Euro-to-Dollar Rate Takes Fourth Ifo Disappointment in its Stride but Headwinds are Mounting

- Written by: James Skinner

© Christian Müller, Adobe Stock

- EUR shrugs off fourth fall in Germany's Ifo business climate index.

- But price action comes as USD weakens ahead of Fed rate decision.

- EUR economy has turned for the worse, threatening the ECB outlook.

The Euro rose Tuesday even after the latest Ifo business sentiment survey revealed a fourth consecutive deterioration in activity and the forward outlook for companies in Germany, but headwinds are mounting for the currency.

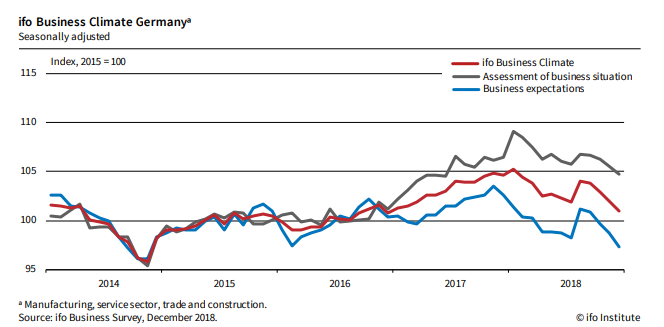

Germany's Institute for Economic Research (Ifo) business climate index fell to 101.0 in December, down from 102.0 previously, when markets had looked for a decline to only 101.8.

Both manufacturing and services industries saw companies mostly reporting a worse current business situation and a deteriorated outlook for December.

Manufacturers scaled back their expectations for future growth during December for the first time since May 2016 while services companies became less satisfied with both their current situation and business expectations.

"December’s fall in the Ifo Business Climate Indicator (BCI) to a twenty-seven month low adds to evidence that the German economy is slowing," says Andrew Kenningham, chief global economist at Capital Economics. "The forward-looking expectations component fell particularly steeply, which does not bode well."

Above: Ifo index. Source: Ifo Institute.

"Manufacturers have led the way this year, as they usually react most sensitive to the cycle. But that services and trade continue to report weaker sentiment month after month shows that the external weakness is gradually spreading to the domestic economy," says Florian Hense, an economist at Berenberg Bank.

The Ifo survey polls 9,000 German companies in the manufacturing, services, trade and construction sectors, asking them to give their assessment of the current business situation and their business expectations for the next six months. The index itself represents an average of responses about the current situation and outlook, with a base year of 2005.

It follows another steep fall in the IHS Markit PMI surveys of activity and sentiment in the German as well as Eurozone manufacturing and services sectors for December. Those emerged last Friday and further dented the Eurozone outlook.

Markets care about the survey responses because they act as a leading indicator of activity in some of Germany and Europe's most important sectors. Germany's economy is the largest in the Eurozone so changes in market expectations of it also impact on the outlook for the bloc overall, and the Euro.

"These are disappointing headlines. The expectations index rose encouragingly in August, but it has been falling since, making a four-year low this month. Across sectors, sentiment in manufacturing, services, and trade weakened, while it remained unchanged, within whiskers of a cyclical high, in construction. Overall, this survey is downbeat at the moment," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

Changes in economic momentum have an impact on the inflation outlook and it is changes in consumer price pressures that dicate the next steps in European Central Bank (ECB) interest rate policy.

"This survey adds to evidence that the slowdown in Germany, and the euro-zone more widely, is more than just a soft patch. The upshot is that the risks to our forecast for GDP growth in Germany to rebound, from 1.5% this year to 1.8% next year, are clearly mounting," says Capital Economics' Kenningham.

Above: EUR/USD (red & blue) at daily intervals, and 2-year German-U.S. yield spread.

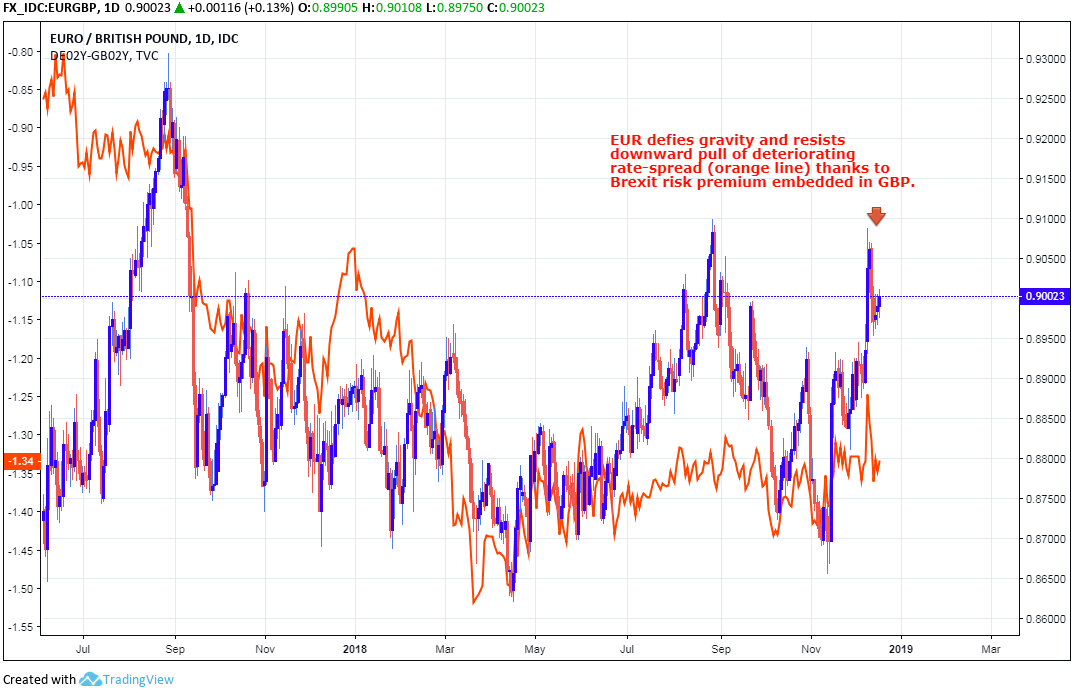

The Euro-to-Dollar rate was quoted 0.31% higher at 1.1384 Tuesday but is down -5% for 2018, while the Euro-to-Pound rate was 0.04% higher at 0.9004 and is up 1.73% this year.

Price action comes ahead of Wednesday's Federal Reserve interest rate decision, which markets fear will aughur a 'dovish' turn in the central bank's commentary on the U.S. economy.

This has led the Dollar to weaken markedly ahead of the announcement, with the Dollar index declining -0.28% Tuesday alone, so Tuesday's price action could be more reflective of concerns over the Fed than the Eurozone outlook.

Above: EUR/GBP (red & blue) at daily intervals, and 2-year German-GB yield spread.

The single currency's appeal to investors is hinged largely upon expectations the ECB will begin raising its interest rate some time in 2019. But in order for it to do this the inflation outlook must remain consistent with a gradual return of the consumer price index toward its target of "close to but below 2%".

Germany's economy contracted by -0.2% in the third-quarter after new EU rules governing emissions testing of cars drove production in the automotive sector to a standstill. Eurozone growth fell by half, to just 0.2%, during the third-quarter.

Growth has been impacted by a range of other factors this year including President Donald Trump's so-called trade war with China, which has hurt both the Chinese and German economies.

The ECB now says GDP will grow by 1.7% next year, down from the 1.8% projection issued in October. Eurozone growth was 2.3% in 2017 and is now forecast to come in at 1.9% for the current year, before declining again in 2019.

"Our forward-looking indicators continue to look lukewarm at best for the Euro area into Q1-Q2 next year (PMIs could drop further)," says Andreas Steno Larsen, a strategist at Nordea Markets. "We expect a rate hike from the ECB no earlier than in December 2019, but would not be overly surprised to see a postponement to 2020."

When combined with the fact that oil prices have now traded an earlier 20% 2018 gain for a -13% loss, the outlook for Eurozone inflation has deteriorated substantially during recent months.

The ECB now says headline inflation will average only 1.8% for 2019, down from 2% currently, although the fall in oil prices and the deteriorating growth outlook mean risks are to the downside.

Moreover, core Eurozone inflation fell from 1.1% to 1% in November. That is exactly the level it was at in January 2018 and is only 10 basis points, or 0.1%, above the level it was at in January 2017.

As a result, the European Central Bank has not made any real progress toward its inflation target, in underlying terms at least, over the last two years.

Accordingly, there is a growing risk the ECB is forced in 2019 to abandon its current forward guidance that interest rates will rise toward the end of that year. If that happens, the Euro-to-Dollar rate would suffer.

Advertisement

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here