Pound Sterling Under Intensifying Pressure

- Written by: Gary Howes

Image © Adobe Images

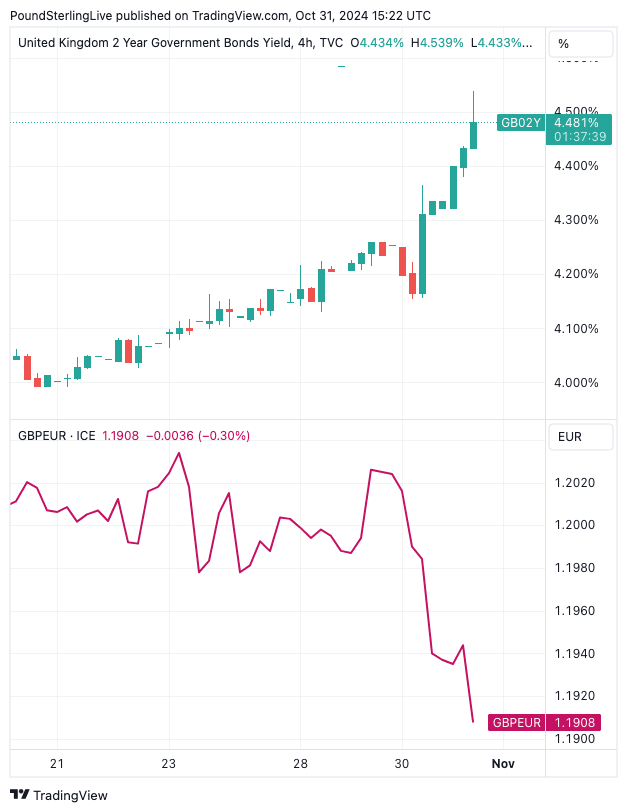

Investors are dumping UK bonds and the British Pound in a sign of renewed unease over the Labour Government's spending and taxation splurge.

We are seeing flashbacks to Liz Truss's ill-fated and abandoned 2022 mini-budget, which ultimately brought her administration down.

"Sterling drops to a two-month low as post-Budget gilt selloff intensifies," says Kyle Chapman, FX Market Analyst at Ballinger Group. "Bond investors are continuing to dump gilts this afternoon after Reeves’ borrowing plans proved to be higher than expected."

The Pound to Euro exchange rate has seen a fresh downside impetus in Thursday afternoon trade, dipping below 1.19 to hit 1.1868. The Pound to Dollar exchange rate has fallen half a per cent to 1.2897.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Investors are dumping UK government bonds, fearing that the UK's debt sustainability is less assured now that the government intends to borrow at least an additional £124BN over the next five years.

"There is a sense of panic around this budget, which is akin to the Liz Truss budget," says Kathleen Brooks, research director at XTB.

Unfortunately for Chancellor Rachel Reeves, her spending binge came alongside the Office for Budget Responsibility's growth forecast that downgraded UK economic growth from 2026 onwards.

Above: It's never a good sign when the pound (top) and bond yields move in opposite directions.

The market would have liked to see the spending deliver higher growth, which would underpin the new debt issuance and limit the risk of holding UK debt. Instead, they got a batch of growth downgrades that made UK bonds riskier and poor value to international investors for money at existing levels.

Chapman says the developments are "rapidly generating a sterling risk premium. Alongside a jump in gilt yields, the pound immediately swung 0.6% to the downside."

"GBP/USD is moving in the opposite direction to its interest rate differential thanks to a ‘bad’ rise in yields, owing to what the market now appears to have concluded are overextended borrowing and spending plans in the budget," he explains.

"Sterling cowers from the bond vigilantes," says Brooks. "The pound is also under pressure. GBP/USD has reversed earlier gains, and is below $1.2920 at the time of writing, suggesting that it is also cowering from the bond vigilantes."

Brooks thinks there is a decent chance Reeves is forced to rethink her plans.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Chapman says yields have risen over the past couple of days in response to the increased bond supply, but the move has intensified over the course of this afternoon.

"The volatility in the gilt market has been extraordinary, with the 10-year yield up 30bps in the past 24 hours alone," he explains.

Reeves said on Wednesday the government would increase spending by about £70BN per year over the next five years.

At least £142BN in additional borrowing would be required over the next five-year period to meet this agenda, while a significant £40BN increase in taxes was also announced.

Reeves justified the spending by saying it would underpin growth; after all she has attempted to frame this as a "growth budget".

But, the OBR begs to differ. The watchdog's growth forecasts show the economy will grow by 1.1% in 2024 and 2.0% in 2025, but from here, it is downhill. The forecast for 2026 is 1.8% in 2026, 1.5% for 2027, 1.5% for 2028 and 1.6% for 2029.

This represents a 0.3 ppt upgrade for 2024 and a 0.1 ppt upgrade for 202. It's a downgrade of 0.4 ppt in 2026, 0.3 ppt in 2027 and 0.2 ppt in 2028.

"When the numbers were seen in plain view, UK markets reacted nervously. Having initially fallen, 10-year gilt yields jumped by as much as 20bps at one stage while sterling sold off," says Philip Shaw, an economist at Investec.