Pound-Euro Exchange Rate Kicks 2023 Off with a Strong Advance

- Written by: Gary Howes

Image © Adobe Images

The Pound to Euro exchange rate (GBP/EUR) started the year with gains following the release of softer-than-expected German inflation data that could suggest the peak in European Central Bank interest rate expectations has now passed.

German inflation data for December came in well below expectations as the Eurozone's largest economy benefited from easing energy costs, although core inflationary pressures persisted.

The Euro was softer across the board after Destatis reported headline CPI inflation rose 8.6% year-on-year in December, below expectations for 9.1% and a material decline from November's 10%.

The month-on-month decline stood at -0.8%, nearly tripling an expected -0.3% reading and accelerating on -0.5% reported in November.

"Lower-than-expected energy prices due to the warm winter weather could, if they remain at current levels, push down headline inflation faster than recent forecasts suggest," says Carsten Brzeski, Global Head of Macro at ING Bank.

Robin Brooks, Chief Economist at the IIF, says the news resulted in a weaker Euro.

"The big drop in Euro on weaker-than-expected German inflation data shows how much ECB hawkishness has boosted EUR/$. We are detecting the same slowing in inflation momentum in the Eurozone that we detected for the US back in July. The peak of ECB hawkishness is behind us," said Brooks.

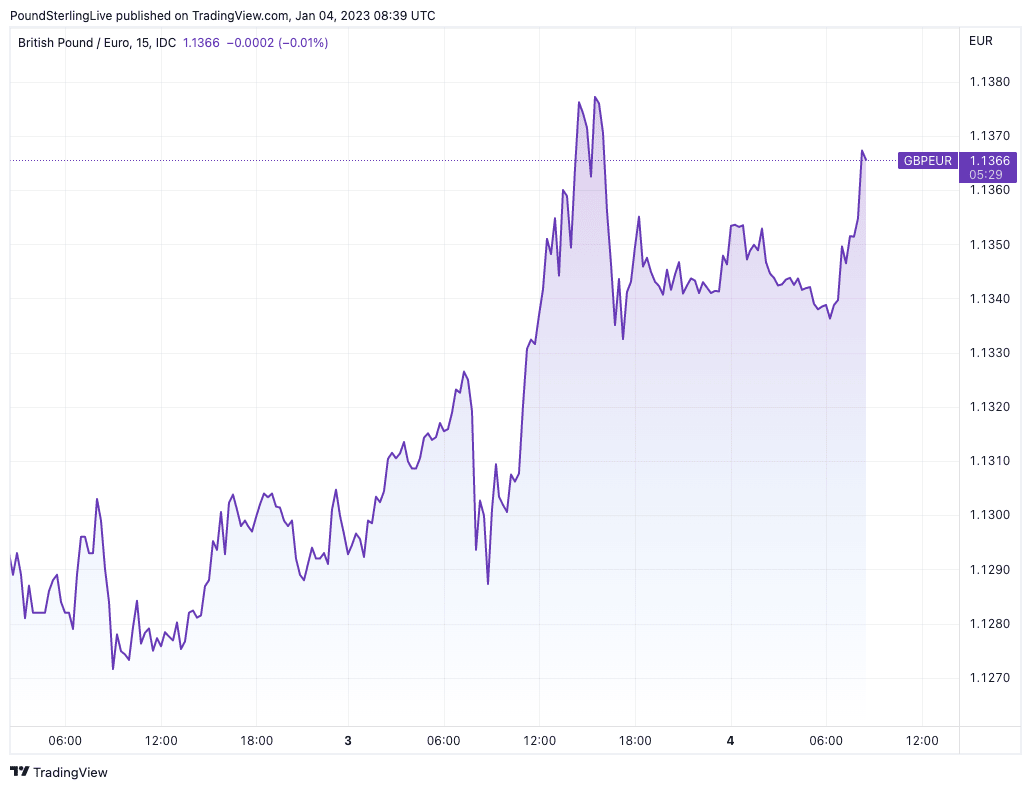

Above: GBP/EUR at 15-minute intervals showing the stronger start to 2023 for the Euro. Consider setting a free FX rate alert here to better time your payment requirements.

GBP/EUR rallied from levels below 1.13 and is back to 1.1370 in midweek trade, EUR/USD suffered its largest one-day decline since October after falling 1.15%.

The headline pair is now back to 1.0617.

The Euro strengthened in December after the European Central Bank's (ECB) December policy decision, where policymakers signalled more interest rate hikes would be required over the coming months in order to bring inflation back under control.

The tone adopted by the ECB surprised markets and investors raised their expectations for the peak in the ECB's basic interest rates and the Euro rallied in response.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

However, should upcoming inflation releases undershoot - as the German figures have done - this 'hawkishness' could be unwound, as per Brooks' suggestion that the 'peak' is now behind us.

The Euro will now look towards Friday's release of Eurozone inflation for a clearer sense of how prices are evolving across the region. A strong reading could again undermine some of the Euro's recent outperformance.

"Lower than expected German inflation data for December yesterday boosted market expectations that Eurozone inflation has peaked. The resulting fall in Eurozone interest rate expectations helped lift the US dollar against the euro yesterday but the rally has shown signs of running out of steam this morning," says economist Rhys Herbert at Lloyds Bank.

Falling inflation might have a downside impact on the Euro, but currency market participants must be aware of the other dynamics at play.

The Eurozone's ongoing inflationary impulse has been driven primarily by higher energy prices, particularly gas prices, which threatened Eurozone economic activity and raised expectations for a recession to take hold in 2023.

However, gas prices have fallen sharply over recent weeks while storage levels remain healthy, suggesting the region's energy security has improved markedly.

This lowers the prospects of a deep and damaging recession, which is a material positive for the Euro's outlook and explains why non-commercial currency market participants now hold a net 'long' position on the Euro.

Indeed, the single currency outperformed in December as gas prices fell; expect further resilience over the coming weeks if this dynamic remains in place and gas prices don't spike again.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes