Euro Strength v Pound Sterling to Stall Near-Term: Deutsche Bank

- Spot market quotes:

- Euro / Pound Sterling exchange rate: 0.9253

- Pound / Euro exchange rate: 1.0806

The Euro has charged hgiher agianst the US Dollar at the start of the new week with the market eyeing the big 1.20 figure. However, the same strength has not extended to the Pound which has actually shown some resillience.

This should come as no surprise.

A strong trend of appreciation in EUR/GBP has seen the exchange rate surpass the key £0.92 hurdle, but now Deutsche Bank's Oliver Harvey suggests the pair may be due a correction.

However, the analyst does stick to his longer-term bullish view for the pair heading into the end of the year.

So while a pause in the trend higher could be likely near-term, it should be temporary.

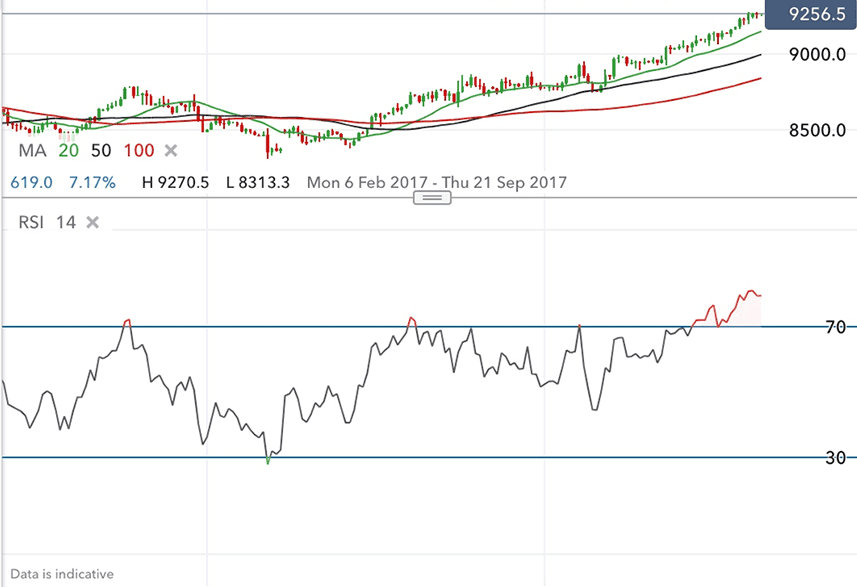

"EUR/GBP is quite stretched. The 14-day RSI has hit the highest level since May's Brexit speech at the Conservative Party Conference last year and has only been more stretched four times since 2008," says Harvey, who holds the position of Macro Strategist at Deutsche Bank.

Our own technical studies of the Pound to Euro exchange rate, published this weekend past, also reflects on the stretched RSI reading noting that the last time such levels were seen was in October 2016. The Pound managed to embark on a strong rally as a result.

We caution that some strengthening in the Pound, or consolidation at the very least, could occur as a result.

The RSI is the Relative Strength Index, which is a momentum indicator calculated by finding the balance of the up and down day's losses and gains over the last measurement period.

For RSI to be overstretched is not a signal in and of itself that the exchange rate is going to reverse and start falling, but it is a sign that the uptrend will probably slowdown and stall.

Normally the overbought region for RSI is defined as over 70, as per the lower panel in the above graph.

A simple consolidation in prices is enough to bring the reading back to normality while the signal for a reversal in the trend is produced when RSI moves back below the overbought level - or 70 - and starts moving concertedly lower.

Beware Better UK Data

Another reason Harvey expects the Euro's run higher to stall is an increase in the strength of the Pound due to improving data.

The data surprise index, which measures the difference between positive data surprises and negative data surprises is "bouncing", and the recent unemployment data release once again undershot the Bank of England's (BOE's) "target of equilibrium" which is the level below which there is upwards pressure on wages and an inflationary effect.

As for the Pound’s recent fall, the Bank of England, they, "are unlikely to be thrilled with recent currency weakness with GBP TWI not far off post-Brexit lows," says the Deutsche strategist.

The market is now particularly pessimistic about the likelihood of the BOE increasing interest rates with no hikes priced in until well into 2019.

The pessimism may have reached extremes from which it could now 'snap back' leading to a rise in the Pound, since expectations of higher interest rates tend to strengthen a currency by increasing inflows from foreign investors seeking to park their money in higher interest-bearing accounts.

The negative view of interest rate potential in the UK has led to EUR/GBP overshooting short-duration money market interest rate differentials.

Normally the exchange rate moves in tandem with these short-term lending rate differentials, reflecting the flow dynamics of international money moving to where it can earn the highest interest, however, it appears that the EUR/GBP has now, "already overshot short-end rates," the inference being that the overshoot will correct and the exchange rate fall.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Better Brexit

On Brexit negotiations which get underway again this week, Harvey notes the Government to be seemingly moving to a more "realistic" stance and this could help the Pound recover in the short-term.

Harvey is mildly optimistic, saying that the UK government's recent proposal of a so called 'EFTA Court' half staffed by British judges and half by European, goes some way to a more realistic proposal and falls in line with the EFTA countries: Norway, Iceland and Lichtenstein, on which the proposal was modelled.

"The next round of negotiations gets underway next week so the EU reaction to the proposal will be interesting. Bigger picture, UK concessions are coming too slowly to be optimistic about agreement at the October meeting, but political noise may rise again in September, particularly with proposed cross-party amendments to water down Brexit legislation," says Harvey.

Longer-Term Headaches

But longer-term, the Pound has fundamental headwinds which should limit any near-term corrections.

Another factor in currency valuation is trade flows, but this is actually getting worse for the Pound as the number of imports outweighs exports.

"The UK also remains very vulnerable on the capital flows front. M&A inflows have dried up and portfolio inflows will be sensitive to ECB tapering," notes Harvey.

"To sum up, the potential for more hawkish rhetoric from the Bank of England, rising political noise in September and stretched technical indicators warrant some near-term caution, so we tactically take profit on our long EUR/GBP recommendation."

Longer-term, however, the strategist remains bearish the Pound and bullish the Euro:

"Big picture, a weak flow picture and little possibility of Brexit resolution before year-end means that we remain structurally bearish on GBP."