GBP/EUR Forecast: Further to Fall and then Recover on Remain Win

- Written by: Gary Howes

There is a good chance sterling will continue falling over coming days but, the further it falls, the greater the recovery that is forecast on the assumption Remain will win the vote.

“The market is currently too complacent about the UK’s EU referendum and we believe that the British pound (GBP) and UK/European equity markets will trade on the weak side over coming weeks.” - Danske Bank.

Dropping nearly 1% against the dollar and the euro at the start of the new week the UK currency is confirmed to be a slave to the ups and downs in opinion ahead of the EU referendum.

There are now less than three weeks to the UK’s EU referendum and we have seen those with impending sterling into euro payments drudging levels as low as 1.2258 on their bank account's international payment offer.

Independent's are offering up to 1.2589 though, but here too, we see risks skewed to the downside.

The most recent downward movement was sparked by a series of polls over the weekend and on Monday that has shifted the net outcome of the poll-of-polls to 51% in favour of leaving and 49% in favour of staying.

Immigration has once again come into focus, reintroducing a wave of uncertainty that appeared to have been put to bed in light of the 13-point lead Vote Remain had around a fortnight ago

While we and the majority of analysts we follow believe that it is slightly more likely that the UK will vote to remain in the EU, there remains an element of uncertainty.

It’s not necessarily that the British pound hates the idea of Brexit, rather, at present, it hates the uncertainty inherent in a tightly-fought campaign.

Since early April, the market moved very far in pricing out Brexit risks in spot FX and equity markets allowing the pound and other financial assets to recover the ground they lost at the start of the year.

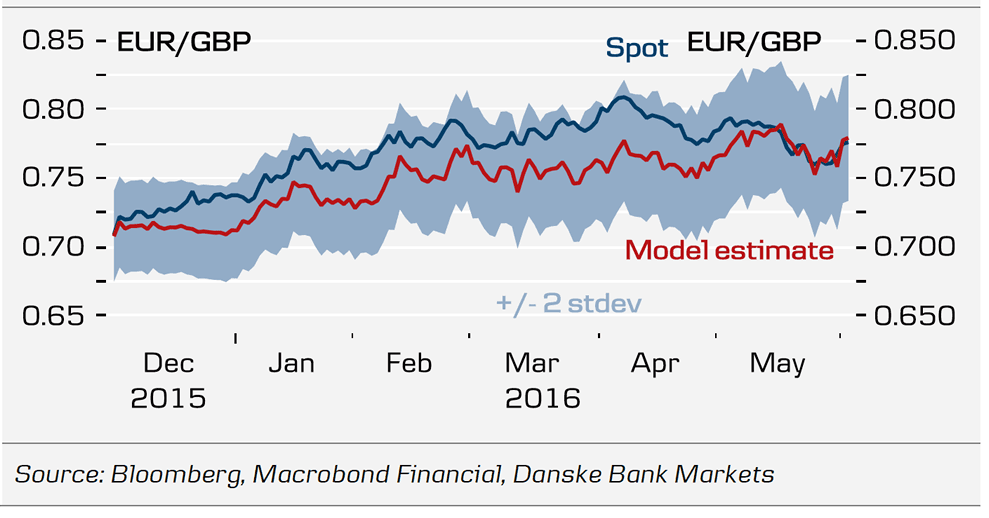

According to Danske Bank’s Brexit risk-premium estimates, 1.25pp is currently priced in the EUR/GBP spot rate.

“The polls are still very close and we believe they will remain close right up until the referendum day on 23 June,” say Danske in a foreign exchange note briefing, “as such, the market is currently too complacent about the UK’s EU referendum and we believe that the British pound (GBP) and UK/European equity markets will trade on the weak side over coming weeks.”

Notably, derivatives in various product areas are pricing in a substantial risk of a Brexit, suggesting that these are where market players have hedged GBP risks. We reported last week that the futures markets were almost in a state of turmoil owing to the massive hedging actions underway by corporates.

The ongoing negative price action across the pound exchange rate complex underlines that polls will probably remain the key driver for GBP going into the referendum on 23 June and as the referendum is moving closer analysts expect Brexit concerns to build up further as long as the polls continue to indicate a close race between the remain and leave camps.

Hence, “we still see risks skewed to the upside for EUR/GBP and expect volatility to increase as the Election Day approaches,” says Danske.

According to Danske’s Brexit risk premium estimates, 1.25pp is currently priced in the EUR/GBP spot rate (two std dev. confidence interval of 0 to +2.5pp). This implies that EUR/GBP is likely to trade at 0.7550-0.7780 post the election in the event of a remain vote.

Turning the equation around to GBP into EUR, this implies the exchange rate is likely to trade up to 1.3245-1.2853 in the event of a remain vote.

Prefer to be Short on the GBP/EUR

There is still more than enough margin for error in the Brexit opinion polls to leave plenty of doubt for FX traders to thrive on.

“I would not be at all surprised to see a 1.37/1.47 or 1.40/1.50 type range in the cable over the next few weeks. It won’t be about being right or wrong, but will be all about getting the market timing and position sizing absolutely perfect. In the very short-term. we should see support/resistance levels emerge at 1.4385/1.4585,” says Sean Lee at Forextell.

Pressed on what position to take on sterling, Lee says if he had to have a medium-term position, he’d prefer to be long EUR/GBP but, “I’m going to avoid the GBP unless I get some 90% trade set-ups.”

The medium-term trend on the euro to pound sterling exchange rate is described as being ‘bear volatile’ - “we have moved into volatile territory so best to wait. Moves are likely to be dictated by Brexit surveys/comments in the coming week,” says Lee.

Latest Polls Deliver a Knife-Edge

Plenty of volatility in the British pound on offer in the London morning session.

“Dropping nearly 1% against the dollar and the euro the currency is continuing to feel the ragged toing and froing of the duelling EU referendum campaigns. The most recent downward movement was sparked by a series of polls over the weekend that suggest the Brexiters have gained ground as immigration has come into focus, reintroducing a wave of uncertainty that appeared to have been put to bed in light of the 13-point lead Vote Remain had around a fortnight ago,” says Connor Campbell of Spreadex.

A YouGov online poll of 3,495 people for ITV's Good Morning Britain showed 45 percent would opt to leave the EU while 41 percent would opt to stay while 11 percent of voters were undecided.

A TNS online poll of 1,213 people showed 43 percent would vote to leave, 41 percent would vote to stay and 16 percent were undecided.

Over the weekend the latest Opinium poll showed 43% now want to Leave as opposed to the 40% who want the UK to stay in Europe.

For the first time since May 12 the Leave campaign has broken ahead of the Remain campaign according to the latest poll-of-polls data.