Pound-to-Euro Rate: 5-Day Forecast

The Pound-to-Euro exchange rate starts the new week on a strong footing as political tensions in the UK ease but our technical studies warn the British Pound remains vulnerable to declines.

The Pound opens the new week stronger against the majority of its competitors in line with our expectations as per the article we published on Saturday, October 7.

We warned readers that the politically-driven Pound would probably take comfort from signs that Theresa May is likely to stay on as leader of the Conservative Party after a series of senior figures publicly backed her in a concerted attempt to silence the debate around her future.

Comments from Boris Johnson, Ruth Davidson, John Major and others all confirmed there is little likelihood of May being forced from her position and as noted by analyst Viraj Patel at ING Bank N.V. - "our short-term financial fair value model estimates show a 1-2% risk premium currently priced into GBP, which suggests that there is a potential for a GBP relief rally if questions over PM May’s leadership credentials abate."

“If concerns over an immediate challenge to PM May’s position continue to subside in the near-term, there is still some scope for the pound to rebound further,” says Lee Hardman,

Currency Analyst with MUFG in London.

But how far can the rally extend?

Patel suggests 1-2% of gains ahead, and we would not argue against his view but we would caution that readers keep in mind that structurally, the Pound is in a downtrend and therefore the path of least resistance is lower.

Robin Wilkin, a technical analyst with Lloyds Bank Commercial Banking says a short-term pullback in the Euro is warranted and he is looking for the Pound to potentially bounce to resistance at 1.1217-1.1260.

However, the analyst is looking for resistance to hold strong and the losses from highs at 1.1433 set at the end of September should extend towards more important support in the 1.1050-1.10 region.

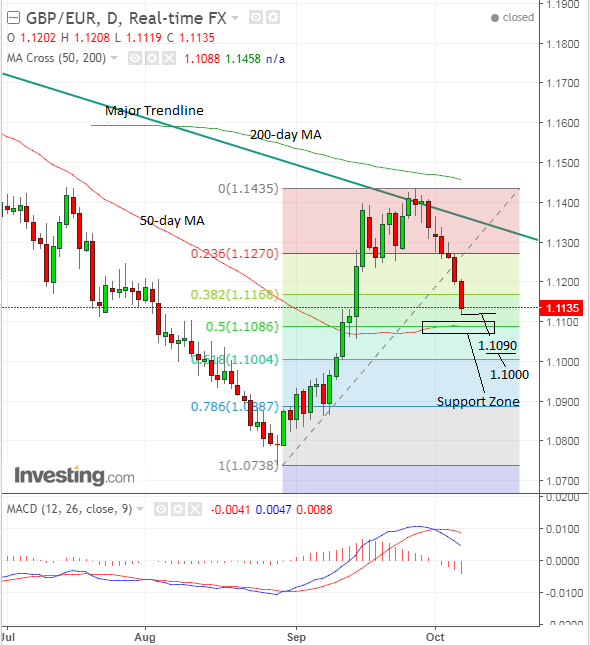

Pound Sterling Live's technical analyst Joaquin Monfort notes the Pound's downtrend against the Euro began after it rose touched the major trendline on the 26th of September and rolled over.

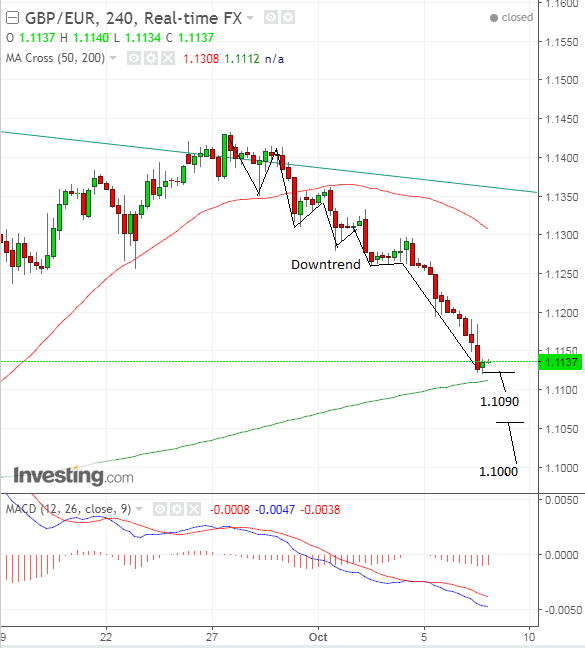

The short-term trend is clearly visible in the downtrending sequence of peaks and troughs on the four-hour chart below, and it is expected to extend given the lack of available evidence to the contrary:

The pair is approaching the 200-four-hour moving average (MA) and whilst large moving averages often act as strong support levels, preventing further progress lower, this is only the four hour chart so we still see a break below it as probable.

The daily chart shows a more formidable zone of support in the 1.1080s from a combination of the 50-day MA and the 50.0% Fibonacci retracement level of the August-September rally.

The 50.0% level is the midpoint of the move, and often has support and resistance properties which can make it an obstacle to price and the location for consolidations, bounces, pull-backs and reversals.

We therefore see this zone as the next target to the downside, and see a break below the current lows at 1.1119 as confirming a continuation down to the next target at 1.1090.

Given the strength of the move down, there is a further possibility of a continuation lower after that, with a break below 1.1055 confirming an extension down to a target at 1.1000, which is a psychologically significant level and the 61.8% Fibonacci retracement of the rally, and as such another significant level for the pair.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Events and Data for the Pound

As already hinted at, politics was the main driver of Sterling in the previous week and it will probably once again be the main driver in the week ahead.

Sterling lost ground as a result of Prime Minister May's leadership coming under criticism, and whilst there are no signs she will resign the flak has weakened her position.

Over the weekend we have noted that the Conservative Party has rallied around May and her position looks to be secure once more and as noted by Viraj Patel at ING Bank N.V. this might offer Sterling some upside. So while the technical studies suggest GBP/EUR is heavy, the relief of fading political risks could well provide some upside.

This makes forecasting near-term direction in Sterling particularly difficult at present.

The coming week is a key time for Brexit negotiations as it will be the last week of talks before the EU summit to determine whether sufficient progress has been made to move onto phase two.

The consensus expectation is that progress will not be judged sufficient to move on.

"Barring any surprising breakthroughs, the EU27 is almost certain to vote that insufficient progress has been made to move onto the 2nd stage of negotiations," said Canadian investment bank TD Securities.

The most important had data to be released is Manufacturing and Construction Output data for August at 9.30 BST on Tuesday, October 10.

TD Securities, again, think there is a substantial chance of a deeper decline than the markets are expecting.

They say that although Manufacturing rose in June for the first time in 2017 they expect the gains to be at least partially retraced in August due to a fall in car sales.

They are also skeptical about the Construction Output result for August, saying that despite their model indicating an uplift due to a delayed effect from strong mortgage and house price data before, more recent Construction PMI's point to a decline.

Other releases to keep an eye on in the coming week are the Royal Institute of Chartered Surveyors (RICS) house price monitor at 00.01 on October 12; the Trade Balance at 9.30 on Tuesday, October 10 and the British Retail Consortium's (BRC's) Retail Sales Monitor on Tuesday at 00.01.

Events and Data for the Euro

In the week ahead probably the main focus for the Euro will be what happens in Catalonia, where there is a possibility the regional government could declare independence, after 90% of voters in the referendum voted for independence.

Whilst only a minority of the population voted - something like 40% - the government may still declare independence.

The Euro's relatively sanguine reaction to the events in Barcelona may be because traders still see little actual risk of Catalonia breaking away and view the episode as being of little threat to the wider Eurozone.

The region has much to lose by a forced withdrawal and little to gain from breaking away, and therefore even pro-independence politicians are favouring negotiaions with Madrid rather than a unilateral split, which could have dire consequences for the Catalan economy.

A newly independent Catalunia would not be a part of the EU and would have to reapply to join, which could take years and require all the present members agreement - even Spain.

Financially it is also heavily reliant of Madrid since it has substantial debts with the central government after it was bailed out during the Eurozone crisis in 2012 using money from an emergency fund set up by Madrid, so again, if it went against the rest of Spain those all-important taps would be switched off.

"The situation would become more difficult if Catalonia declared independence and Spain refused to extends its loans. Two thirds of Catalonia’s debt (€52.5bn) is with the liquidity funds for autonomous regions (FLA) which the central government set up in 2012 to finance regions which had been cut off from capital markets. The extension of outstanding bank loans to the region also requires Madrid approval since EFSF support was given in 2012," said Commerzbank's Deputy Head of Economic Research (Germany), Dr. Ralph Sorveen.

On the downside for the outlook for the Euro, however, the Catalan's spirited resistance may trigger copycat separatist attempts in other EU states, and worse still for the currency, and the European project in general, doom Macron's plans to unify the EU fiscally: part of the Catalan's grievance with Madrid is that they contribute more in tax revenue than what they receive in public money to spend.

The same appears to be true of German misgivings about bailing out Greece - and if the sentiment were more universally shared than expected it could halt moves to deeper unification.

On the data front, the main releases are German.

Industrial production is first off, out at 7.00 BST on Monday October 9 and expected to show a 0.7% recovery.

Then the trade balance is out at 7.00 on Tuesday.

German CPI for September is out at 7.00 on Friday, and is forecast to show a 0.1% rise - this will be a key foretaste of Eurozone inflation out next week before the October ECB rate meeting.

Eurozone Industrial Production, meanwhile, is out at 11.00 on Thursday, and is forecast to show a rise of 0.5% in August compared to July.