Euro Underperforms on German Inflation Undershoot

- Written by: Gary Howes

Euro exchange rates were under pressure after soft German inflation figures softened expectations for the outcome of Tuesday's all-Eurozone inflation release.

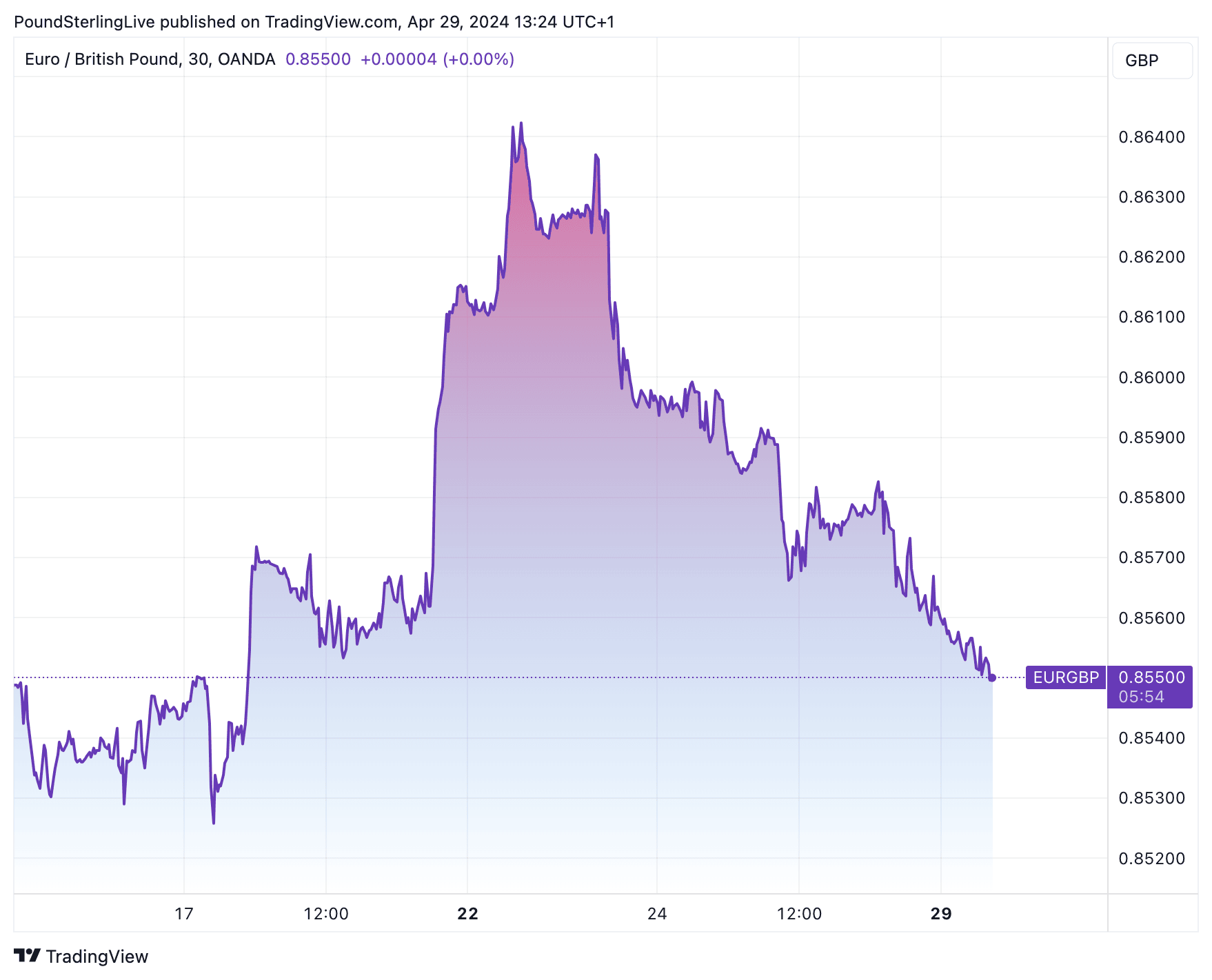

The Euro to Pound Sterling exchange rate edged lower to 0.8550 (pounds into euros = 1.17) after Germany's CPI inflation print printed at 2.2% year-on-year in April, which was unchanged on March but underwhelmed expectations for an increase to 2.3%.

The monthly rise stood at 0.5% said Destatis, which was below the 0.6% anticipated by the market consensus.

"So far the data looks to be confirming a June cut," says Noah Buffam, an analyst at CIBC Capital Markets. "EUR/GBP is now back to its 0.85-0.86 range which has persisted for much of 2024."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Released earlier in the day, Spanish CPI inflation read at 3.3% y/y in April, below the 3.4% the market expected. Core inflation read at 2.9%, this was notably lower than expectations at 3.2%.

Spain's inflation print is closely watched as economists say the passthrough of inflation is faster in Spain than elsewhere, meaning it can signal upcoming trends for the wider region.

"EUR is lower on most G10 crosses overnight as the flash estimate of Spanish HICP came in below expectations," says Buffman.

The ECB has long signalled it is prepared to cut interest rates in June, and based on these inflation data, there is little reason for the central bank to disrupt markets by disappointingw with another decision to hold interest rates.

What will matter greatly for Euro exchange rates is whether the central bank delivers a follow-up July cut.

We would anticipate the single currency to weaken if this idea gathers traction. Should the disinflation process continue, a July cut can be increasingly viewed as likely.

Next up is the French and Eurozone inflation prints due Tuesday.