"Liberated" Euro Can't Now be Stopped by the ECB says Deutsche Bank's Saravelos

"The Euro can strengthen despite, not because of higher bund yields” - George Saravelos, Deutsche Bank.

Analysis conducted by one of the world's largest foreign exchange dealing houses suggests there is little the European Central Bank can do to stop the Euro's charge higher.

Findings by Deutsche Bank come after another good week for the Euro which benefited from ECB President Mario Draghi’s speech to the Forum on Central Banking on Wednesday which hinted at a future of higher interest rates at the Bank and the end of quantitative easing.

The Euro moved higher but saw some of those gains made against Pound Sterling reversed as the Bank of England’s Mark Carney delivered a similar message the following day that saw markets turn positive on Sterling in anticipation of a potential 2017 interest rate rise.

But it is the ECB President’s message that is likely to have a lasting impact on foreign exchange markets we are told, and this spells for potential weakness in GBP/EUR.

Draghi's speech “was important not because he marked a hawkish shift to policy but because he implicitly signalled that the ECB is not as concerned about low inflation any more: it is now considered temporary,” says foreign exchange strategist George Saravelos at Deutsche Bank.

Euro Liberated from the ECB

According to Saravelos, “the language shift is critical because it ‘liberates’ the Euro, disinflationary strength in the currency may now matter less for the ECB.”

In short, the ECB is not likely to be worried that a rising Euro weighs on inflation and will therefore not fight back against episodes of strength, as has been the case over recent years.

The ECB has a mandate to ensure Eurozone inflation stays around the 2% mark to ensure price stability.

Over recent years inflation has languished well below 2% leading the ECB to put in place policies that sought to stimulate economic growth, and thus inflation.

A side-effect of these policies - which include record-low interest rates and quantitative easing - is a significantly undervalued Euro.

But the ECB needs an undervalued Euro to act as a third weapon in their arsenal as a weaker Euro helps keep Eurozone exports stay cheap and therefore helps the economy via boosting exports.

Whenever the Euro has appreciated in the past the ECB has sought to work against the strength by threatening further quantitative easing, or actually delivering further quantitative easing.

But, the ECB might be losing control of the Euro.

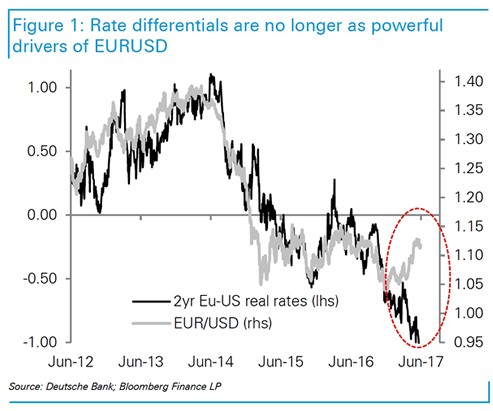

Saravelos notes the shift in language seen at the ECB actually coincides with another regime change that has been evolving in recent months and is even more important: “the complete breakdown of EUR/USD with rate differentials suggesting the ECB was losing control of FX anyway.”

For Saravelos, both these observations are critical “because they suggest that the Euro can strengthen despite, not because of higher bund yields”.

In fact, the more the Euro appreciates the more ECB tightening will be slowed.

“The key driver of Euro strength is not ECB hawkishness but medium-term rebalancing of structural post-crisis underweights in European assets,” says Sarvelos. “The ECB may not able to do much about it.”

In short, there is nothing stopping a huge flow of capital into Eurozone assets now that the ECB economy is outperforming once more. This should create upside pressures on the single currency that the ECB cannot fight.

This should serve as a reminder to those watching the Pound to Euro exchange rate that the Euro is on the move higher and there might be little standing in its way.

Potential Limits to the Euro

Of course the Euro cannot keep rising forever, and nothing ever moves in a straight line, so those watching the GBP/EUR exchange rate should be careful when it comes to timing.

“Since the market is obviously unwilling at present to let this spoil its EUR-positive mood – which is supported by a friendly economic and political environment – the appreciation trend could indeed still continue near-term,” says Thu Lan Nguyen at Commerzbank.

However, Nguyen differs from Sarvelos in believing the ECB will become more sanguine about inflation and the value of the Euro.

He therefore offers a word of caution on the Euro longer-term:

"On a somewhat longer-term perspective, the euro’s gains are unlikely to be sustained, though. For one thing – in contrast to what the market currently expects – it is unlikely that the ECB will already raise its key rates next year, given the slow pace of inflation in the Eurozone."

"The ECB would no doubt strike a more aggressive tone in its communication, should the EUR appreciate too strongly in its view, jeopardising its outlook for economic growth and inflation."

Commerzbank see the downside limit in GBP/EUR at 1.11 as a result.

British Pound to Struggle on Disruptive Brexit

While the outlook for the Euro is looking more constructive, concerns over the Pound linger.

In mid-June Deutsche Bank reiterated their negative stance on the British Pound owing to the latest political developments in the UK.

The month has seen Theresa May lose her majority in the house of commons and the Prime Minister’s diminished authority makes a so-called “muddled Brexit” more possible.

The political developments “have provided sufficient evidence to make the muddle-through strategy we outlined our baseline. We view this development as particularly negative for Sterling and we reiterate our bearish FX view,” says Saravelos.

Elsewhere, analysts at Wall Street giant Goldman Sachs have briefed clients that they “continue to hold a bearish view on GBP, particularly against the USD.”

The market seems to be taking the opposite view to ours that activity matters less than inflation in monetary policy decisions," says analyst Silvia Ardagna at Goldman Sachs’ London office. "Perhaps this is because activity is decelerating from a high level and growth remains above trend, while inflation is above the policy target."

However, against the Euro, the Pound is forecast to tread water around current levels for the foreseeable future.

Current Account Data Spells Bad News for the Pound

When it comes to the Pound - keep the current account in mind - it is arguably the single most important economic concept when it comes to determining currency value.

This is the country’s bank balance with the rest of the world and the currency’s fundamental long-term valuation depends on a combination of how much we import, export and how much foreign capital the country attracts.

Unfortunately for Sterling, the current account has been in deficit for many years now as the UK imports more than it exports, leaving it reliant on foreign investment inflows to keep the Pound propped up.

The reason the Pound is so vulnerable to Brexit is because a bad outcome could hit our exports or stop foreign investor inflows from shoring up the account.

There had been some improvement in the current account towards the end of 2016; however latest data from the ONS has confirmed the improvement has stalled.

While the UK is an exporter of services the country remains hampered by an inability to export goods, particularly to Europe.

“The total trade deficit widened to £8.8 billion in Quarter 1 2017 following a sharp narrowing of the deficit in Quarter 4 2016 (£4.8 billion); this was due to a widening in the deficit on trade in goods and a narrowing in the surplus on trade in services,” report the ONS.

A current account deficit of £22.2 billion was recorded with the EU in Quarter 1 2017 whilst a surplus of £5.3 billion was recorded with non-EU countries.

In terms of the Brexit debate this point is irrefutable - the European Union gains a great deal more value from the UK than does the UK benefit from the EU.

Looking ahead, there are however signs that the UK’s trading position might improve.

“The latest monthly trade data and surveys of export orders suggest that net trade will start contributing positively to GDP growth in the coming quarters,” says Scott Bowman, UK Economist at Capital Economics.

As can be seen, the UK’s reliance on foreign goods is as sizeable as ever.

There were hopes that the fall in value of Pound Sterling would go some way in boosting exports and reducing imports.

Analysts at Goldman Sachs believe the size of the fall in Sterling must be far greater than that already experienced for this to come about.

Goldman Sachs research shows a decline in Sterling of between 20% and 40% from pre-Brexit levels was needed to bring the current account deficit back to sustainable levels.

This is a huge adjustment that would surely push inflation to levels that would shatter economic growth.

“At the end of Q4, balance of payments data showed a sizeable improvement in the UK current account which would imply that the correction towards a sustainable current account has already happened, but we highlighted that it is still too soon to assume this improvement will prove persistent,” says Silvia Ardagna at Goldman Sachs.

It looks as though the current account deficit is going to a millstone around Sterling’s neck for a while longer.