EUR-GBP Falls Despite UK Economic Growth Disappointment

The British pound exchange rate complex suffered a setback on the release of the latest set of growth figures out of the UK.

The pound to euro exchange rate (GBP-EUR) slumped a quarter of a percent after it was shown UK GDP grew 0.3% on quarterly basis to March.

Analysts had priced the GBP-EUR higher on expectations that a reading of 0.5% would be delivered.

However, losses proved short-lived against the euro with markets tending to focus on broader themes - the UK economy ultimately continues to eclipse its Eurozone counterparts.

The conversion rate is seen at 1.3988 while the euro to pound sterling rate is at 0.7150.

Above: EUR-GBP reaction to GDP data. The move proved shortlived.

As we can see from the above representations, currency markets were primed to sell Sterling on any disappointments which did indeed come to pass.

"In the long-term, prices are in an underlying declining trend. However, the potential successful test of the key support at 0.7089 and the general oversold conditions suggest a limited medium-term downside potential," says Luc Luyet from Swissquote Bank.

Please note. All currency quotes mentioned above refer to the wholesale market. Your bank will affix a discretionary spread when transferring money internationally. However, an independent provider will seek to undercut your bank's offer, thereby delivering up to 5% more currency in some instances. Please learn more.

GDP Data Lower than Expected

It was shown GDP increased by 0.3% in the first quarter of 2015.

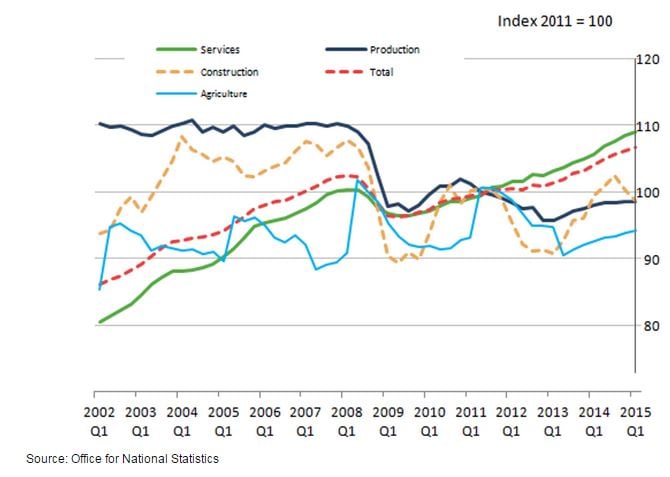

The largest contribution to the increase came from the services sector, which increased by 0.5%.

The increase in GDP followed growth of 0.6% in Quarter 4 (Oct to Dec) 2014.

In the latest quarter output increased in services by 0.5% while the other 3 main industrial groupings within the economy decreased with construction falling by 1.6%, production by 0.1% and agriculture by 0.2%.

GDP was 2.4% higher in Quarter 1 (Jan to Mar) 2015 compared with the same quarter a year ago.

This remains a strong figure and the UK economy should continue to outperform its main Eurozone rivals through 2015.

As such we maintain a bullish outlook for the pound to euro exchange rate.

However, expect some temporary weakness owing to the figure missing market expectations.

We would suggest this offers a good opportunity for those holding euros to buy sterling.

The Bottom Line: More Sideways Trading Ahead

The strong rally in the GBP complex that brought us into 2015 is now over and sideways movement appears to be the dominant trend concerning the immediate outlook.

EUR/GBP has been locked in a sideways range in the 0.7150/0.7400 area.

“The negative impact of the election uncertainty on sterling eased of late. Last week sterling broke temporary out of the established ST range (0.7150 area) on positive BoE minutes. This test is still ongoing,” says Piet Lammens at KBC Markets.

Sentiment on sterling is fairly constructive, but we and many in the market maintain the view that further sustained sterling gains will be difficult ahead of the elections.

The longer-term picture does however remain skewed in favour of sterling with the euro ultimately likely to be undermined by the massive quantitative easing programme announced at the start of the year by the European Central Bank.

The increased supply of currency should drive the price of the euro (exchange rate) lower in a classical supply and demand dynamic.

That said, we take notice of the views at HiFX where analyst Andy Scott suggests even in the longer-term gains will be capped:

"Against the euro, we feel sterling is going to struggle to move significantly above the recent highs of 1.4200, as we feel the euro is undervalued here. We also believe that the ECB’s Q.E. programme will continue to assist the Eurozone economies to recover and cause money to flow back towards the single currency.”

These views reflect the opinion of Lloyds Bank who, in their latest euro forecast note that the worst could now be behind the shared currency.

However, consider that the longer-term range for the pound v euro lies above 1.40 and below 1.50. Thus, it could be wise to adop the view that while there are gains to come they will likely be more gradual in coming.