U.S. The expiry, if not extended or voided by an agreement over the EU's alleged "unfair" trade practices, could potentially embroil the EU in a trade war with the U.S. barely more than two weeks after the October 31 Brexit deadline and a month after the next scheduled talks with China.

"This will obviously do wonders for US-EU trade relations and geopolitical tensions, to say nothing for the economy – although there are of course substitutes for all of these that are Made in America," says Michael Every, a strategist at Rabobank. "So with the prospect of politics getting far too real for markets to enjoy, and of the economy’s prospects looking far less real, is it any wonder that equities slumped yesterday, and that bond yields did too?"

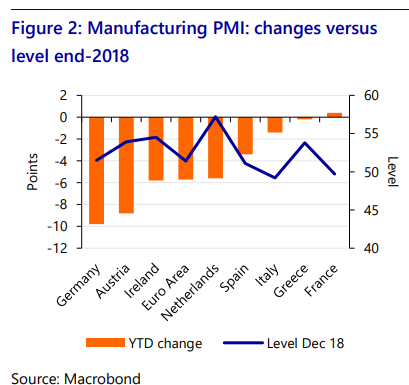

The global economy has been in retreat for more than a year now and the manufacturing sector has slipped deeper into recession amid declining international trade, which has shrank in the face of President Donald Trump's trade war against China. The tariff fight has damaged the world's second largest economy but arguably, hurt the trade-sensitive Eurozone even more than the two protagonists in the story.

Above: Eurozone manufacturing PMI indices. Source: Rabobank.

"Investor confidence has crumbled off the back off a couple of weak US data prints, whilst impeachment talk and geopolitical troubles from Hong Kong to North Korea are not helping. European investors also battling the real prospect of a no-deal Brexit and worries about a new tariff war with the US after the WTO back Washington over the Airbus case," says Mark Wilson at Markets.com.

EU officials will be in the midst of dealing with either a 'no deal' Brexit or the start of negotiations on the future relationship when President Trump's decision on whether to push ahead with the car tariffs is announced. That will come at a time when the economy is widely believed to be stagnating and as some economists continue to warn that Germany probably slipped into recession in last quarter.

Trump announced and then delayed those tariffs back in May pending the outcome of talks aimed at reducing EU levies and opening up its agricultural market to U.S. farmers. However, few expect the EU to entertain the idea of opening up the politically sensitive and tariff-protected agricultural market to U.S. farmers. The car tariff deadline will fall just a month after October 10 and 11 trade talks with the Chinese, which markets hope will produce a truce in the U.S.-China tariff fight.

"US-EU trade talks are fraught with problems anyway as the US wants to use the threat of car tariffs to prise open EU agricultural markets. For the EU, this is a political no go. Fortunately, we find little political support in the US for a trade war against the EU. Unlike China, the EU is not seen as a geopolitical rival steeling commercial secrets. EU car makers are widely seen as creating rather than destroying jobs in the US," says Holger Schmieding, chief economist at Berenberg.

Above: Euro-to-Dollar rate shown at daily intervals.

"Interestingly, this too put pressure on the US dollar yesterday, while in theory, it should support the US currency as the imposition of tariffs on EU imports should be inflationary and thus raise the US rate outlook. Instead, the threat of a trade war with Europe is seen as deteriorating the US growth outlook and market rate expectations, as a result, have started to fall again," says Thu Lan Nguyen, an analyst at Commerzbank.

Weakening global growth has not only seen the European Central Bank (ECB) rush to support growth in the Eurozone with an interest rate cut and fresh round of quantitative easing, it's also pushed the Federal Reserve (Fed) into the beginning of what it says is a 'mid-cycle adjustment' in interest rates, but what markets are wagering will be the beginning of a broad cycle of interest rate cuts. But the Fed cuts are yet to undermine the Dollar, which is still backed by the highest rate in the developed world.

The U.S. Institute of Supply Management (ISM) Manufacturing PMI surpsised the market previously on Tuesday when it fell to decade low for the month of September, with most components of the survey helping to paint a picture of a U.S. economy that is now being bitten by President Donald Trump's trade war with China. Until now, the Fed has been reluctant to indulge markets and the White House with the level of interest rate cuts that many say is necessary for the U.S. economic expansion to be kept alive.

"The ISM manufacturing index has dropped to a 10-year low as trade worries, weak global growth and a strong dollar weigh on the sector. Given the threat of contagion to other parts of the economy further Fed rate cuts are coming," says James Knightley, chief international economist at ING. "It was below every single forecast in the market... These figures suggest that further output declines are likely and point to downside risks for Friday’s US jobs report."

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement