Euro Bolstered by Inflation Surprise

- Written by: Gary Howes

Image © Adobe Stock

Euro exchange rates were broadly firmer following the release of data that showed Eurozone inflation surprised to the upside in February.

GBP/EUR extended its one-week loss to 1.1686 after Eurostat reported headline CPIH inflation hit 3.1% year-on-year in February, overshooting an expectation for a fall to 2.9% from February's 3.3%. The EUR/USD extended its recovery from a midweek dip to 1.0818.

"The euro received a double boost on Friday from upward revisions to the February manufacturing PMIs as well as hotter-than-expected Eurozone flash inflation figures," says Raffi Boyadjian, Lead Investment Analyst at XM.com/

The Eurozone's manufacturing PMI was revised up from 46.1 to 46.5, indicating a lesser contraction than previously thought.

"More importantly, inflation across the bloc fell less than expected in February," says Boyadjian. "An underlying measure of CPI also came in above expectations, denting hopes of an early rate cut."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Core inflation rose 0.7% month-on-month in February, marking a significant pick-up on January's -0.9%. The year-on-year measure for core inflation fell from 3.3% to 3.1%.

The ECB meets next week for its March policy meeting and may refrain from signalling a rate cut soon following these CPI data.

The reaction by Euro exchange rates to the Eurozone inflation figures could have been greater were it not for the release of country-level figures a day earlier that hinted that an upside surprise was coming.

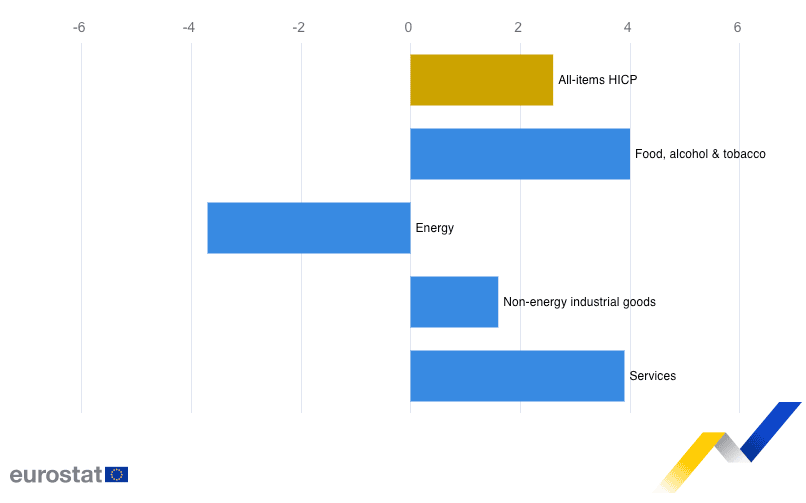

Above: Services inflation is expected to remain a persistent contributor to above-target inflation.

In particular, Spain's national figures printed at hotter-than-expected levels, which is significant as Spain is considered a leading indicator for Eurozone inflation dynamics as the pass-through of price developments tends to be faster.

Dr. Thomas Gitzel, Chief Economist at VP Bank in Liechtenstein, says the Eurozone's inflation trend is currently at a critical stage.

The decline in the inflation rate reported in February is mainly due to base effects. Energy prices were still very high in the same month last year and they fell by 3.7% compared to the same month last year.

"However, the actual inflation dynamics can be seen much better from the monthly comparison. And things look far less favourable there. Compared to January, prices have risen by 0.6%, which is a very high number," says Gitzel.

With regard to core inflation, Gitzel says the critical phase has now started, as price increases in the services sector are still high. In February, it was still 3.9% higher than in the previous year. In a direct monthly comparison, inflation was even a high 0.8%.

"Wages are rising significantly in the service sector. The risk of second-round effects has therefore not yet been averted. This is precisely why the ECB will not be celebrating the latest drop in the inflation rate. Instead, it is likely to continue to monitor wage trends carefully and not lower interest rates for the time being. We expect the first interest rate cut in June," says Gitzel.