German and French Inflation Trend Lower

- Written by: Gary Howes

Image © Alfred Yaghobzadeh, European Commission Audiovisual Services

Fresh from its post-ECB drubbing, the Euro now faces a string of European inflation releases that could well determine whether another interest rate hike in September is likely.

The ECB said on Thursday it was no longer on a preset path to higher interest rates, instead preferring to base future decisions on the shape of incoming data.

Most important will be Eurozone inflation for July, due for release next Monday. But the market will have a pretty strong idea of how Monday's release will fall as Germany, Spain and France will release inflation figures on Friday.

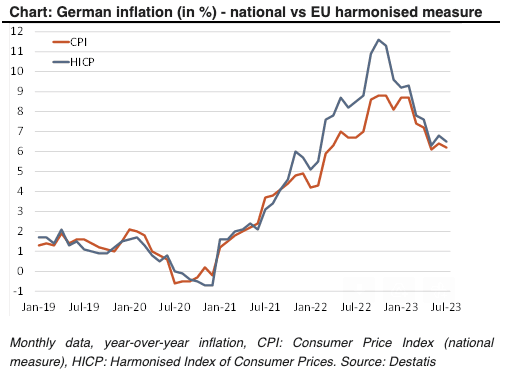

Germany reported headline inflation of 6.2% year-on-year in July, which was in line with consensus and lower than June's reading of 6.4%. This was after an unchanged 0.3% increase month-on-month, which was in line with consensus expectations.

"German inflation returned to its downward trend in July. This bodes well for the Eurozone inflation release due Monday. If sustained in August, the downtrend could strengthen the case of the doves at the ECB who would like to keep rates on hold in September," says Salomon Fiedler, an economist at Berenberg Bank.

France earlier released data showing inflation was flat month-on-month in July, undershooting expectations for growth of 0.2%, which would have been unchanged on June's reading.

French CPI read 4.3% y/y in July, in line with expectations and just below June's 4.5%.

Spain surprised to the upside with a m/m reading of 0.1%, which was in excess of the -0.4% the market was looking for, albeit well down on June's 0.6%. The y/y reading was at 2.3%, which was above the expected 1.6% and up on June's 1.9%.

Some economists reckon Spain has the fastest transmission of price rises of the major Eurozone economies and is therefore a forebear of inflation dynamics elsewhere.

This data is consistent with inflation that is trending lower and this will potentially bolster expectations that the ECB will not raise interest rates in September.

In response, the Euro trended lower against the Pound through the course of the day but has recovered a small portion of the large loss experienced against the Dollar yesterday.