The Pound-to-Euro Week Ahead Forecast: Chance of a Pause in the Downtrend

Image © Pound Sterling Live

- GBP/EUR is closing in on preliminary targets in the lower 1.10s

- Brexit developments will be key for Sterling this week

- Eurozone inflation numbers in focus for the Euro

The British Pound continues to sell-off versus the Euro on 'no-deal' Brexit fears, ensuring the exchange rate touched its lowest level in eleven months early on Monday, August 27 at 1.1042.

At the time of writing a pound buys 1.1057 Euros on the inter-bank markets, while bank accounts are offering in the region of 1.0670-1.0747 for international payments, specialists providers are offering as high as 1.10.

Public information notices on how the UK will prepare for a 'no deal' Brexit published last Thursday appear to have failed to help the Pound ensuring the exchange rate remains caught in a technical downtrend on the charts.

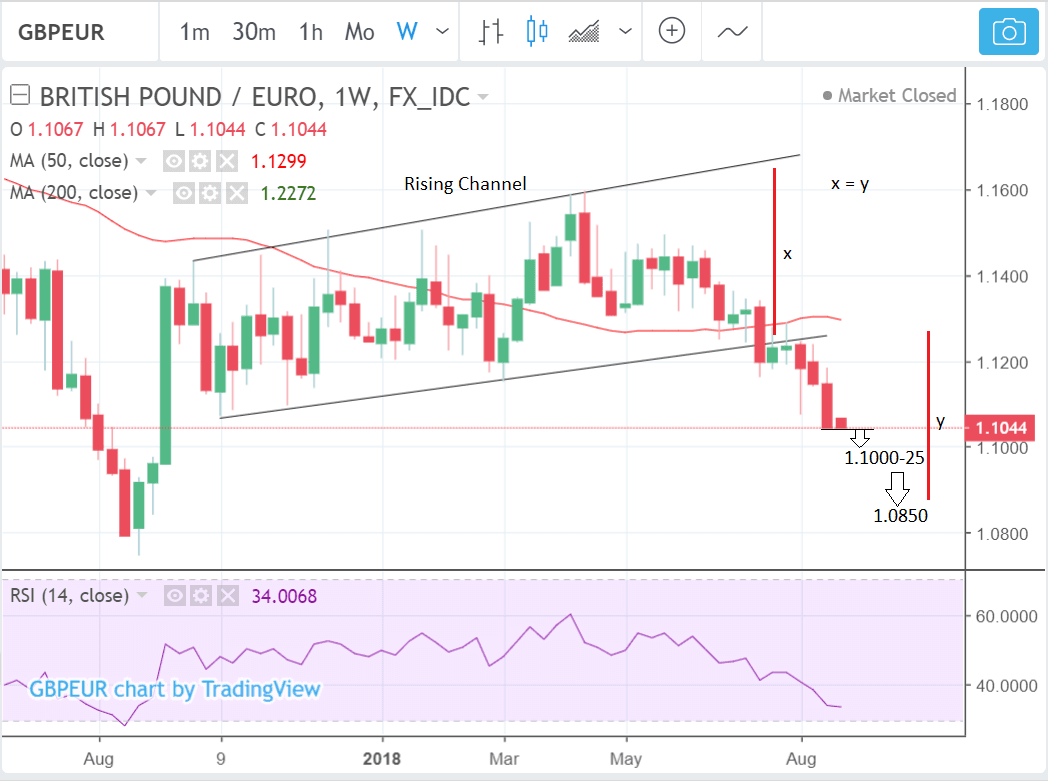

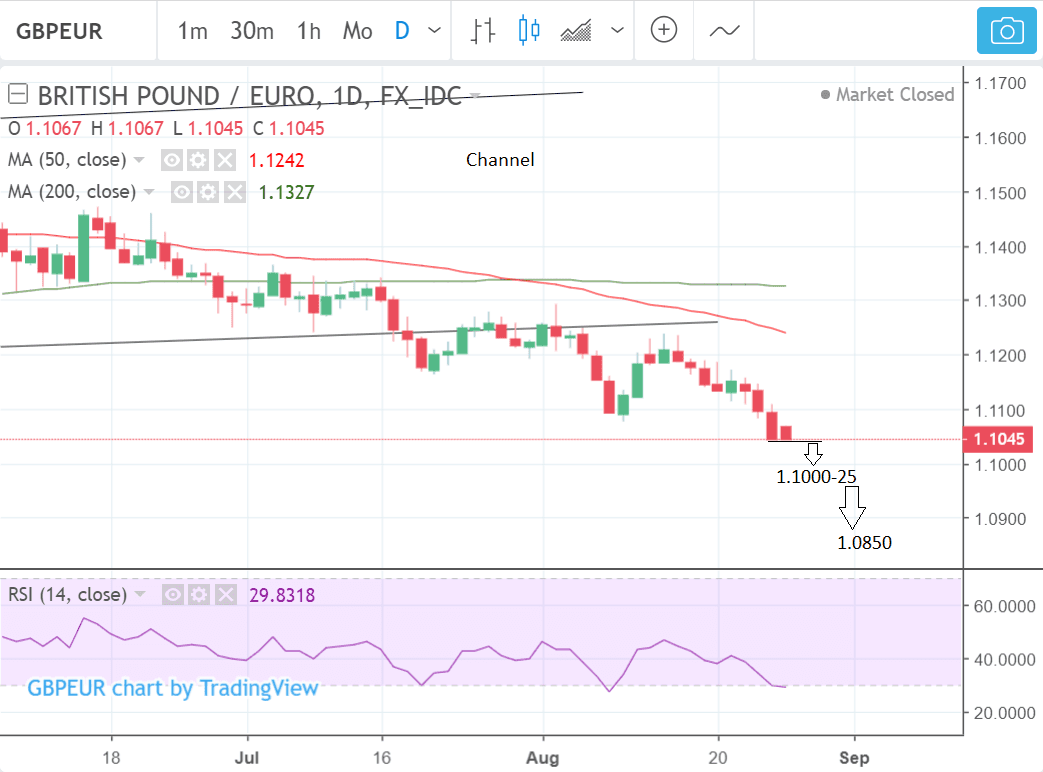

Ongoing losses in GBP/EUR will not be a surprise to technical traders who have been expecting more downside since the exchange rate broke down out of the rising channel it had been in since autumn 2017.

The break below the August 9 lows was the final determining factor.

As a rule, prices tend to fall the equivalent of the height of the channel (x) (or a ratio of 0.618), extrapolated lower (y) following a breakdown. In this case this produces a conservative downside target of 1.1000-25 - which has already nearly been reached - and a maximum target of 1.0850.

The pair is now close to the first downside target in the 1.10s at 1.1025 which suggests the market may be close to bottoming - at least temporarily.

Momentum as measured by RSI is marginally in the oversold zone on the daily chart, which indicates traders should not open any more short trades, although it is not a bullish reversal sign until the indicator has come back out of the oversold zone, and RSI can remain in oversold for lengthy periods of times before the market reverses.

Given the fact the exchange rate is nearing the conservative target generated from the breakout and momentum is now oversold, the charts are showing an increasing risk that the exchange rate may be about to reach a bottom of some description, although in the absence of an actual rebound in price action we remain, on balance, marginally bearish.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Pound Sterling - What to Watch this Week

Brexit remains the overarching factor driving Sterling values at present with negotiations entering a key phase with markets becoming increasingly weary that the two sides remain too far apart to reach a deal.

After their meeting on Tuesday, August 21 UK Brexit Secretary Dominic Raab and EU chief negotiator Michel Barnier announced that with some key autumn deadlines fast approaching, negotiations will now be ongoing. Raab and Barnier will probably meet again on Tuesday, August 28, so we will be looking for any communications.

“I remain confident a good deal is within our sights, and that remains our top and overriding priority. If the EU responds with the level of ambition and pragmatism, we will strike a strong deal that benefits both sides." - Secretary of State @DominicRaab pic.twitter.com/k2ZIlpofOZ

— Exiting the EU Dept (@DExEUgov) August 23, 2018

Latest developments see Prime Minister Theresa May preparing a "cabinet crisis summit" to prepare for a 'no deal' Brexit, amid fears that a cabinet row between 'Remainers' and 'Brexiteers' will stop Britain going it alone, and undermine her negotiating position with Brussels.

The Prime Minister's office has reportedly ordered cabinet ministers to clear their diaries for September 13 to work on a plan to pump fresh cash into critical areas not yet covered by disaster plans.

Only when markets are convinced that a 'no deal' Brexit will be avoided to we believe the conditions for a sustainable recovery in the Pound will emerge.

On the calendar, there are no stand-out events for the Pound in the week ahead so we comment on them chronologically.

The week for Sterling starts with the continued testimony of Bank of England (BOE) officials before the the Parliamentary treasury select committee on Tuesday, August 28. Any new information on where interest rates in the UK are headed over coming months could well move Sterling.

Few analysts realistically expect the BOE to raise interest rates until the outcome of Brexit is clarified and therefore the next possible move will likely come later in 2019, but there is always an outside chance officials may hint differently on Tuesday.

If it seems more likely interest rates will rise then the Pound will also rise because higher interest rates attract greater inflows of foreign capital, drawn by the promise of higher returns.

The next major release for the Pound is house price data from Nationwide, on Wednesday, at 07.00 B.S.T, which is forecast to shown a 0.1% rise in August from July and 2.6% compared to a year ago. This is unlikely to move Sterling unless it comes out widely different from expectations.

Thursday sees lending data out at 9.30, including BOE Consumer Credit in July, Net Lending to Individuals, Mortgage Lending and Mortgage Approvals also all for July. These may be significant as the gauge consumer's stomach for credit and therefore their ability to spend extra cash. Higher spending generally aids growth and is positive for Sterling.

Friday sees the release of Gfk Consumer Credit data for August, which is expected to come out negative at -10, when it is released at 12.01. This is important in a similar was as the BOE data above.

The Euro: What to Watch

The main release in the week ahead for the Euro is preliminary inflation data for August, out on Friday, August 31, at 10.00 B.S.T.

Inflation data is forecast to show a 2.1% rise in broad inflation and 1.1% in core inflation which leaves out volatile food and fuel components compared to a year ago.

Higher-than-expected inflation might boost the Euro if it is substantially higher than estimates as it would increase the probability of the European Central Bank (ECB) raising interest rates earlier than the currently-expected date of Autumn 2019.

However, all indications suggest inflation is unlikely to move materially higher and we therefore are sceptical that the single-currency will find support from this channel.

The Eurozone unemployment rate in July, is released at the same time, and is forecast to show a 8.2% rise from 8.3% previously. A stronger-than-expected unemployment print would also be expected to impact positively on the Euro as it reflects a healthier economy, which makes foreign investors more likely to invest in the region, increasing inflows and therefore demand for the currency.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here