Pound Sterling Forecast to Grind Lower vs. Euro Short-Term Amidst Persistently Low Volumes on Exchange Rate Markets

- Written by: Gary Howes

The Euro is pushing the British Pound lower at the start of the new year amidst an environment of thin trading volumes, but there are signs that 2018 could be a decent year for the UK's currency.

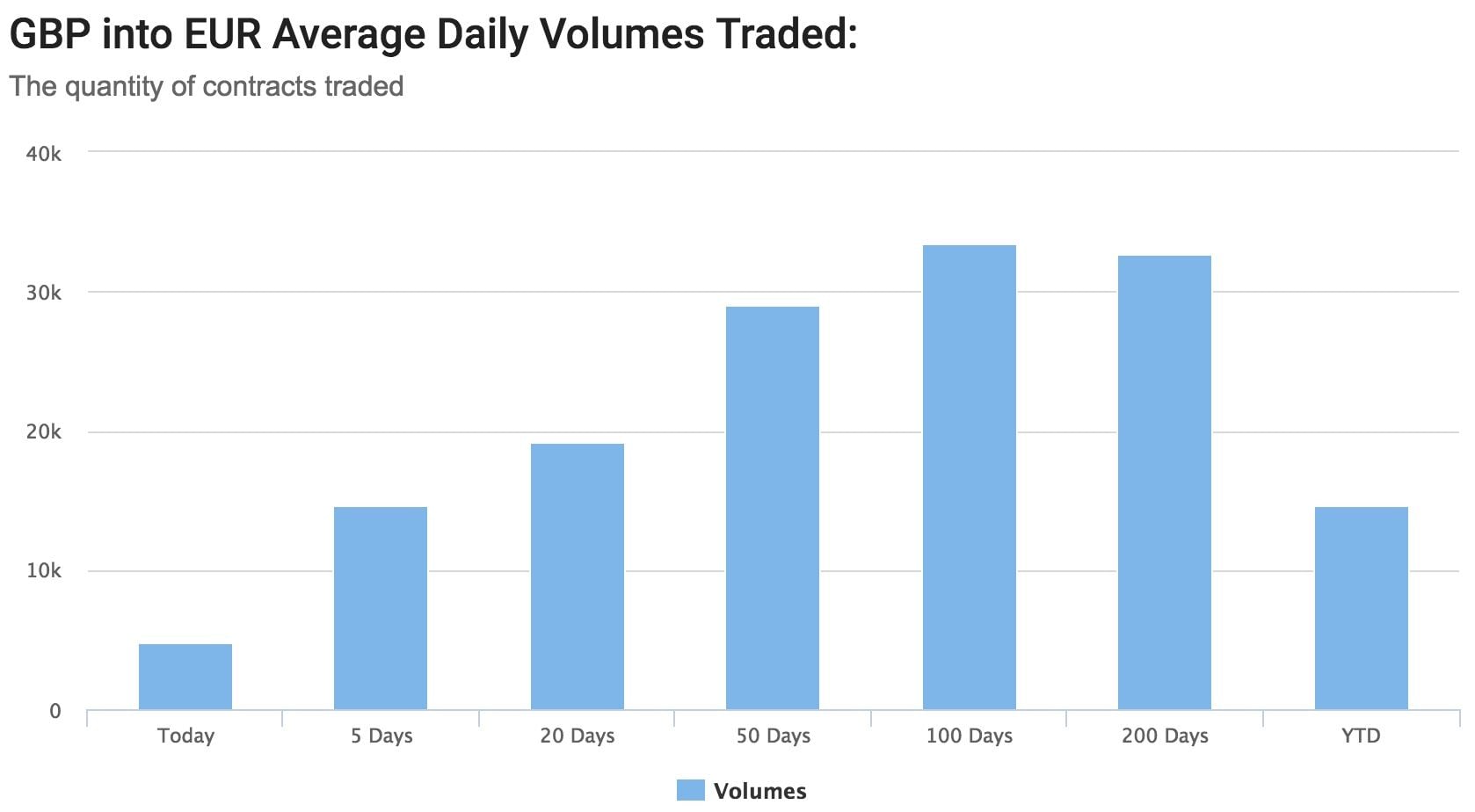

For Pound Sterling, an environment of low volumes appears to be marginally negative as the exchange rate continues to edge lower against the Euro.

Volumes are low, with the first week of 2018 seeing less than half the interest witnessed back in September, indeed there has been a trend of declining volumes heading into the turn of the year:

This trend is to be expected as the Christmas period and new year are typically quiet times for financial markets in terms of volumes owing to the numbers of traders being away from their desks.

Low volumes also tell us volatility is likely to be low, and indeed, the charts confirm an incredibly stable market since about mid-December when inter-day spikes and troughs in the market flattened out:

What is important to note however, is that a lack of volatility means the trend in the market is unchallenged, and for those wanting a stronger Sterling this is not necessarily good news as the short-term trend is lower.

As the above graph shows, since the highs at 1.1505 were rejected back on December 12, the Pound has been on offer.

It is hard to say where the selling will end, but an educated guess would suggest it will be a case of more of the same unless market interest spikes.

"The combination of solid data out of the Eurozone, more hawkish ECB speak and broad based negative sentiment for the

US Dollar have accounted for this continued run in the single currency, now looking to extend its run following a healthy

period of consolidation. Any stress relating to German coalition talks and Italian elections have been brushed aside," says Joel Kruger, an analyest with LMAX Exchange.

However, technical analysts - those who study an exchange rate's charts with the view of predicting future moves - believe no major damage should be done to Sterling with the range lows towards 1.11 likely to provide protection.

Analyst Robin Wilkin with Lloyds Bank believes the near-term trend that sees the Pound "grinding" lower will remain intact intact, noting that overall, the market remains trapped in a range between 1.15 resistance and 1.11 support.

So we could well see the slow grind lower continue over coming days but we would be very surprised if a substantial decline were to transpire.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Brighter Outlook Longer-Term

When 2018 finally gets going in earnest there are suggestions that the Pound could appreciate against the Euro; indeed data into the positioning of traders on the market confirm negativity towards Sterling is rapidly fading.

Analysts at global investment banking giant Morgan Stanley say their in-house models show GBP positioning increased to 'long' in the final weeks of December.

"There was broad-based GBP buying across all investors captured in our positioning tracker. GBP was one of the only two currencies bought by non-commercial IMM accounts in the three weeks to December 26," says Strategist Gek Teng Khoo at Morgan Stanley in London.

Khoo say this trend was led by asset managers buying to become mostly 'long' on the British Pound for the first time since June 2016, while leveraged funds were small sellers.

"GBP was also the only currency bought by Japanese retail accounts in the last three weeks of December, and the only currency where sentiment is bullish. Global macro funds were also GBP buyers. While bullish sentiment has not reached extreme levels yet, long positioning could be a risk if sentiment turns around," says Khoo.

The data is revealed by Morgan Stanley's FX Position Tracker which monitors sentiment amongst traders in the global currency trading community.

![]()

The model combines a host of available data points on sentiment amongst traders in the global currency sphere; including the IMM Commitment of Traders Report, the Toshin, TFX and internal measures of ETF flows and internal sentiment monitors.

Meanwhile, a report from Citi - the world's largest dealer of foreign exchange - echoes the findings of Morgan Stanley.

Citi report "the strongest hedge fund flow in the final week of 2017 was NZD, GBP and JPY buying and AUD and USD selling, in a reversal of previous weeks."

Above (C) Citi

Currency traders might not necessarily be turning positive on Sterling however, rather they might just be 'less negative'.

As noted by analyst Viraj Patel with ING, we could be witnessing a situation whereby traders are merely exiting negative 'short' bets against Sterling; such a move would logically shift the market's stance into a more friendly one for the currency.

"While speculative investors have turned net long in recent months, this adjustment in positioning has been mainly driven by GBP shorts bailing – which suggests to us that the attractiveness of selling GBP has been fading given the absence of any factor that could seriously delay Brexit talks and push the U.K. closer towards the March 2019 cliff-edge," says Patel in a note dated January 3.

Patel joins a host of other foreign exchange analysts who believe the recovery in Sterling seen in 2017 could well extend into 2018.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Euro Finds no Boost from Latest Inflation Data

The Euro maintains an advantage against the British Pound and US Dollar ahead of the weekend thanks to some solid inflation data out of the Eurozone on the morning of Friday, January 5.

The final day of the first week of 2018 promises to be an interesting one for currency markets owing to the large amount of data on tap with the Euro's highlight being inflation numbers which confirmed prices rose 1.4% in December by Eurostat, a shade down on November's 1.5%.

This should take the annualised figure up to 1.0%. Inflation matters as it is a key gauge of economic performance at the European Central Bank - the ECB has for years now been trying to stimulate inflation back towards its 2.0% target by deploying a number of measures such as cutting interest rates to record-low levels and printing large sums of money.

A side-effect of this stimulatory effort has been a weaker Euro and while. The ECB is betting inflation is creeping back to the 2.0% target and as such the ECB has indicated it is to start reducing stimulus, something that saw the Euro rally in 2017.

However, for this trend to extend into 2018, we would ideally like to see Eurozone inflation push higher.

“Despite a small uptick, core inflation in the eurozone remains subdued and is still some way off the ECB’s two percent target," says Dennis de Jong at UFX. “Until we see sustained inflation growth, it seems unlikely the central bank will deviate from its asset buying and QE programme, which it has already committed to until at least September."

“Given that Mario Draghi remained firm on a loose monetary policy while inflation was on the rise last year, it would now be a surprise to see him change course before 2019 – at the earliest,” adds de Jong.

Hence, today's data suggests that the all-clear for Euro strength in coming months is yet to be given. Analyst Robin Wilkin with Lloyds Bank says today's data "may reinforce expectations that the ECB will continue to take a cautious approach in moving towards less stimulatory monetary policy."

Following the release the Euro index - a measure of broad-based Euro performance - is flat at 96.2.

The Euro-to-Dollar exchange rate is seen trading at 1.2056, the Euro-to-Pound exchange rate is at 0.89 and the Euro-to-Australian Dollar is at 1.5377.

At these levels the single-currency will have made a decent advance against all three currencies during the first week of the year.