Pound Sterling Hits Turbulence as Bank of England Forced into a Denial Over Bond Sales

- Written by: Gary Howes

Image © Adobe Stock

The British Pound's strong run came to a shuddering halt on Tuesday following some fresh uncertainty in UK bond markets.

UK gilts fell and the yield they offered rose after the Bank of England was forced to deny it would further delay its programme of quantitative tightening.

This is the process whereby it sells back to the market the gilts it hoovered up as part of its quantitative easing process.

Quantitative tightening forms a key component of the Bank's policy of normalising monetary policy as it fights inflation.

The Financial Times reported Tuesday the Bank was ready to delay the programme to ensure bond markets remain steady following the volatility of recent weeks.

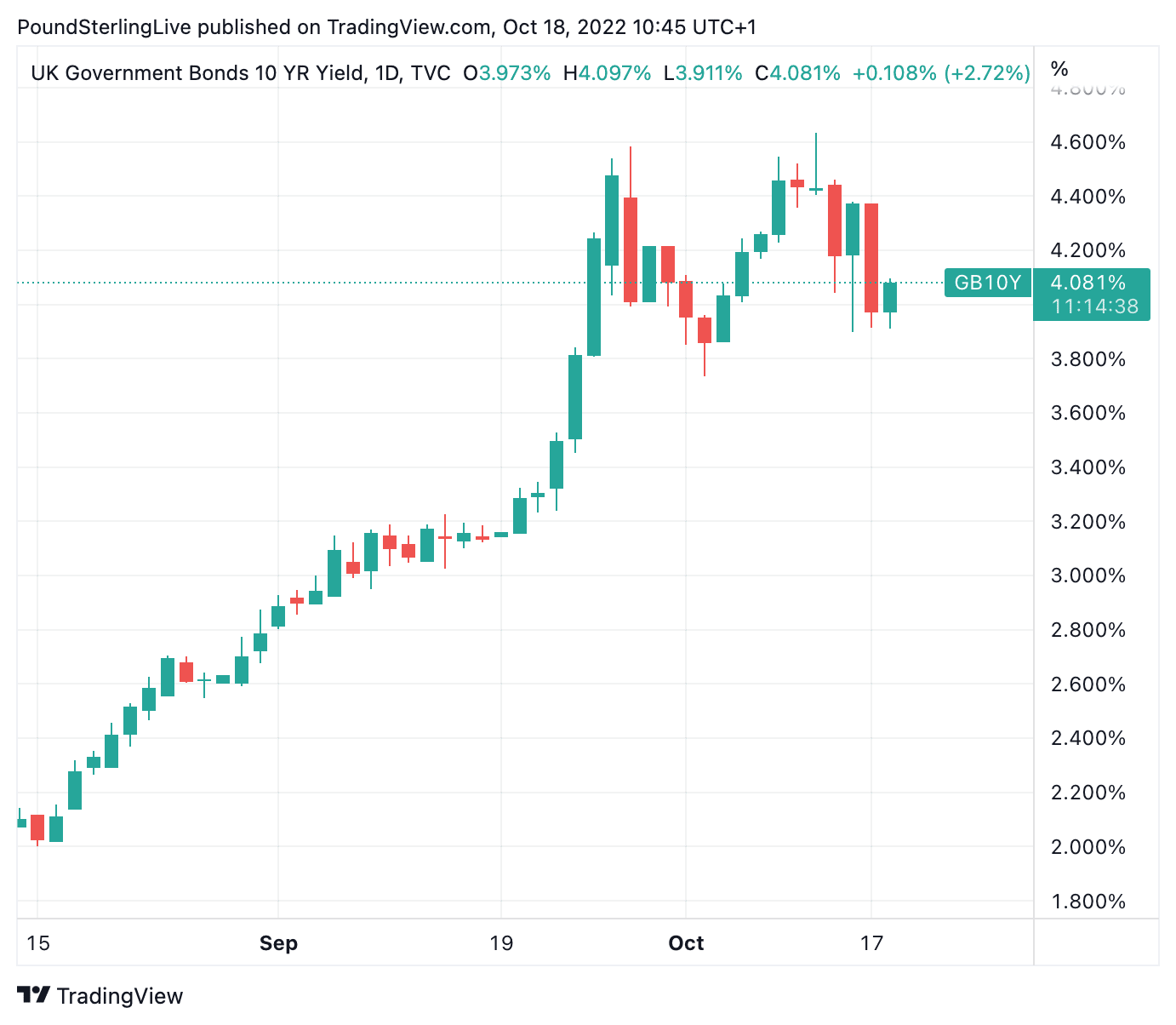

Above: UK ten-year bond yields are up again on Tuesday.

The Bank allegedly fears an increase in the supply of bonds will only lower their value and raise yields at a time of heightened nervousness about the outlook for the UK's debt sustainability.

The Bank had already delayed the start of its bond sale programme from October 6 to the end of this month.

The FT says a further delay was now likely as the Bank judges UK bond markets to be "very distressed".

The Pound has proven highly sensitive to developments in the bond market of late, which explains why the Pound dropped after newswires on Tuesday morning reported that the FT's claim that quantitative tightening would be further delayed is false.

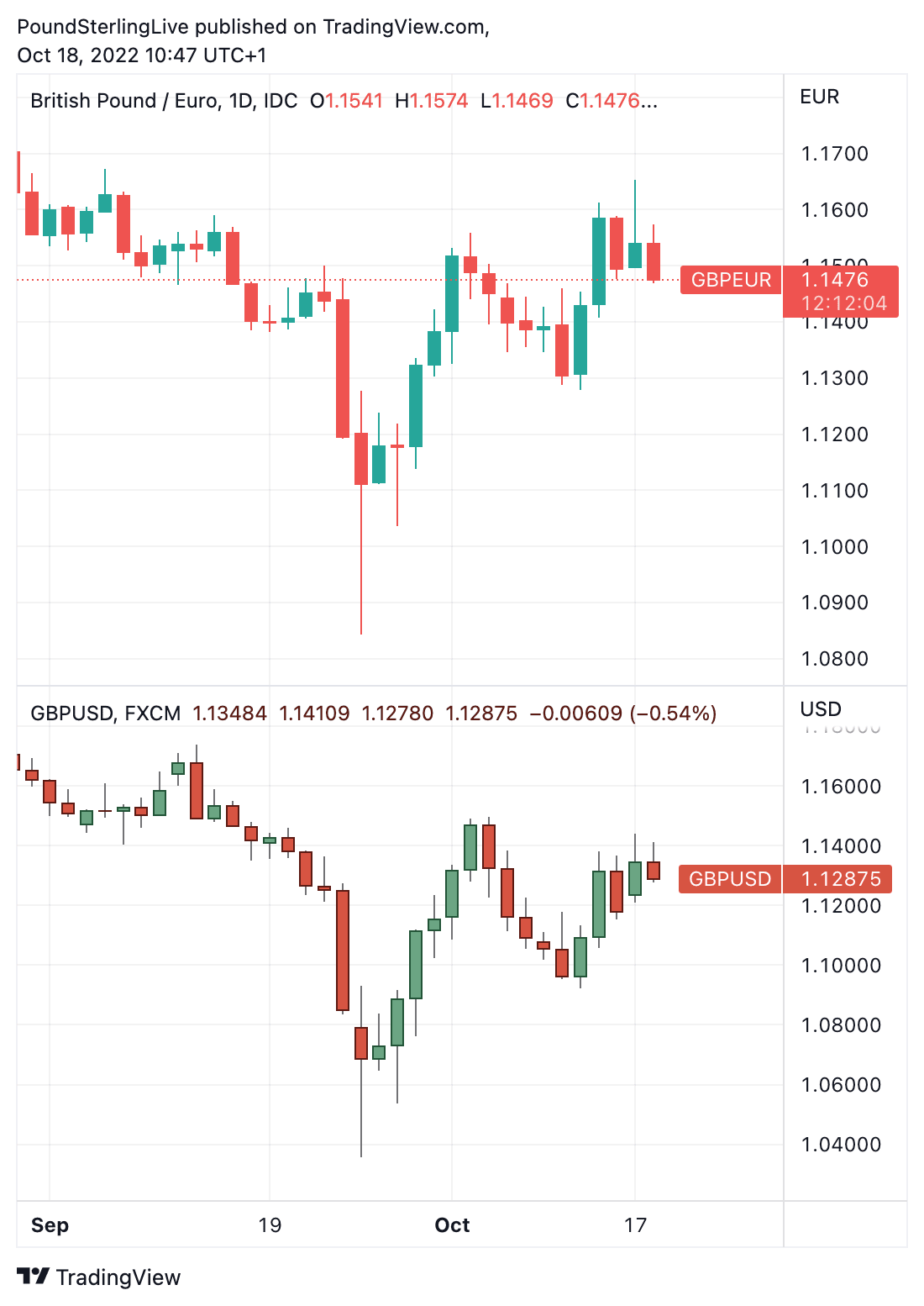

The Pound to Euro exchange rate retreated to 1.1490, having been as high as 1.1576 earlier in the day. This takes bank transfer rates to approximately 1.1260 and those on offer at payment specialists to approximately 1.1450.

The Pound to Dollar exchange rate retreated to 1.1315 from 1.1409, taking bank transfer rates to around 1.1090 and those at payment specialists to around 1.1280.

Above: GBP/EUR (top) and GBP/USD at daily intervals. To better time your payment requirements, consider setting a free FX rate alert here.

The yield on UK ten-year bonds rose to 4.05%, having been as low as 3.911% earlier in the day.

By all means, the moves aren't massive, but an uptick in yields would suggest the recent turn lower in yields could be over.

It also means bond yields have not fallen to pre-'mini budget' levels, suggesting an element of scarring in the market.

Could this therefore imply the recent recovery in the Pound is also over?

What is for sure, the bond market is now firmly in control of the UK government, and the currency.

Antoine Bouvet, a developed markets rates strategist at ING Bank, says the Bank will ultimately recognise now is not the time to engage in quantitative tightening (QT).

"Trading conditions in gilts have been deteriorating all year and it has become obvious since the summer that QT would only throw more fuel on the fire," says Bouvet.

ING says following Hunt's fiscal U-turn, what was needed for gilts to rally below 4% was a delay to QT sales, and a re-pricing lower of hike expectations.

So far, only one of these conditions has been delivered.

Look for a pivot from the central bank in the coming days to offer further support to Sterling. If not, the rally could be done.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes