Euro to Resume Charge Higher Against the Pound say DNB Markets

The Euro to Pound Sterling exchange rate (EUR/GBP) is likely to resume its former climb argues a new analysis of the pair.

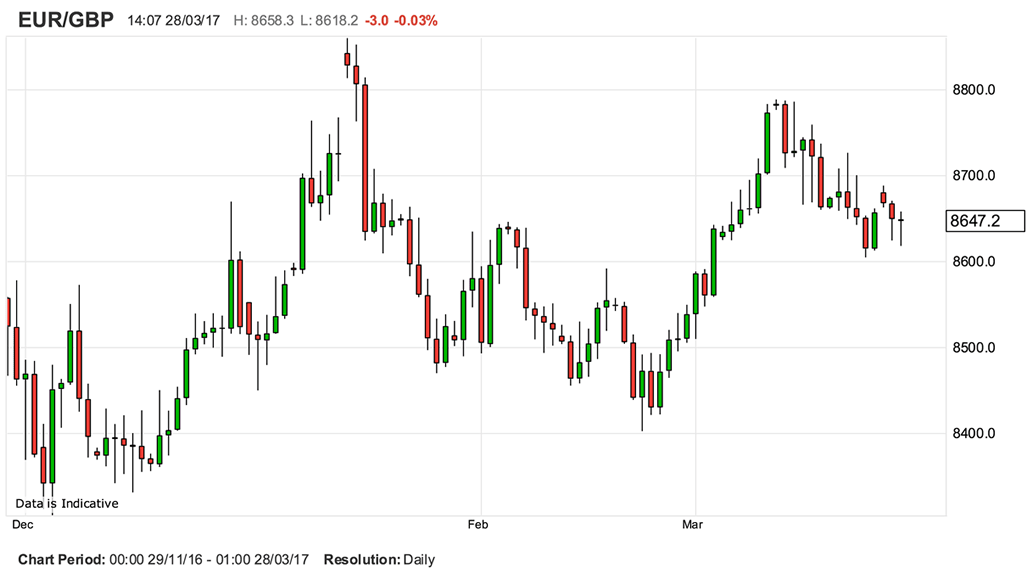

The call by Norway’s largest financial services institution - DNB Markets - comes at a time of losses for EUR/GBP which has dropped from a high of 0.8788 reached in mid-March down to 0.8650 recorded at the time of writing.

From a Pound into Euro perspective this equates to a rally from lows of 1.1380 to current levels at 1.1560.

The reasons for the Pound's rise are justified by a string of decent economic data releases of late; but whether they can influence the thinking at the Bank of England is the key point to consider when it comes to projecting the path of the Pound from here it is argued.

Above: EUR/GBP has faded after a strong start to March, but the move higher should resume we are told.

Strong Economic Performance, but the Bank to Stay Firm

A combination of strong UK inflation and retail sales data and recent communication from the Bank of England have all helped contribute to the British Pound’s outperformance against its cross-channel rival.

Retail sales rose more than expected, up 1.4% in February while CPI rose to the highest level since September 2013. (CPI up 0.5% to 2.3% y/y in February, and core CPI at 2.0% y/y.)

“CPI is now above BoE’s inflation target, pushed up by the depreciation of GBP,” says Magne Østnor, a foreign exchange specialist at DNB Markets.

But this does not suggest to Østnor that the Bank of England’s decision-makers are likely to hike interest rates.

In the latest Inflation Report BoE projected inflation to rise above the 2.05% in Q1 and 2.46% in Q2 and peak at 2.86% next year.

“We do not think the MPC will hike rates anytime soon,” says Østnor.

Therefore, at DNB Markets what matters are the trajectory of UK interest rates; this is not unusual as higher UK interest rates are likely to attract the foreign investor inflows required to push the value of the Pound higher.

Sterling has fallen steadily over recent months as the yield on UK debt (interest rates) have fallen as a result of action at the Bank of England.

Uncertainty over Brexit negotiations is expected by DNB Markets to prevail and this should in turn keep the Bank of England wary of raising interest rates over coming months.

Growth has been resilient to Brexit, but Østnor and his team believe it will slow due to increased uncertainty and negative trade effects.

“The Bank of England is clearly worried over the inflation overshoot, expect rates on hold next three years,” says Østnor. A three year hold is longer than most in the market are expecting and sets out DNB as being in that camp of Sterling bears.

And the UK's large current account deficit - which has resulted from the UK being a net importer of goods - has Østnor arguing foreigners will demand a premium by way of a weaker GBP to finance that deficit.

DNB Markets are forecasting the Euro to Pound rate to trade at 0.88, 0.89 and 0.92 in 1,3 and 12 months respectively.

From a Pound to Euro exchange rate perspective this equates to 1.1364, 1.1236 and 1.0867.