British Pound Steadies Ahead of the Weekend

- Written by: Gary Howes

Image © Adobe Images

The British Pound firms ahead of the weekend amidst a settling in UK bond yields.

Stabilisation in UK government bonds and the currency come after Chancellor Rachel Reeves addressed recent market volatility and said the government has sufficient "headroom" to deliver on its spending plans without triggering a deterioration of the UK fiscal metrics.

She said the government will put in place safeguards to help convince investors it won't spend its borrowing binge on day-to-day costs.

"Given all that, we think that the government should ultimately succeed in appeasing the gilt vigilantes. That being said, if sustained, the spike of sovereign credit risks could damage the GBP investment appeal across the board," says Valentin Marinov, Head of FX Strategy at Crédit Agricole.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Gilt markets seem to have largely stabilised this morning after yesterday's post-budget sell-off," says a note from TD Securities.

Despite some stabilisation, the hit to Pound Sterling is significant, and it looks set to record its single biggest weekly loss against the Euro since January 2023.

The Pound to Euro exchange rate remains below the key 1.19 marker after UK government bonds fell sharply following Wednesday's budget that saw Reeves announce £142BN in additional borrowing over the remainder of the current government's term.

"Unhealthy price action for sterling," the Pound has weakened despite a net hawkish repricing of the BoE over the next 15 months, notes Deutsche Bank.

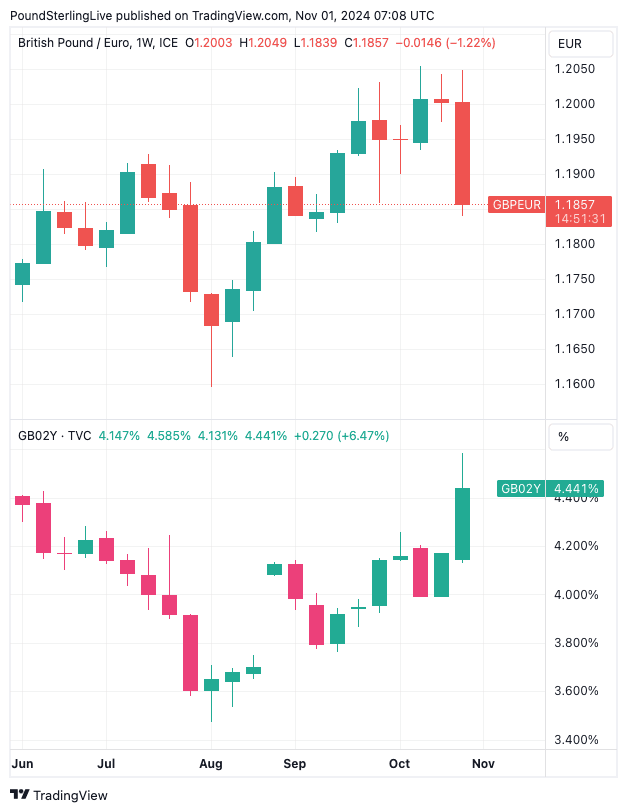

Above: GBP/EUR and UK 2-year government bonds. Note the breakdown in correlation this week.

Expectations for back-to-back interest rate cuts from the Bank of England have faded on the prospect of a 'sugar rush' of spending due in the coming months, which would boost inflation, meaning the Bank would need to maintain a tight monetary policy stance.

This prompted investors to sell UK government bonds, which pushed higher the interest rate they yield.

Usually, such an increase in returns offered by bonds attracts foreign investment that would, in turn, support the Pound. However, the relationship between the Pound and bond yields has broken down since Wednesday in a clear sign international investors are increasingly queasy about the prospect of the UK government's plans.

"It's still early days, but the immediate price action following the conclusion of the Chancellor's budget has not been favourable for our constructive bias on sterling," says Shreyas Gopal, Strategist at Barclays.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Pound Sterling came under notable pressure in the Thursday session amidst a fresh selloff in UK bonds and some market analysts drew comparisons with the aborted 'mini budget' of Liz Truss in 2022.

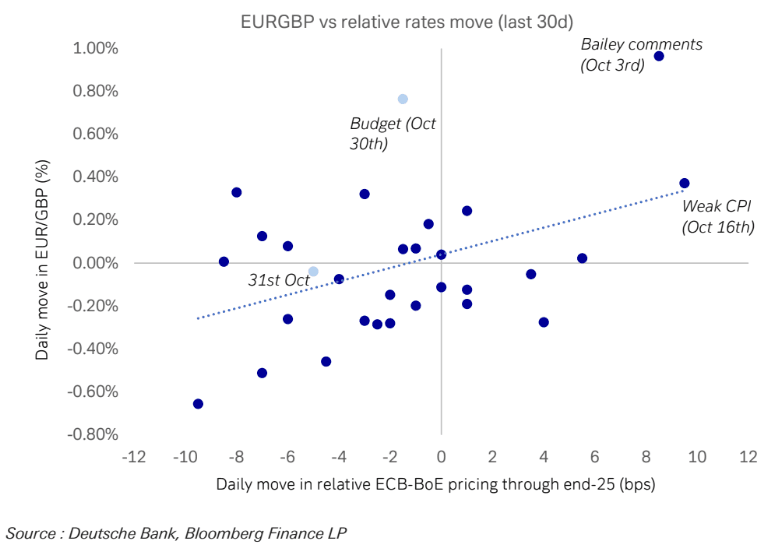

Gopal says that the market is now pricing fewer than 100 bps of cuts from the Bank of England between now and the end of next year, opening a gap in policy rates with the (European Central Bank) ECB of nearly two percentage points.

"This ought to be a positive signal for the pound, but EUR/GBP is higher than it was before the budget," he says.

The Euro-Pound exchange rate is up 1.24% this week and is quoted at 0.8432, giving a Pound-Euro exchange rate of 1.1858, representing the lowest level for euro buyers since September.

Above: "Unhealthy price action for sterling" the Pound has weakened despite a net hawkish repricing of the BoE over the next 15 months notes Deutsche Bank.

The Problem

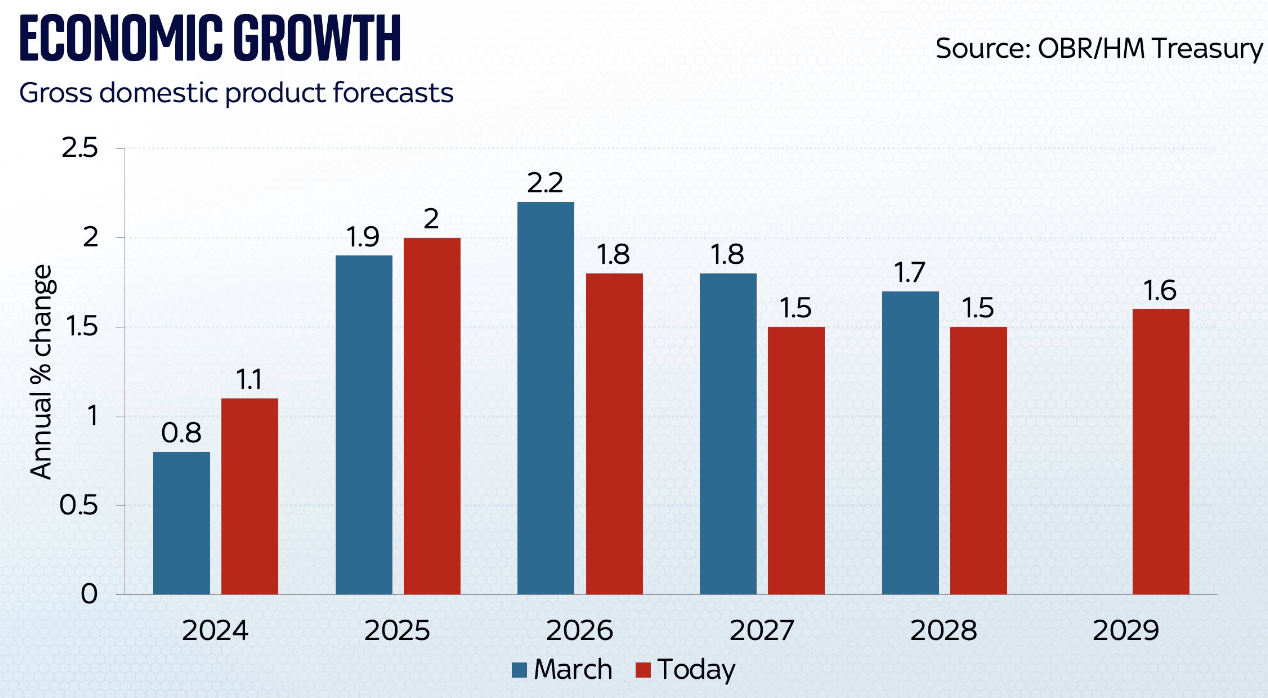

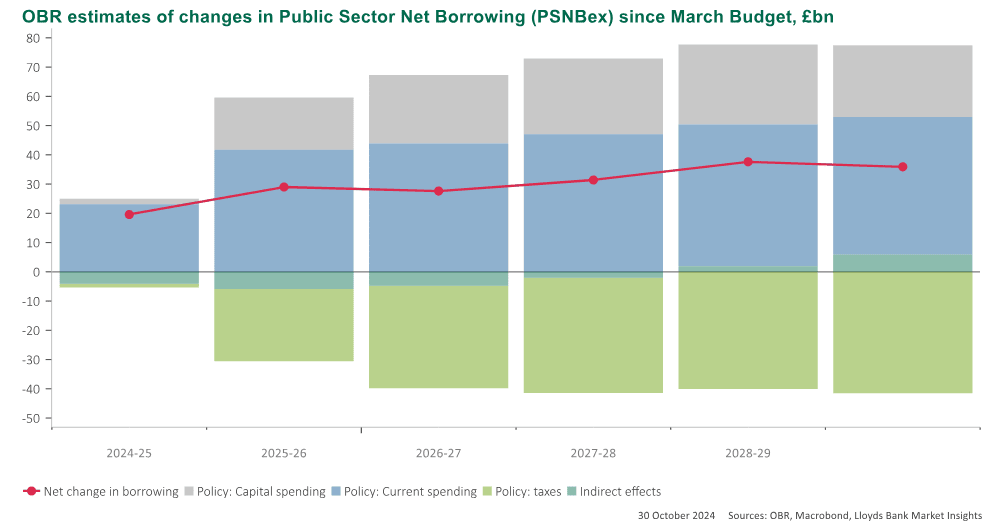

New projections from the independent Office for Budget Responsibility show the UK economy will actually experience weaker growth levels in the coming years than had been previously forecast.

This is despite a planned spending increase of £70BN per year over the next five years.

The spending will be funded by approximately £40BN of tax hikes aimed largely at businesses and £142BN in additional borrowing over the next five years.

Above: Higher borrowing meets growth downgrades (below).

Spending and borrowing up and growth down represents incredibly poor returns for UK taxpayers and international investors are left wondering how sustainable the government's finances will prove.

"When the numbers were seen in plain view, UK markets reacted nervously. Having initially fallen, 10-year gilt yields jumped by as much as 20bps at one stage while sterling sold off," says Philip Shaw, an economist at Investec.

The selloff in bonds draws immediate comparisons to the Liz Truss 'mini-budget' of 2022 that cratered the Pound as investors baulked at Truss' plans to slash taxes and increase spending.

"Sterling cowers from the bond vigilantes," says Kathleen Brooks, research director at XTB. "The pound is also under pressure. GBP/USD has reversed earlier gains, and is below $1.2920 at the time of writing, suggesting that it is also cowering from the bond vigilantes."

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Bank of England the Next Focal Point for Sterling

Looking ahead, Brooks says there will need to be some damage control, and we would not be surprised if some measures are rolled back on. "The new government now know the limit of the bond market to its spending plans."

"The stakes are now also higher for next week's Bank of England meeting, at least from a currency perspective," says Gopal.

"The MPC sticking to its more cautious messaging on cuts from the last meeting should then see sterling catchup to the signal from rates, and recover some of its lost ground over the past 24 hours," he adds.

Anna Titareva, an economist at UBS, says the November cut will be followed by a pause in December. "On the one hand, a more pronounced moderation in headline and, importantly, services inflation, could justify a faster pace of rate cuts (i.e. cutting in December). On the other hand, some of the progress seen in the data could be offset by the inflationary impact of the Budget."