Analysts: GBP/EUR Exchange Rate to Remain Vulnerable

The GBP/EUR exchange rate has been bleeding lower over recent days and several market technicians are saying this is likely to continue.

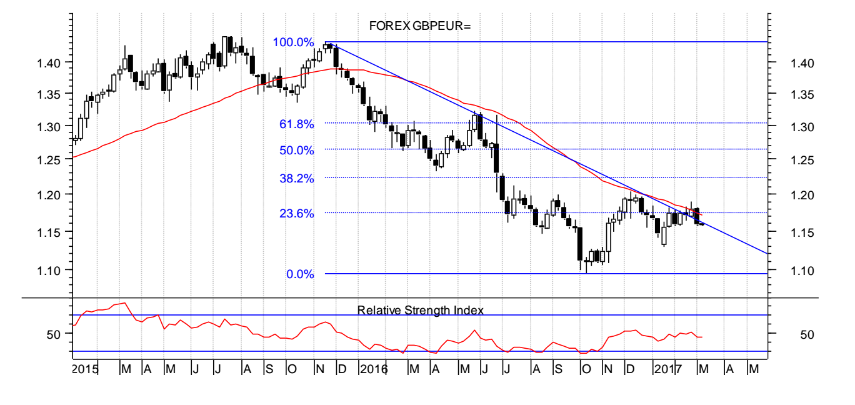

As we ourselves have noted, Pound to Euro has broken below a key trendline drawn from the October lows, producing a bearish signal for the pair.

But we are not the only ones who are bearish; London-based investment broker Charles Stanley’s technical analyst Bill McNamara is also anticipating the current bout of weakness to extend.

Rather than focus on the uptrend line from the October lows McNamara focuses instead on the exchange rates failed attempt to break above an even more important multi-year trendline hugging the downtrend:

“The week before last Sterling pushed up through its 15-month downtrend for the first time and traded as high as 1.19 before the sellers re-emerged,” says McNamara in a note to clients dated March 7.

This selling activity pushed the exchange rate back down below the trendline and started a deeper sell-off towards the 1.15s.

“Last week, however, the sell-off accelerated to the extent that the ‘break’ of resistance was negated and the 1.8% decline over the week as a whole strongly suggests that market participants are keen sellers when the UK currency gets anywhere near its December highs (at 1.195 or so). Further near-term weakness now looks likely,” concludes MacNamara.

Elsewhere, Associated Foreign Exchange (AFEX) were expecting the step progress of the pair higher from the early Jan lows to extend they changed their stance when the pair broke below the 1.1640/50 level.

“Any loss of 1.1640/50 secondary support would probably be sufficient to damage the recovery sequence from 1.1300 and provoke another examination of at least 1.1500,” said the report from technical analyst Lucy Lillicrap at AFEX, in a note seen by Pound Sterling Live dated March 16.

Indeed a break below the 1.1490/1.1500 level which is only 42/32 basis points below the current 1.1532 market level, would completely, “negate” the uptrend, “in favour of 1.1200/1.1050 instead.”