Latest: Pound-to-Euro Exchange Rate Breaks 1.12, Consolidation Expected Going Forward

Above: Sterling received support from Bank of England policy-setter Gertjan Vlieghe © Bank of England, Pound Sterling Live

- British Pound best performer in first-half of the week

- Lloyds Bank strategists expect consolidation near-term

- But, Euro expected to end 2018 on a stronger footing

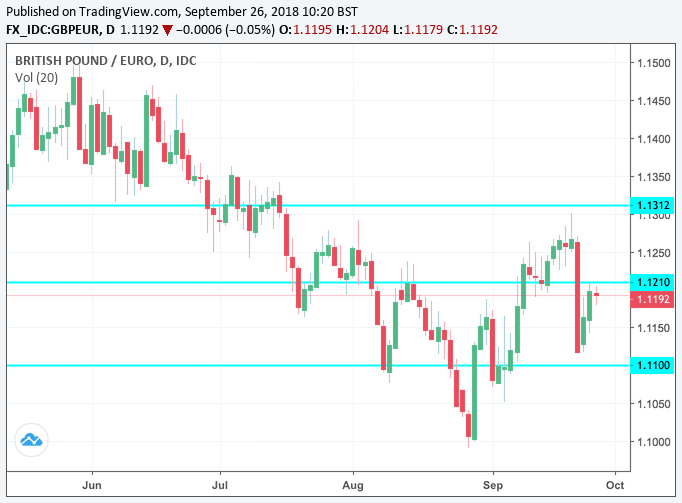

The Pound-to-Euro exchange rate rallied above the psychologically important 1.12 level in mid-week afternoon trade to quote this week's best at 1.1233 on the inter-bank market.

The move back above 1.12 defies expectations for Sterling to suffer further Brexit-related falls this week and ensures the currency has now recaptured more than half of the losses suffered on September 21.

Sterling was one of the top performers among the major currencies for a third straight session, having been buoyed both by constructive monetary policy signals and some encouraging signs around Brexit which leaves traders maintaining a view that a deal by year-end remains an odds-on possibility.

Over the course of the past 24 hours, Sterling got an initial lift from Bank of England policy-setter Gertjan Vlieghe, who on Tuesday said his own forecast is for 1-2 rate hikes per year.

"This was somewhat more hawkish than market pricing, which currently sees the next 25 bps hike being delivered in August 2019," says Andreas Georgiou, Investment Analyst with brokers XM.

Georgiou says Sterling was then further boosted on media reports suggesting E.U. negotiators are willing to offer the UK a “free-trade area” after Brexit, but contrary to Chequers, there should be a customs border that would involve some “friction” on trade.

Importantly, the EU is prepared to make a “special case” of Northern Ireland given its small population and allow it to be one of these free trade areas – though extending this to the entire UK would give it an unfair advantage.

"While there wasn’t much further detail, the mere fact the EU seems ready to make some concessions on the Irish border issue is encouraging by itself, potentially laying the groundwork for some progress in the coming weeks," says Georgiou.

Good meeting w/ @EESC_President. We are working for an orderly #Brexit and a new partnership that respects the UK's sovereignty, as well as the founding principles of the EU, such as the integrity of the single market. pic.twitter.com/VmwQg6kVNu

— Michel Barnier (@MichelBarnier) September 26, 2018

Expect Consolidation

The Pound-to-Euro exchange rate is being tipped to potentially enter a sideways pattern short-term; good news for those burnt by the sharp 1.0%+ sell-off in the pair on September 21.

Those looking for a stronger Pound are however urged to keep expectations contained: there is little evidence in the current atmosphere to suggest a near-term recovery above 1.13 is likely.

Indeed, consolidation might be the name of the game.

Robin Wilkin, a technical strategist with Lloyds Bank says "prices are now consolidating" between 1.1210 and 1.11. If this recovery is a classic technical "flag" consolidation after last week’s impulsive drop from 1.13, "then we need to dig in" at these levels adds the analyst.

Wilkin says any further strength through 1.1210 and "the pattern will start to look wrong and risk a return towards" the 1.1312 highs.

"Our outlook suggests that GBP/EUR is likely to remain contained within its medium-term range, at least for now," says Gajan Mahadevan, a Quantitative Strategist with Lloyds Bank.

Lloyds are forecasting the GBP/EUR exchange rate to trade at 1.14 by December ahead of a fall to 1.13 by March 2019.

If the Lloyds forecasts are correct, then those with currency payment commitments can look forward to an extended period of relative stability for the pair.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Beware a Stronger Euro into Year-end

The Euro is meanwhile being tipped to put in a more robust performance going forward from here, something that could well keep Pound-to-Euro exchange rate gains capped, even in the event of Brexit expectations improving.

"The recent turnaround for the Euro supports our view that further downside for the euro from already undervalued levels should prove limited," says currency analyst Lee Hardman with MUFG in London.

Hardman says part of the single currency's outperformance partly stems from fading concerns over the direction Italy is taking under its new coalition government.

Hardman finds it "reassuring that Italian government officials have displayed more restraint when setting the budget for next year, which has materially reduced the risk of a sharper adjustment lower for the Euro in the year ahead."

There were fears the new Italian government would destabilise the Euro by pursuing a populist spending and tax cutting spree that would push the country's budget deficit above 2.0% of GDP. This would breach E.U. rules on the matter which seek to keep deficits below 2.0% in order to ensure fiscal unity across the Eurozone.

However, cool heads appear to be reigning in Rome and this should bode well for the single currency over coming weeks.

However, we are today seeing reports that there is some discord in the ranks, we will follow this evolving story closely.

AWAITING Italian Finance Minister Giovanni Tria's comments in about 35 minutes. He's due to speak just as news is surfacing that Five Star will vote down the 2019 #budget if it doesn't include a citizen's income. #Italy #Europe Follow the headlines on @TheTerminal

— Christine M Burke (@cmarie_burke) September 26, 2018

The Euro has this week shifted onto the front foot this week after European Central Bank (ECB) President Mario Draghi sounded an optimistic tone about the continent's inflation outlook.

Draghi boosted the Euro after telling the European Parliament he is seeing a “vigorous pick-up” in underlying inflation; markets interpreted this as a sign that the ECB is on the front-foot when it comes to preparing for a 2019 interest rate rise.

Currency's tend to rise in response to expectations for higher interest rates as investors divert capital towards where returns are expected to increase.

Furthermore, the Euro also appears to have benefitted from fading concerns concerning Turkey where a financial and currency crisis erupted over the summer.

The Euro appeared to suffer amidst investor fears for contagion from Turkey into the Eurozone, particularly via bank exposure.

"The recent softening of the US Dollar and more decisive domestic policy response has helped at least temporarily to stem the bleed," says Hardman.

Economists at ANZ - the Australia-based global investment bank - have meanwhile told their clients to be on alert for a stronger Euro through 2019, largely thanks to the European Central Bank tightening monetary policy i.e. raising interest rates.

"Over the medium term we remain bullish, this is contingent on the economy continuing to improve and the ECB becoming more hawkish," says Been.

ANZ note Eurozone growth is stabilising, momentum is strong, labour market resource utilisation is rising, wages are rising, industry capacity utilisation is close to its highs, credit growth is expanding, house prices are rising and the ECB is confident that core inflation will move, gradually but persistently, towards target.

"These are not the conditions for a persistent slide in the euro. Barring a negative shock, we continue to expect modest Euro appreciation over the forecast horizon," adds Martin.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here