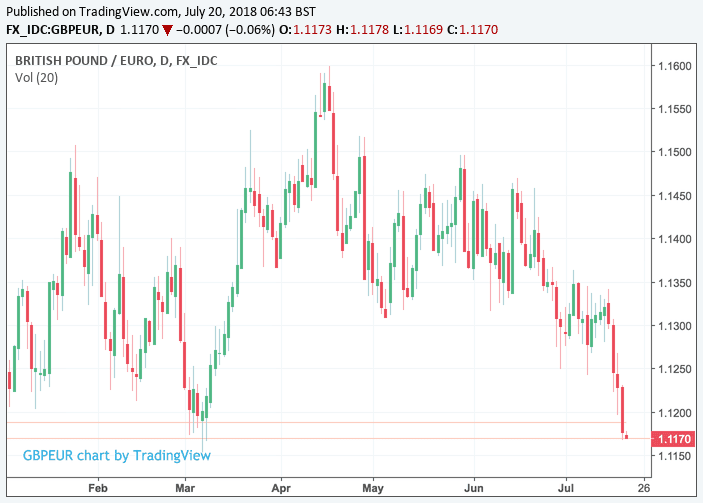

Pound Sterling Faces EU General Affairs Council Hurdle as it Registers Weakest Close of 2018 Against the Euro

Above: Dominic Raab and Michel Barnier strike a relatively constructive tone following their first meeting. Image © European Union, 2018 / Source: EC - Audiovisual Service / Photo: Lukasz Kobus

- Initial Raab-Barnier meeting passes without hitch for Sterling

- But EU General Affairs Council is key risk ahead of weekend

- Pound-to-Euro exchange rate at 1.1168, suffers weakest close of 2018 on previous day

The UK data calendar is empty on Friday, July 20 but political risk remains elevated with the EU General Affairs Council meets to assess the UK's Brexit white paper.

The European Commission's chief negotiator, Michel Barnier, will inform the Council, meeting in an EU 27 format, about the Brexit talks with the UK.

"The EU General Affairs Council meets to assess the UK's Brexit white paper. Barnier will discuss his conclusion of the Brexit white paper with the 27 EU ministers and make recommendations to the council, and will give a press conference to summarise their conclusions," says a foreign exchange briefing note released by TD Securities ahead of the weekend.

The outcome of the talks will be the final event risk of the week for GBP/EUR which has fallen for five consecutive days now.

Indeed, the close at 1.1127 overnight is the weakest close for the exchange rate of the year which pushes the retail rate available for those looking to conduct international payments into the 1.0779-1.0850 zone at the UK's leading banks. Independent currency providers are now offering in the region of 1.10.

The Pound is heavily sold and traders will be looking for potential triggers to conduct a relief-style rally.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Optimism Ahead of the Weekend

The European ministers will discuss the state of play of the negotiations, focusing on:

- completion of work on withdrawal issues

- issues related to the border between Ireland and Northern Ireland

- discussions on the framework for the future relationship with the UK

- In particular, the Council will discuss the white paper that the UK government published on 12 July, setting out its position on the future EU-UK relationship.

The conclusion of this meeting could well give the Pound-Euro exchange rate a bump in either direction ahead of the weekend - will it provide the currency much needed relief or will it provide the final impetus lower at the end of what has been a challenging week?

"Investors will be focusing on the EU response to the Brexit white paper. With cable looking comfortable in a new trading range below 1.3050, we see additional upside risks to EUR/GBP if the EU's tone turns increasingly dismissive or combative toward the UK. This would leave resistance at 0.8968 vulnerable despite expectations for an August BoE rate hike," say TD Securities.

Resistance of 0.8968 translates into risks for a decline to support at 1.1150 in GBP/EUR.

What is important for Sterling therefore is that a constructive tone is maintained; and at this juncture we believe this is exactly what the EU message will reflect.

On Thursday, July 20 the meeting of Dominic Raab and Michel Barnier, Raab's first as the new Brexit Secretary, appears to have gone off without any negative headlines ensuring the Pound clears a potential stumbling block into the weekend.

If Barnier had a warning message to push we would have likely received a hint on Thursday.

"Very happy to meet Dominic Raab this afternoon. I’m looking forward to our work over the coming weeks to 1) finalise the WA (including the backstop on IE/NI) & 2) prepare a political declaration on our future relationship," says Barnier.

With domestic politics likely to fade ahead of the summer recess, and an apparent constructive tone to negotiations being maintained by the main protagonists in Brussels, we believe the downside impetus suffered by Sterling could be ending.

"I enjoyed meeting Michel Barnier, discussing the progress we have made, and the outstanding issues to resolve across the Withdrawal Agreement and the Future Framework. I’m looking forward to stepping up the pace and energy in our negotiations," Raab said following the meeting.

Raab's promise to meet Barnier regularly strikes a sharp contrast with the attitude adopted by his predecessor David Davis who was often criticised for not meeting Barnier regularly.

While Barnier is likely to address the UK's Chequers agreement at the EU General Affairs Council, it must be remembered the Chequers document is largely focused on the future trading arrangement, which is not a priority to the EU right now as the two sides have until late-2020 to negotiate this.

"Barnier's focus is therefore likely to be on any implications of the Chequers agreement for the Irish border, as that is most relevant for the withdrawal and transition agreements that must be signed this year," say TD Securities.

The continued focus on the Irish border comes as prime minister Theresa May delivers a speech in Belfast on Friday where she is exepcted to say the UK's new Brexit plan agreed at Chequers will deliver for Northern Ireland.

Theresa May will give the address at Belfast's Waterfront Hall on Friday morning.

It forms part of a two-day visit to Northern Ireland focussing on Brexit and the stalemate at Stormont.

The Brexit negotiations are at a crucial stage, with the Irish border being a key sticking point.

Markets need clarity that the Brexit process is back on for Pound Sterling to be offered any shot at redemption.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here