GBP/EUR Rate Steadies Above 1.1550 as Eurozone's Economic Slowdown Invites ECB Caution

- Written by: Gary Howes

Image © Adobe Images

The Pound to Euro exchange rate cemented itself above 1.15 following the release of survey data showing a sharp slowdown in Eurozone economic activity in July, underscoring the potential for a 'dovish' European Central Bank guidance on Thursday.

The ECB forms the focus of this week's calendar lineup with another 25 basis point rate hike expected, although the latest S&P Global PMI data would suggest enough by way of hikes has already been delivered.

The headline Composite PMI read at 48.9, a sub-50 figure that suggests the region's economy has fallen into contraction, whereas the market was expecting a softening to 49.7 from June's 49.9.

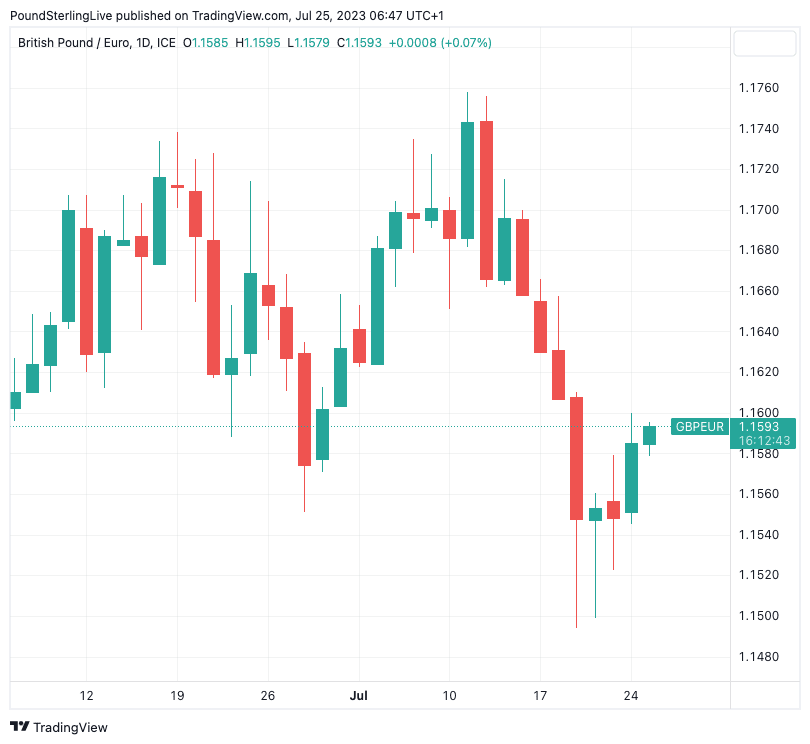

The Pound-Euro rate rose a third of a per cent on the day of the PMI's release and closed at 1.1589, levels that hold at the time of writing on Tuesday.

The pair had probed sub-1.1550 levels on four successive days but in a blow to the bears failed to close below here, in turn hinting that the July selloff might already be running out of steam.

The move higher in Pound-Euro comes amidst a further retreat in the headline Euro-Dollar rate to 1.1073 from last week's high at 1.1278. "The Fed and ECB central bank meetings are obviously the highlights of the week, but yesterday’s Eurozone PMIs already caused some movement on the market. They were weaker than expected, putting downside pressure on EUR," says You-Na Park-Heger, an analyst at Commerzbank.

S&P Global said the slowdown in future output expectations and new order inflows reported by businesses in the latest survey "point to the likelihood of the downturn deepening in coming months".

Hiring was down as were price pressures, suggesting the ECB can expect further declines in inflation over the coming months without the need for further interest rate hikes. Last week a number of prominent ECB Governing Council members said that although a July hike was a certainty, the outcome of September's meeting was less clear.

"This Thursday, the European Central Bank (ECB) will almost certainly raise its policy rates by another 25bp. However, the outlook beyond that is far less clear. We see a 60% probability that the ECB will hike again by a final 25bp on 14 September," says Salomon Fiedler, an economist at Berenberg Bank.

Above: GBPEUR at daily intervals showing support emerging in the 1.1550 region.

"However, softer data such as the drop in the Eurozone composite PMI indicate a rising chance that the central bank will stay put in September already. Like many other central banks, the ECB is now approaching the end of its rate hike cycle," he adds.

Euro exchange rates have been boosted in 2023 by a string of ECB interest rate rises that have been accompanied by guidance that further rate hikes are needed.

This has improved the attractiveness of Eurozone bonds with domestic and international investors, creating currency flows that have supported the Euro.

But with a peak in the ECB's rate hiking cycle now clearly materialising, further upside support via the interest rate channel might soon fade.

If the ECB turns more 'dovish' on Thursday the Pound-Euro can extend higher and recover much of July's losses, however, should Frankfurt display a heightened vigilance to inflation and guide to a further hike in September, then the Euro can recover.

"Room for EUR to weaken further," says Quek Ser Leang, Markets Strategist at UOB Bank. "While the sharp and swift drop appears to be a tad overdone, the weakness in EUR has not stabilised."

Of particular concern for the Eurozone was the further decline in German manufacturing, where the PMI for July slumped to 38.8 from 40.6 previously and signalled the engine of Europe's economy is undergoing a deep contraction.

But France's manufacturing sector is also struggling with a reading of 44.0 being recorded. For both Germany and France some support did however come from the services sector which was at 52 or the former and 47.4 for the latter.

UK PMI figures undershoot expectations however the composite fell to 50.7 (from 52.8 previously), keeping it above 50 and consistent with further economic expansion.

The UK and Eurozone economies are certainly slowing, but the UK appears more resilient at this point and should prompt the Bank of England to maintain a more 'hawkish' policy stance that can support the Pound further.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes