GBP/EUR Exchange Rate: Prospect of 1.43 Remains Alive

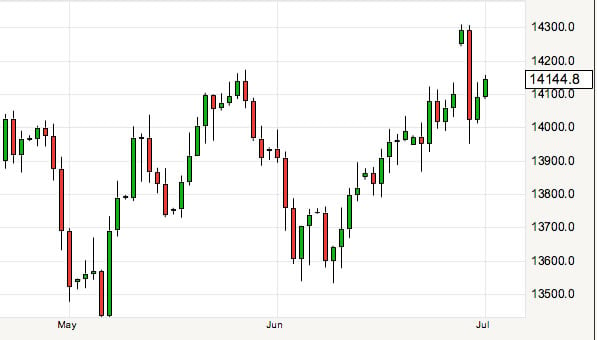

As long as the key support zone of 1.40 remains unbroken we favour further advances.

The British pound has endured volatile trade over recent days - the records seen at 1.43 agains the euro seen early on Monday were unfortunately missed by most of those looking for a higher exchange rate to execute international payments owing to the fleeting nature of the move.

The subsequent fall to a low of 1.3950 was eye-opening to say the least - but as Jaisal Pastakia wrote - the euro is a remarkably resilient currency and can easily frustrate those hoping for a fall.

If we have learnt one thing it is that the Greek crisis is not likely to be the foreign exchange driver many assume. Rather the same, arguably less spectacular, drivers apply - yield on German government bonds, ECB policy, US Fed policy and of course economic data releases.

There are also technical considerations that we believe will play a role in dictating the outlook.

For now we are happy to call the support zone at 1.40 the single most important level determining the outlook for pound to euro exchange rate levels:

Should support hold, and UK data releases be decent over coming days the prospect of 1.43 being reached again remains attractive. That said we would suggest expectations are kept in check as there are some other significant hurdles that will thwart buying pressure. We saw in May that holding ground above 1.4150 proved an extremely challenging prospect.

We would suggest that the move higher will be slow and arduous with pullbacks being regular.

Those looking to execute payments at or above these levels should ensure their FX provider has placed the necessary buy orders to trigger when these levels are reached.

Remember though that all currency is provided with a margin subtracted meaning watching 1.43 being hit on a graph does not necessarily it has been reached on the retail markets. That is why looking for tight spreads is essential.

Boost for Sterling as UK Growth Revised Higher

The pound sterling returned to winning ways against the euro on Tuesday the 30th of June when it was reported that the UK economy has grown faster than previously estimated in the first three months of the 2015.

The Office for National Statistics said the economy grew by 0.4% in the quarter, compared with an earlier estimate of 0.3%.

Growth was boosted by a better performance from the construction industry than previously estimated.

Annual growth to March was also revised up to 2.9% from 2.5% previously.

The outperformance of the British pound will continue to rely on strong data releases - the pre-requisite for the Bank of England to deliver its first interest rate rise of the upcoming cycle of increases.