Euro Outlook Darkens as PMI Data Confirms Recent Soft Patch is Lingering

- Latest business survey data confirms a slowing in the region's growth trajectory

- Data does not bode well for the Euro as ECB might opt to extend supply of easy money to Eurozone economy

- The data is far "far from encouraging" say Pantheon Macroeconomics

© kasto, Adobe Stock

A struggling Euro was greeted with bad news mid-week on signs expansion continues to slow in the two biggest sectors of the Eurozone economy - manufacturing and services.

The latest IHS Markit PMI data for May shows a by eight basis points to 53.9 in the services sector and seven basis points to 55.5 in the manufacturing sector, down from April's 54.7 and 56.2 respectively.

Expectations had been for services to remain unchanged at 54.7 and Manufacturing to fall by only a basis point to 56.1. The composite PMI declined to 54.1 from 55.1, when expectations had been for a more modest drop to 55.0, so the actual result presents a big disappointment and suggests the slowdown suffered by the Eurozone at the start of 2018 is lingering longer than those who blamed the poor weather will have liked.

Questions are now being asked as to whether the European Central Bank has the stomach to start weaning the Eurozone off the easy money it has been supplying over recent years; market assumptions that an announcement on the matter would be made in July were key to the Euro's strong performance in 2017.

The data could suggest to the ECB that assistance will be required for longer, a development that would likely weigh on the Euro going forward.

"The Euro needs better data, Italian political resolution (without an on-going threat of leaving the Eurozone) and better positioning. The last of these will be solved imminently but the other two are going to take time and the market isn't waiting," says Kit Juckes, macro strategist at Société Générale.

The PMI results are based on survey responses by pivotal purchasing managers within companies and are viewed as quite a reliable leading indicator for the economy. Results of over 50 indicate expansion and those below 50 contraction, so the May results, though down on April, still indicated expansion - just expansion at a slower rate.

The surveys showed a slowdown in hiring and backlogs of work. They also showed optimism about the future falling to its lowest level in 18-months. There was mixed news on prices and some signs that selling price inflation had fallen.

A fall in the rate of new orders was linked to slower export growth which fell to a rate not seen since April 2016.

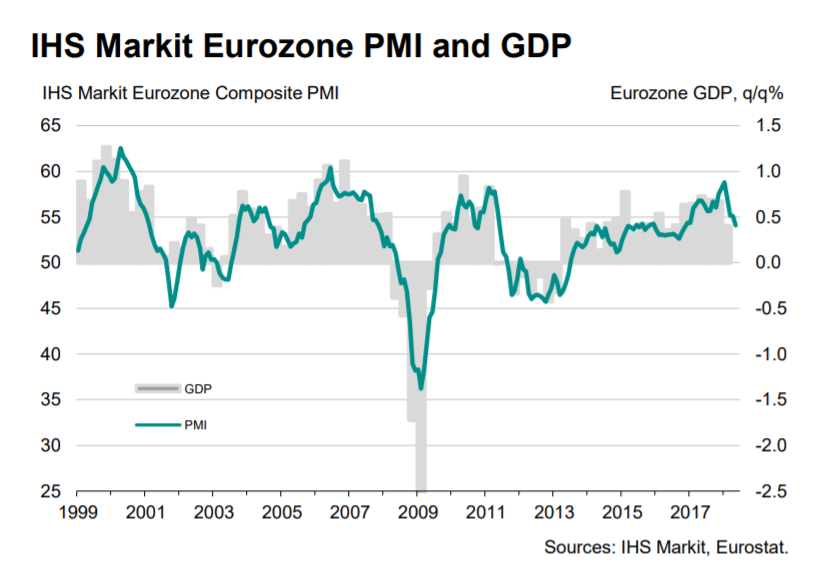

The close correlation between the results of the composite PMI and Eurozone GDP is reflected in the chart below.

"Despite the headline PMI dropping to an 18-month low, the survey remains at a level consistent with the eurozone economy growing at a reasonably solid rate of just over 0.4% in the second quarter," says Chris Williamson, chief economist at survey compiler IHS Markit.

"It’s also becoming increasingly evident that underlying growth momentum has slowed compared to late last year, especially in relation to exports," adds the economist.

"Hiring has consequently shown signs of being reined-in. More expensive oil and rising wages are meanwhile continuing to push companies’ costs higher, but weak final demand means firms are struggling to pass these higher costs onto customers," added the analyst.

The data is far "far from encouraging," says Clause Vistesen, chief European economist at Pantheon Macroeconomics.

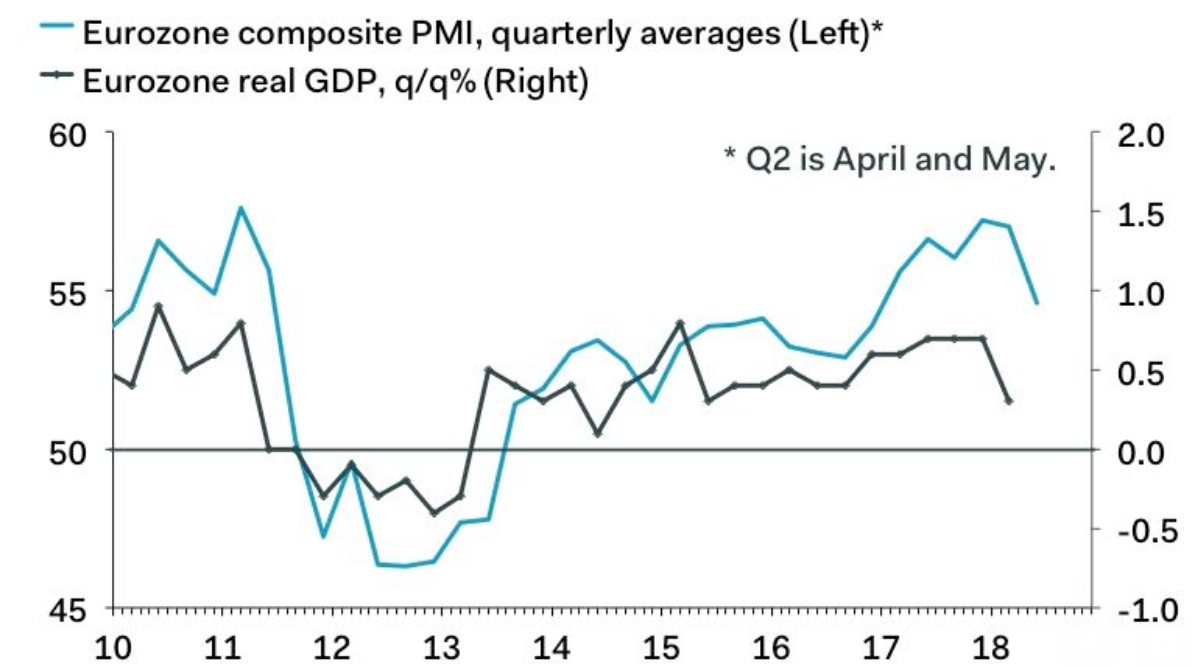

"Although we remind readers that the PMIs are not always good indicators of the real economy. Such as it is, however, they suggest that the Eurozone economy continued to slow in Q2. This is consistent with our expectations," adds Vistesen.

(Image courtesy of Pantheon Macroeconomics)

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.