The Pound-to-Euro Rate 5-Day Forecast: Rally to be Challenged

Image © European Central Bank

- GBP in recovery mode as Brexit sentiment improves

- But, tough technical resistance zone ahead

- Inflation data dominates Sterling's calendar

The Pound-to-Euro exchange rate rose over half a percent in the previous week as chances of a no-deal Brexit continued to wane.

The pair increased 0.54% from an open of 1.1176 to a close of 1.1237, and in the week ahead we see a likelihood of consolidation of these gains and perhaps even further upside too.

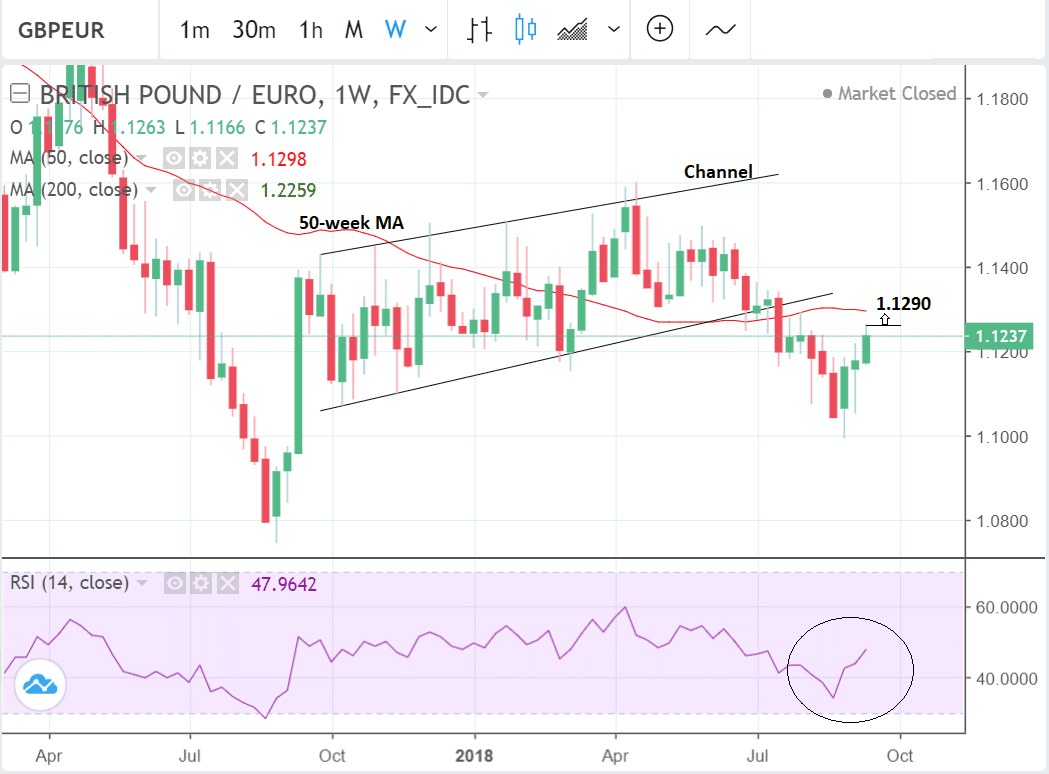

After three up-weeks in a row and a break on a closing basis above the 50-day moving average (MA) the short-term trend is now probably bullish and this suggests a bias for more upside as the 'trend is your friend' so is likely to extend, according to the old market adage.

Yet considerable obstacles lie in the way of further gains and these caution against an exuberantly bullish approach.

First amongst these is the 50-week MA at 1.1298 which is likely to lead to the exchange rate stalling and possibly even pulling-back.

This is why our first upside target lies just underneath at 1.1290; then there is the 200-day MA at 1.1316; and not far above is the lower channel line of a rising channel in the mid-1.1320s which is also likely to act as an obstacle to rising prices.

This suggests a hefty resistance zone in the 1.1290-1.1330 range which could see Sterling hit by selling pressure as technical traders fade the trend in anticipation of a correction.

The one caveat to this forecast would be further positive developments regarding Brexit, something which could see technical resistance broken and allow GBP/EUR to go higher.

Given the pace of negotiations is likely to be stepped up in the week ahead this outcome is a possibility.

We would also, therefore, like to add that we see a break clearly above the resistance zone would be confirmed by a move above 1.1350. Such a move would probably be expected to run higher to an initial target of between 1.1400-50 given the strong bullish technical implications.

Momentum indicators are overall fairly bullish. The RSI is rising strongly on both the weekly and daily charts, and on the daily it is so high that the last time it was at the same level was back in May when the exchange rate was trading in the 1.14s.

This may indicate all the newfound bullish confidence has not yet been fully priced into the exchange rate and suggests more upside round the corner. On the weekly chart RSI has former a 'V-shaped' reversal with a steeper rise than fall, which also accentuates the bullishness of the outlook.

The pair has just formed a 'rising three methods' Japanese candlestick pattern on the daily chart, which is a further sign of continuation of the uptrend.

Advertisement

Lock in the Pound's recent advance against the Euro: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Pound: What to Watch this Week

Sterling has made a decisive recovery in September as the terms of reference of the Brexit debate have undergone a dramatic change.

Whereas previously they were somewhat polarised into the Chequers proposal on the one hand and a 'no-deal' pure Brexit on the other the gap now appears to have closed.

Now even 'die hard' Brexit purists appear to be advocating a deal based on the EU's deal with Canada - known as a 'Canada plus' deal - whilst Chequers, and even continued membership of EEA is being considered as the soft option avoiding the most economic disruption.

We heard from analysts at Nordea Markets in the week past that the Pound should actually rise under all Brexit scenarios, but expect a bloodbath if a 'no deal' arises.

The bottom line for the Pound is should the probability of a 'no-deal' continue to diminish the currency should see more gains.

"Brexit talks between the UK and the EU are expected to be stepped up in the coming days with the topic likely to dominate the informal summit of EU leaders in Austria on September 20. Sterling should therefore continue to see high volatility as it remains sensitive to Brexit headlines," says a note from forex broker XM.com.

On the hard data front, meanwhile, there are also some notable releases in the week ahead including inflation figures for August and retail sales.

Headline inflation is forecast to dip back to 2.4% in August (from 2.5%) on a year-ago comparison basis, while the core rate is predicted to fall to 1.8% from 1.9% previously (year-on-year).

Analysts are overall a bit downbeat about the prospects of economic data in the week ahead so surprises to the upside would be likely to drive the Pound higher, whilst those to the downside might weigh but to a certain extent will already be accounted for.

"Next week’s indicators may not be as positive and could fail to provide support for the pound in case the Brexit negotiations were to break down," says XM.com, "CPI figures will be watched on Wednesday for evidence that inflationary pressures in the UK continue to edge lower towards the Bank of England’s 2% target."

The other hard data release is retail sales on Thursday which is forecast to show a 0.2% month-on-month contraction in sales in August after a 0.7% bounce in July.

The overall assessment for UK data is that it remains 'sluggish' and more at risk of decline than growth.

Regardless of data no-one expects the Bank of England (BOE) to raise rates until Brexit is clarified.

Since interest rates are the main driver of foreign exchange - pushing the Pound up if they are hiked - the currency is ultimately at the mercy of Brexit negotiations rather than data, since everything hinges on the terms of divorce.

Put a different way, pure economic data is not the main consideration of when the BOE will next raise interest rates, and as such has less impact on the exchange rate. Indeed, this appears to have been the message from last week's September Bank of England policy decision.

"While inflation has started to come back down to earth and retail sales have firmed, economic growth in the U.K. has remained sluggish, with real GDP rising 1.5% annualised in Q2. Given slower economic growth and ongoing Brexit negotiations, we look for the Bank of England to remain on hold in coming quarters until these concerns subside," says a note from analysts at investment bank Wells Fargo.

The Euro: What to Watch

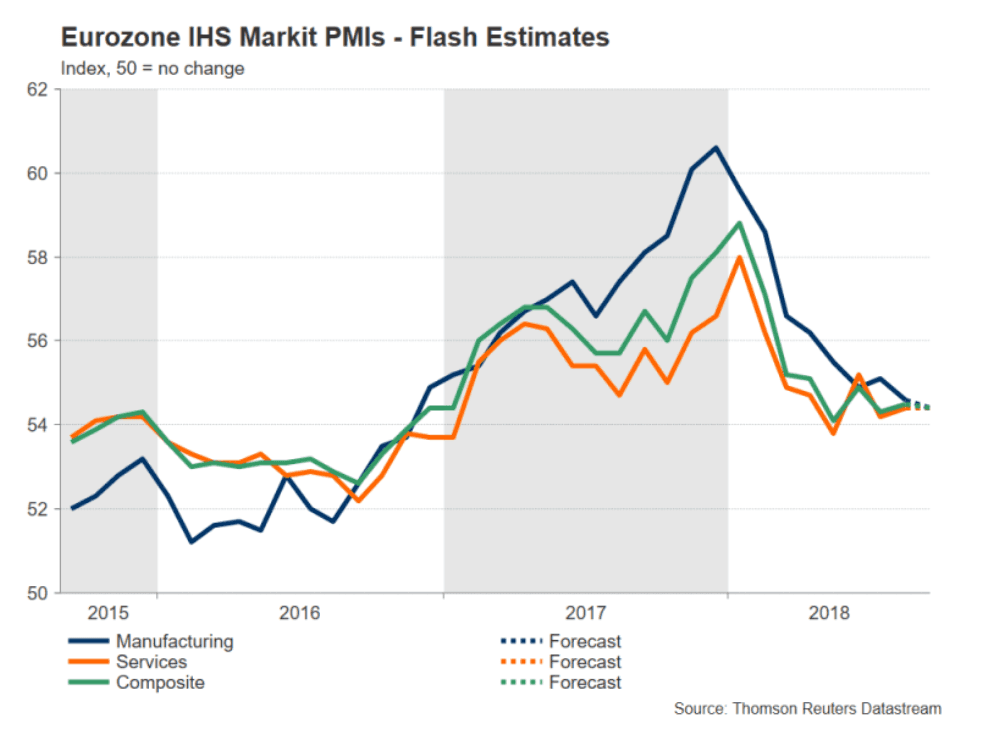

Given the continued fragility of growth in the region, the main releases for the Eurozone in the week ahead are the initial estimates for Manufacturing and Services PMIs in September, out on Friday at 9.00 B.S.T.

PMI's measure activity and Manufacturing activity in the Eurozone is expected to show a slight slowdown to 54.4 from 54.6. Services is forecast to remain unchanged at 54.4. The composite of the two is forecast to decline a basis point to 54.4 from 54.5.

A result over 50 is indicative of expansion and of under 50 of contraction. PMI's are surveys of purchasing managers conducted by data provider Markit IHS.

A higher-than-expected result is likely to support the Euro and vice versa for a lower-than-expected result.

"The composite PMI, consisting of both the manufacturing and services sectors, is forecast to decline by 0.1 points to 54.4 in September. A surprise stronger reading could be viewed as a sign that worries in the bloc over a global trade war are subsiding, indicating faster growth in the months ahead. Eurozone growth has failed to bounce back from a slowdown at the start of the year and a change in the outlook would drag the euro out of neutral mode," says forex broker XM.com.

Another key release is Consumer Confidence on Thursday, which is forecast to dip further to -2.0 from -1.9 previously, when it is released at 15.00.

CPI data out on Monday is just the final estimate for August and unlikely to change much from the previous result.

The Bundesbank monthly report on Monday as well as some speeches by ECB officials also pepper the calendar in the first half of the week.

Finally the current account surplus is out on Wednesday at 9.00 but because it is for July is considered rather backward-looking and therefore of limited consequence to the exchange rate today.

Advertisement

Lock in the Pound's recent advance against the Euro: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here