Political Risks in 2018 Unlikely to Threaten Euro: Nomura

The Euro is unlikely to be as tested by political events in Italy and Spain in 2018 as it was during France's watershed election last May.

The Italian election in the Spring of 2018 is expected to be the next big threat to European integration and the future of the Euro, after the French elections in March ended with a collective sigh or relief when Emmanuel Macron defeated the far-right anti-EU Marine La Penn.

The Euro fell heavily in the run-up to Macron's win, but the same is not expected to happen in Italy due to the different financial dynamics in the two countries, or at least so says Nomura bank analyst Yujiro Goto in a recent note setting out an analysis of potential risk factors in 2018.

The Euro fell heavily before the French elections because foreign investors decided the prudent thing to do - faced with such unprecedented political risk - was to sell their French investments, a large part of which were comprised of French bonds.

"Japanese investors were significant net sellers of French bonds ahead of the French election and EUR underperformed," says Goto.

This was part of the reason why the Euro fell too, but the same cannot be said of Italy and Spain, despite the risk of a problematic political result in both cases.

"Into the first half of 2018, Spanish and Italian politics will attract some market interest. However, we expect the impact on foreign investment in the euro area to be much smaller than the impact of French election uncertainty," says Goto.

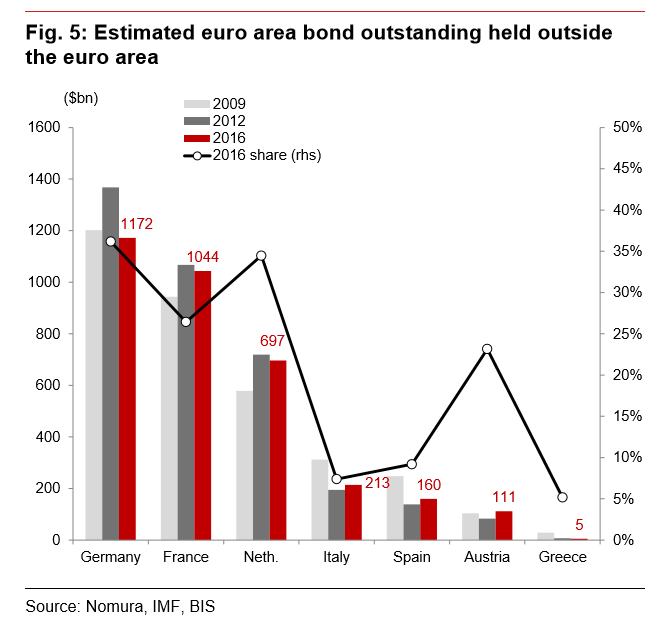

The reason is that outside investors hold far fewer Italian and Spanish bonds compared to French bonds so the potential for a large sell-off is much reduced.

"We estimate $1044bn of French bonds were held by non-euro area investors as of end 2016....In comparison, only $213bn of Italian bonds and $160bn of Spanish bonds were held outside the euro area," says Goto.

Therefore the impact on international capital flows from Spanish and Italian politics is expected to be much smaller.

A Case of Quality Not Quantity

It is not just a case of numbers - after all, the economic and political crises in Greece during the European debt crisis had a severe impact on the Euro yet the exposure of foreign investors was relatively small compared to that of France.

Greece's total government debt is only 300bn, which is much less than the 1044bn of French debt held in foreign hands.

Yet Goto notes that the old relationship between the Euro and perceptions of peripheral risk have also shifted.

Previously the Euro had a negative correlation to changes in the difference between the interest premium investors require in order to lend money to the Eurozone periphery and the core - known as the 'peripheral spread' - but fresh evidence now points to an uncoupling or even inverting of that relationship.

"In fact, the sensitivity of EUR to the peripheral spread has been relatively contained recently, suggesting political uncertainty is having only a limited impact on global investment flows," says Nomura.

The Euro has actually risen whilst the peripheral spread has widened recently, in a complete reverse the old relationship.

This means the Euro has risen when risks in the European periphery have widened relative to Germany.

Again, this suggests the Euro could very well stay resilient in the run-up to elections in Italy and Spain in 2018, as investors don't seem to be attaching the same level of concern to either as they did to the French presidential election, which was perhaps seen as a greater threat to the region as a whole.