Pound-to-Euro Exchange Rate Forecast to Test 1.12s Next

Michel Barnier. Image © European Union , 2018 / Source: EC - Audiovisual Service

- Pound Sterling extends recovery vs. Euro

- Barnier-inspired relief rally can extend suggests technical analysis

- Possibility of a continuation up to 1.1220s

- But still too early to call an end to the broader downtrend

The British Pound's recent recovery leaves it looking a great deal more constructive in the near-term suggest our latest technical studies; however medium-term downtrends will require a great deal more work by Sterling bulls before they are invalidated.

The Pound-to-Euro exchange rate advanced over 1.0% on Wednesday, August 29 after the EU appeared to soften its negotiating stance and 'serenade' the UK into accepting a Brexit deal and the gains have extended through the London session on Thursday, August 30.

The rally takes the GBP/EUR exchange rate up to a new weekly high at 1.1145; a decent recovery considering the pair had been as low as 1.099 earlier in the month.

The recovery in Sterling started early mid-week but was given a notable boost on comments made by the EU's chief Brexit negotiator Michel Barnier who said the EU was open to agreeing a special trade partnership with Britain "such as had never been agreed with another third country".

The comments came following a meeting with German foreign minister Heiko Maas and indicates Europe's most influential country might have a hand in the new direction being adopted by Europe.

The comments indicate the EU is keen to do a deal and avoid a 'no deal' Brexit, an outcome that has weighed on Sterling valuations over recent weeks.

Sterling was further supported by comments from Dominic Raab, the UK's chief negotiator that a deal was "within our sights" and that negotiations were 80% complete.

In another piece of Sterling-positive news it is reported the date for completion and of the talks would be moved from from mid-October down to mid-November.

Technicals Advocate for further Gains

The Pound surged by an average of a percent across the majority of its pairs after the news which all point to the chances of a 'no deal' Brexit becoming less likely.

From a technical perspective, the outlook for the Pound-to-Euro exchange rate has perked up somewhat following several weeks of decline that saw it touch fresh 2018 lows at 1.0991 on fears of the economic consequences of a 'no-deal' scenario.

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

GBP/EUR rose from 1.1010 to 1.1116 following the positive mid-week developments, adding a whole cent onto the value of the Pound.

The rebound supports the notion put forward by several analysts that GBP/EUR is at risk of a reversal because 'a lot of bad news has already been priced in'.

We reported ahead of the rebound that analyst Trevor Charsley at AFEX saw the 1.10 region as a level that would provide support and potentially put a temporary end to the weakness. The view was spot-on.

Yet, from a technical perspective it is still a little early to call a reversal of the downtrend which has dominated Sterling pairs over recent weeks.

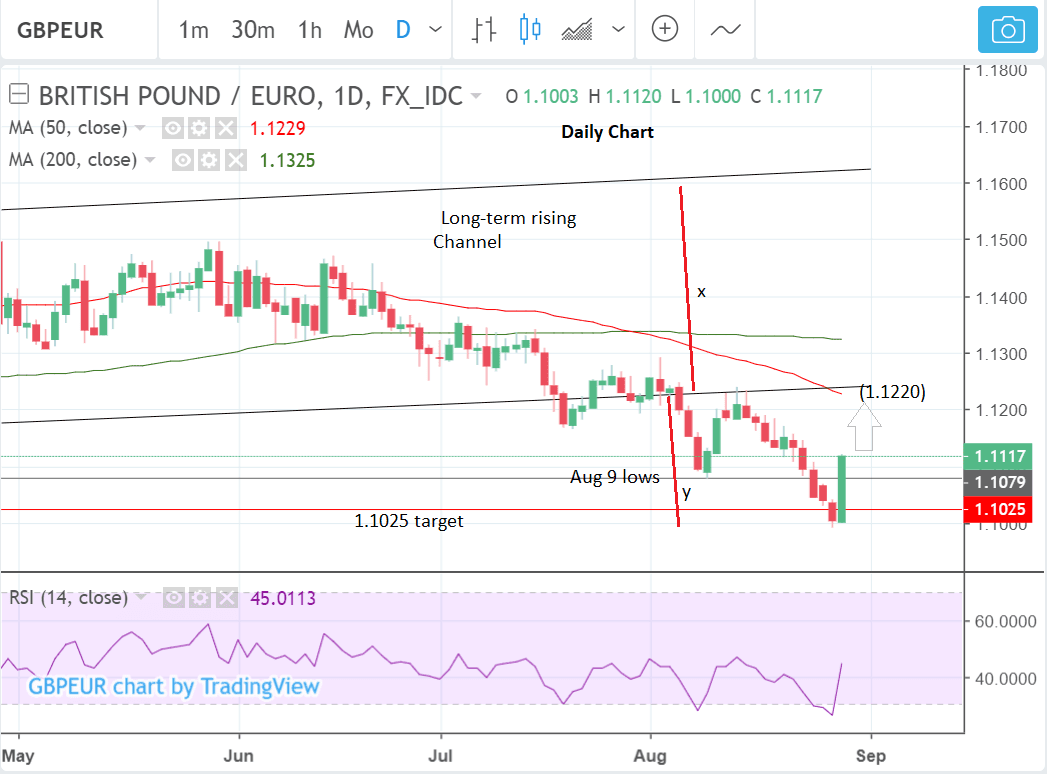

Nevertheless recent price action has the hallmarks of major trend reversals that they start with very strong up-days and so this might very well be the start of a new uptrend, and if it extends then the next target higher would be at 1.1220 and the bottom of the long-term channel.

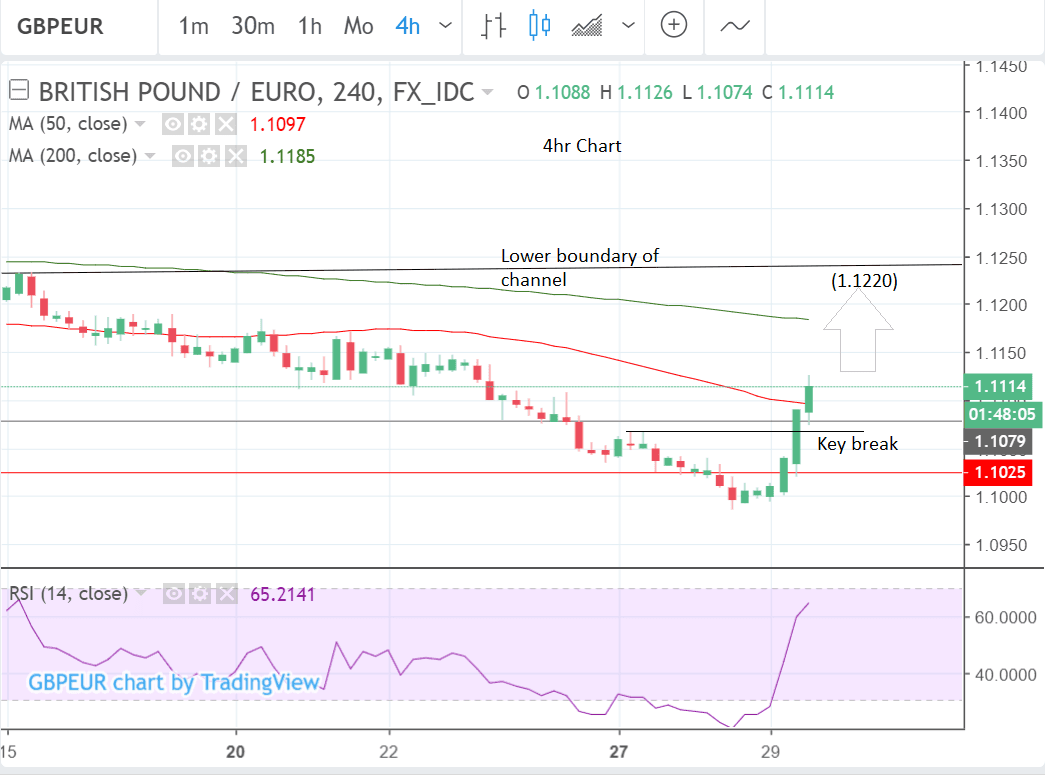

We would look for two consecutive higher highs and lows on the 4-hr chart for confirmation of a short-term reversal. Whilst we don't have that yet because of the speed of the climb, the break above 1.1070 is a major bullish achievement and suggest peaks and troughs may be turning.

The Barnier-inspired recovery came only a day after GBP/EUR met its minimum downside target at 1.1000-25 which we set out in our most recent week-ahead forecast.

The target was based on the standard technical method of taking the golden ratio (0.618) of the height of the long-term rising channel (x) the pair and extrapolating it lower from the breakout point (y).

The fact the pair has met its minimum target suggests the possibility that the downtrend may now be done; suggesting it could be ready for a rebound, further supporting a bullish outlook.

Breaking above the August 9 lows is another bullish sign since key lows often provide resistance to a recovering market but in this case the exchange rate just tore higher, suggesting confidence underpinned the move.

The RSI momentum indicator has surged out of the oversold zone and this is a signal to buy after the end of an oversold market.

Whilst there is still a risk the pair could fall back down to its 1.0850 target, which corresponds to the full height of the channel extrapolated lower, the pair would have to re-break below the 1.0991 lows to confirm such a bearish revival.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Broader Downtrends Prevail

We must however emphasise that the recent gains in Sterling-Euro must be approached within the broader context of the downward medium-term trend in place since April.

As can be seen above, despite improvements for Sterling over recent hours, medium-term trends still advocate for more weakness. Sterling needs to put in more work before a bottom can be called.

"Sterling finally rebounded after comments from EU’s Barnier as he said that the EU wants to keep a close, special relationship with the UK. The market saw the quotes as a sign of a more reconciliatory attitude from the EU. We are not convinced," says Piet Lammens, a foreign exchange strategist with KBC Markets in Brussels. "The move was probably in the first place a short-squeeze on recent substantial sterling losses. Whatever, the correction was quite impressive and deserves monitoring."

We are also hearing words of caution from various analysts who argue recent developments are by no means a decisive game-changer for the trajectory of EU-UK negotiations.

Luca Mezzomo, Head of Macroeconomic Analysis at Intesa Sanpaolo argues that there is no indication in Barnier’s announcement that the deal offered by Brussels will reconsider the red lines laid out ever since the beginning of the negotiations.

These include the four freedoms necessarily required for participation in the single market, as explicitly reasserted by Barnier.

"Specifically, the EU’s chief negotiator spoke of a generous FTA (free trade agreement) and of parallel accords on internal security, defence, and air transport, as already prospected by the European Commission months ago. Therefore, the pound’s movement is excessive if considered as a reaction to Barnier’s words," says Mezzomo.

Looking ahead, the next major test for the Pound comes on Friday as Dominic Raab and Michel Barnier are to meet in Brussels.

.@MichelBarnier will meet @DominicRaab this Friday @EU_Commission to take stock of the #Brexit negotiations. This will be preceded by technical level negotiations on the Withdrawal Agreement and the future relationship: https://t.co/q2O3W5EImX pic.twitter.com/5DzUFsQaQe

— Daniel Ferrie (@DanielFerrie) August 29, 2018

A briefing is expected in which the two principles are expected to update on recent progress ensuring markets could be in for further excitement ahead of the weekend.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here