ECB seen Shielding the Euro from Italian Political Concerns

- The Euro has weakened but not as much as investors might have expected from the political risks in Italy

- Its restrained decline may be due to the lack of contagion in financial markets across the Eurozone

- Check and balances within the economic and political framework may be protecting the single currency

© Vetralla5Stelle, reproduced under CC licensing

The Euro continues to drift lower, with EUR/USD now settling around 1.1700, but investors could be forgiven for expecting a much steeper decline given the quite significant political risks bubbling away in Italy.

One reason for the lack of downside momentum may be that the crisis has so far been limited to Italy alone.

Italian government bond prices collapsed on the news of the coalition's generous tax and spend policies but this has not spread to other Eurozone member debt markets, as was the case during the Eurozone debt crisis in 2011-12.

The chart below shows the difference in Italian government bond yields and Spanish government bond yields - yields, to the uninitiated, are really just the inverse of bond prices.

The sudden fall in Italian bond prices when the coalition formed is reflected in the spike in yield - or rather the difference between the two country's yields, as Spanish yields remained more or less unaffected, reflecting the lack of cross-border contagion.

Even minor contagion from Italy to Spain would have led to a less pronounced spike in yield differential.

The spike is similar to that between rock-solidly low German bond yields and Italian bond yields, reflected in the chart below.

Although the difference is more pronounced at over 180 basis points compared to 100 in the Italian-Spanish case - because German bonds have a lower starting yield (higher price) - the difference is one of magnitude, not effect - both showed a spike in differentials.

The charts underline the idea that contagion is not spreading, which had been one of the main concerns for the Euro.

Yet why is it not spreading?

The main reason is a stronger Eurozone banking system and the role of the European Central Bank (ECB) as a buffer, says Dr. Ralph Solveen, an analyst at Commerzbank.

Eurozone banks are in much better shape then they were back in 2011-12 just after the great financial crisis.

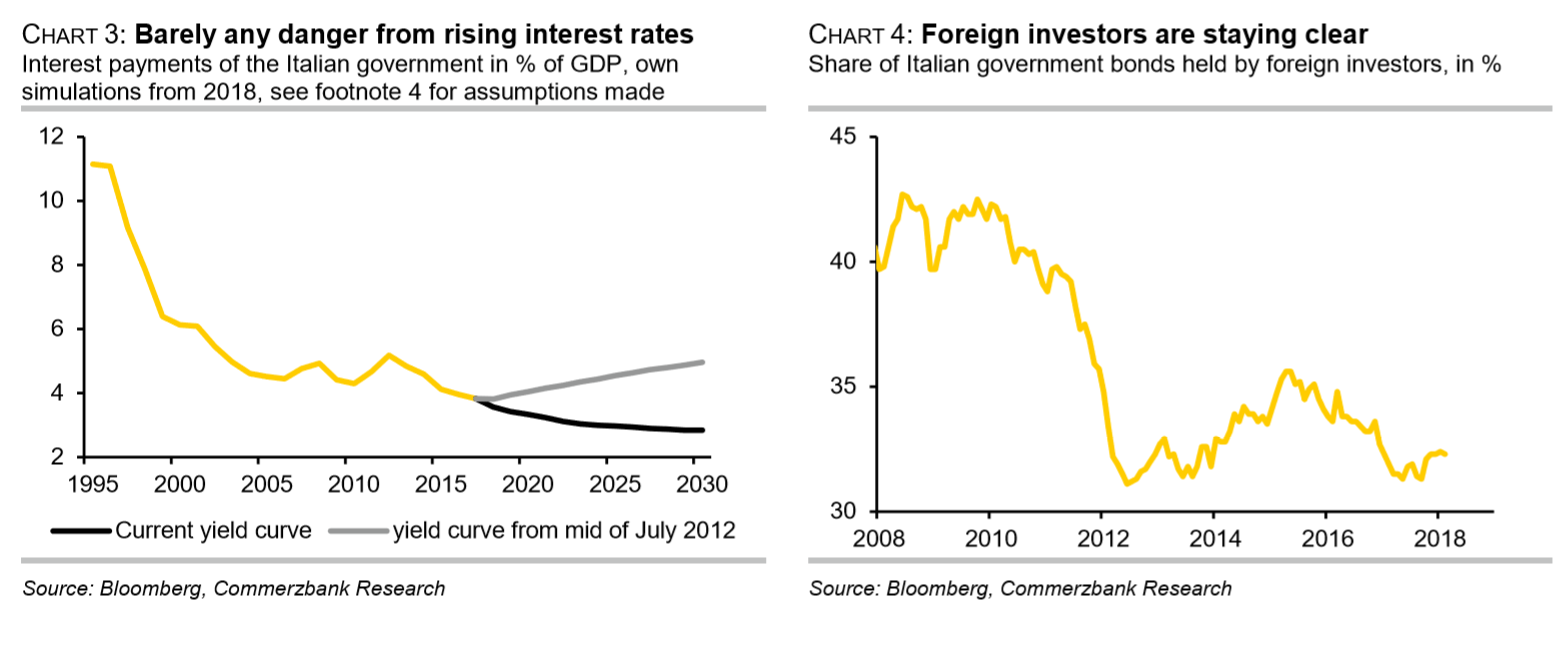

Secondly, the composition of holders of Italian debt means that any crisis in its bond market is likely to remain more contained.

The ECB, for example, is a major holder of Italian bonds and is, therefore, acting as a sort of "anchor investor", in the words of Dr. Solveen, whilst other major holders include Italian banks and financial institutions.

Much less foreign investors now own Italian bonds than was the case before - roughly 10% compared to 40% previously - so if they decide to ditch Italian bonds it will not create the same waves as before. There is unlikely to be a measurable outflow of funds from the Eurozone with the concomitant spike in Euro supply vis-a-vis FX competitors.

Experience from the financial crisis shows that domestic investors tend to be more loyal compared to foreign holders who tend to act more fickly at the first sign of trouble.

The ECB is also acting as a buffer to the crisis in other ways which is preventing the debt crisis from spiraling down.

The ECB's low-interest-rate policy means Italy can refinance its old debt and issue new debt at remarkably low-interest rates, which will keep its repayments low - falling even for some time ahead according to Dr. Solveen.

"The ECB’s actions have lowered the general interest rate level in the euro area to such an extent that the debt service cost in Italy would not increase even if risk premiums were higher. Our simulations show that the interest burden – i.e. government interest expenditure as a percentage of GDP – will continue to fall for many years even at the current yield level," says the analyst.

Although Euro-traders may be on tenterhooks awaiting the next major development in Italy, which is probably the naming of the next Finance minister, and whether it is the Euroskeptic Savona, the reforms of the Eurozone financial system and the policies of the ECB may act as a backstop to any shockwaves from the news.

There are other checks and balances, however, which could also halt the crisis from spiraling out of control.

President Mattarella is one of them. He has made it clear he is not in favour of anything which is likely to upset stability and wants Italy to honour her debt obligations.

The coalition has promised to cut taxes and increase public spending which are likely to place it in jeopardy of breaking the EU's 3.0%(of GDP) maximum deficit rule, but more worryingly it has also raised the idea of asking the Troika for write off 250bn of its 2.1tr debt.

As President, Mattarella has the power to veto any policies he sees as extreme as well as the choice of cabinet ministers. It is well known he does not favour Savona and could prevent his ascension to the post of Finance Minister if he chose to exercise the powers vested in his office.

Further, the 81st act of the Italian constitution states clearly that the government should try to balance the budget and a failure to do so would place the state at loggerheads with constitutional law.

The coalition's ambitious tax cuts and spending plans will almost certainly lead to a widening the country's budget deficit and possibly in contravention of its own constitution.

"The State shall balance revenue and expenditure in its budget, taking account of the adverse and favourable phases of the economic cycle," says the constitution.

Given the wide-ranging checks and balances built into both the political and the economic system the Euro's failure to sell-off more sharply as a result of the risks building in Italy is easy to understand, as it is possible they may be overstated.

If we accept these alleviating circumstances it is possible to see views at the more pessimistic end of the spectrum, may be over exaggerating the risk to Italy and the Euro somewhat.

These concerns are reflected in the views of Jack Allen, european economist at Capital Economics.

"Perhaps more worryingly, if we are wrong and the government presses ahead with all of its current proposals in full, the economic and financial fallout would be huge," says Allen.

"The budget deficit and debt would surge, potentially sparking panic in the bond markets and a run on the already-weak banks," he adds

"What’s more, the EU would almost certainly have to impose sanctions on Italy for breaking its budget rules. This could easily turn public opinion against the euro, encouraging the government to renew its call for Italy to leave the currency union," says the economist.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.