Sterling vs Euro Volatility Could Rise 156% on Hung Parliament

Image (C) Pound Sterling Live 2015.

The British pound exchange rate complex (GBP) is forecast to come under increased levels of volatility as the United Kingdom goes to the polls in 2015.

The prospect of political risk will ensure those looking to make a sterling euro exchange in coming months will need to be on their toes with the value of transactions likely to vary significantly over relatively short periods of time.

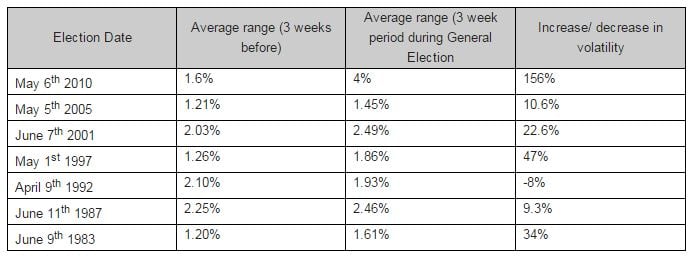

New research released by currency brokerage HiFX shows that, “the rate of sterling vs euro has, on average, increased in volatility by 40% over the last seven General Elections.”

Volatility reached a record high in 2010 when coalition government was elected, soaring to 156%:

Faced with the prospect of heightened volatility those with pound to euro exchange rate requirements are being urged to lock-in the current strong levels seen in sterling to avoid the emotional roller-coaster that volatile currency markets present.

Why is GBPEUR in for a Wild Ride?

The HiFX analysis examines the three week period leading up to each General Election since 1983 (‘83,’87,’92,’97,’01,’05,’10), and compares the rate of the sterling against the euro for the same time period over the election, to determine how the rates fluctuate.

HiFX say General Elections are event risks and their outcomes can have dramatic repercussions on the FX environment in the weeks and months that follow.

For example, in 2010, the formation of a coalition government led to a climate of uncertainty, and a huge 156% increase in volatility. This increase led to the rate of the sterling against the US dollar increasing from 1.4475 to a high of 1.5420.

Similarly, following the 1997 General Election, the Bank of England was granted independence to make monetary policy decisions.

During the lead up to the election, the rate of the sterling against the euro was steady at 1.26% but soared to 1.86%; a direct result of the election’s outcome. In contrast, over the 2005 election, volatility was below average at 10.6% when it was a labour-to-labour result.

Commenting further on the impact to foreign exchange markets, Mark Bodega, director at HiFX says:

“General Elections undoubtedly cause uncertainty. They are a risk event and so create volatility in the currency markets. As we’ve seen in every election since 1983, levels of volatility for sterling can reach up to 156% - however the level of volatility is dependent on the environment during the election, and a direct outcome of the election’s result, as reflected in the low levels seen in 2005’s labour-to-labour election.

“This year’s General Election is one of the most open many of us will have seen in our lifetimes. For the short to medium time, we expect the rate of sterling against euro to remain steady at around 1.37. However, considering how unpredictable this General Election is panning out to be, it’s highly likely that volatility could exceed the average 40%. We would recommend that those looking to transfer money for their summer holidays or are investing abroad, look to do their transfers before the election. There’s no telling where sterling may sit in the immediate weeks following the election.”

The British pound exchange rate complex (GBP) is forecast to come under increased levels of volatility as the United Kingdom goes to the polls in 2015