British GBP/EUR Exchange Rate: Next Target is Resistance @ 1.19

The Pound has made fresh advances on the Euro on Thursday January 26 thanks to some solid economic data out of the UK.

The ONS has reported that UK GDP grew by 0.6% in the final quarter of 2016 - ahead of analyst forecasts for growth of 0.5%.

This saw the UK economy grow by 2.2% in 2016, it also confirms that the economy grew at a faster pace in the six months following the EU referendum than it did in the six months preceeding the referendum.

The data leaves the Pound in bullish territory, but just how far can the gains extend?

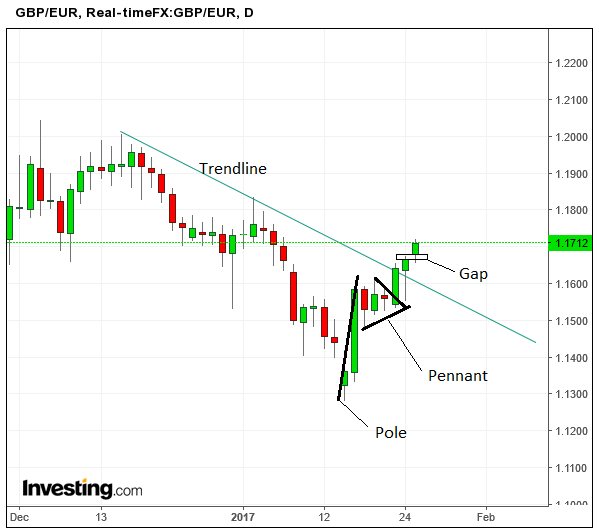

Our studies show the GBP/EUR rate has solidified its initial break above the downtrend line for the previous decline, by gapping higher this week.

The pair formed a pennant continuation pattern several days ago which suggested another break to the upside was looming - and indeed our call was right.

How High Can it Go?

Pennants are composed of a ‘pole’ which is a steep move higher, and the actual ‘pennant’ at the end of the pole, which is a triangular consolidation and resembles the pennants which flew from medieval castles.

If the market breaks higher out of the triangle it is expected to move the same distance as the height of the pole prior to the consolidation.

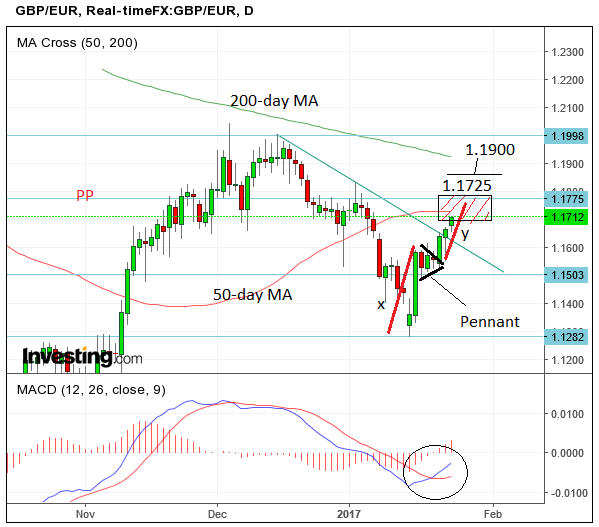

This is illustrated on the chart below in which the pole is labeled ‘x’ and the extension is labeled ‘y’.

In effect ‘x’ usually equals ‘y’ which suggests a target of around 1.1795.

The exchange rate may run into problems reaching that target, however, as there are two tough resistance levels standing in the way.

The first is the 50-Day MA at 1.1735 which is likely to provide an obstacle to more upside, and then there is the central pivot point at 1.1775.

Pivots often act as obstacles to price as traders use them to fade the trend.

The toughest level for the exchange rate to break above, however, is the 50-day MA at 1.1735, and our first target lies just below this level at 1.1725.

This has almost been reached at Wednesday’s 1.1723 highs.

We expect a continuation higher to 1.1795 eventually but for confirmation we would ideally want to see a break above 1.1800.

Such a move would likely continue higher to a target at 1.1900 just below the 200-day MA.