Pound Struggles to Fend off Near-term Euro Strength as ECB Hawks Set Wing in Sintra

- Written by: Gary Howes

ECB President Christine Lagarde presenting introductory remarks at the ECB Forum on central banking, 27 June 2023 in Sintra, Portugal. © Sérgio Garcia/Your Image for ECB.

The Euro is proving to be an outperformer in global foreign exchange ahead of month-end, aided by 'hawkish' commentary from a number of European Central Bank officials that has boosted expectations for higher interest rates in the Eurozone.

Speaking at the ECB's annual summit in Sintra, Portugal, President Christine Lagarde said further interest rate rises must be anticipated in order to bring regional inflation firmly under control.

"It is unlikely that in the near future the central bank will be able to state with full confidence that the peak rates have been reached," said Lagarde.

Developments are therefore supportive of the Euro given we reside in a foreign exchange world highly sensitive to interest rate hike expectations.

The comments come amidst data that reveals the economy has slowed to the extent that it likely contracted in June, which would typically prompt central banks to become more nervous. However, the ECB's messaging from Portugal suggests it is keen to oversee a 'higher for longer' interest rate regime.

"The euro added to its June advance after hawkish talk from area central bankers played up the theme of policy divergence," says Joe Manimbo, Senior Currency Analyst at Convera. "Upside for the euro has come in fits and starts, given uncertainties related to the bloc’s weaker economic outlook. Still, the euro tends to benefit from expectations for the ECB to raise rates."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The comments continue to highlight that the weak euro-zone economic data flow is not yet encouraging the ECB to shift way from their hawkish policy stance which is helping to dampen the negative impact on the euro," says Lee Hardman, Senior Currency Analyst at MUFG.

The Euro to Pound exchange rate rallied a further 0.30% to quote at 0.86 on the opening day of Sintra, as the single currency looks to add a second consecutive weekly gain on its cross-channel peer. The Pound to Euro was therefore lower at 1.1625.

"The market has turned a bit hot and cold on sterling after last week's aggressive 50 basis point rate hike by the Bank of England that lifted rates to 5%, the highest level in 15 years," adds Manimbo.

The focus is however now firmly back on the ECB given Sintra has commenced. "The EUR is stronger as an ECB conference gets underway, with President Lagarde warning the ECB will not be able to declare the peak rate soon," says Daragh Maher, Head of Research for the Americas at HSBC.

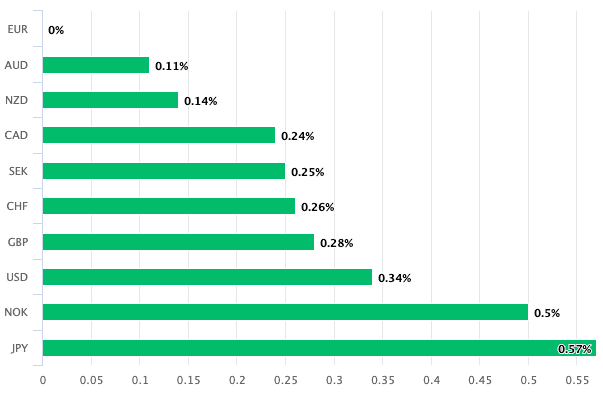

Above: EUR performance relative to other G10 peers on June 27

It is noted ECB Governing Council member Martins Kazaks said Eurozone economic growth is not yet weak enough to bring down inflation.

Gediminas Simkus said, "I wouldn't be surprised if we continue hiking also in September," which markets a departure from the previous guidance of data dependency beyond July.

"We remain bullish on the EUR, expressing it through a buy EUR-GBP trade idea," says Maher.

The Pound nevertheless maintains a higher central bank base rate and will likely occupy higher ground than the Euro by the time the cycle is over.

This suggests it can continue to benefit from 'carry', whereby investor capital flows to where interest rates are set higher in anticipation of greater returns.

As such, the downside in Pound-Euro will likely remain limited until it becomes clear UK inflation is falling fast enough to bring down expectations for UK interest rates.

"We have turned more positive on the pound near term, particularly in crosses but also EURGBP relative to our previous forecasts," says Sheryl Dong, a currency analyst at Barclays.

Jeremy Stretch, a currency strategist at CIBC Capital Markets, points out the Pound's resilience due to this carry-based rate support.

"Until the consumer rolls over, amplifying recession risks, Sterling will continue to garner a degree of carry-based rate support," he notes

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes